Walmart Embraces Amazon MCF: A New Era of Cross-Platform Fulfillment for eCommerce

Walmart Embraces Amazon MCF: A New Era of Cross-Platform Fulfillment for eCommerce

Understanding how you’re going to receive money from your customers should be one of the key concerns while you’re setting up your online store. So make sure that you define a robust payment process for your Shopify store. By far, Shopify Payments is the most flexible mode of accepting online payments. Adding a payment method in your Shopify store is not a step-by-step process. It should rather be a wise decision which will decide if the overseas shoppers can shop from your store or not. This blog is all about how to add Shopify Payments as a payment method in your Shopify store.

BNPL, cryptocurrencies, and cardless payment methods are some of the emerging digital payment trends. Keeping in mind the broader term payments – we have directed the blog in 3 parts. For merchants who don’t see Shopify Payments as a payment method can sign-up with various third-party payment gateways – Click here to know more.

Third-part of the series highlights various online payment trends that emerged recently and how Shopify merchants can instill the payment trends in their store. The links are hidden somewhere in this blog. Let’s see if you can find it.

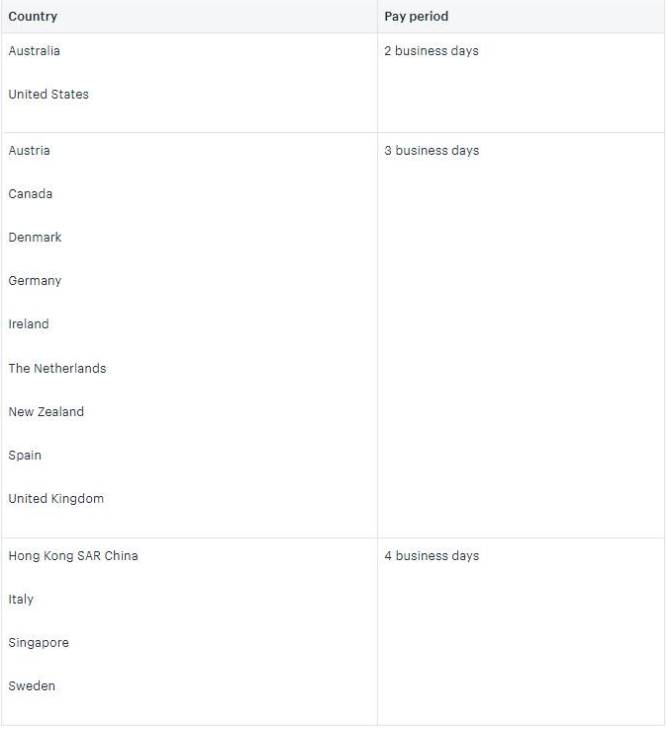

When a customer orders from your store, their payments much be processed before they reach you. A payment provider checks all the payments. Due to this, there is a delay before the amount gets credited to your bank. So it would help if you were choosy when adding a payment method in your Shopify store.

Third-party payment providers will have their ways of collecting funds from your customers. You can make a list of payment providers that suits you best and check with their website for more details.

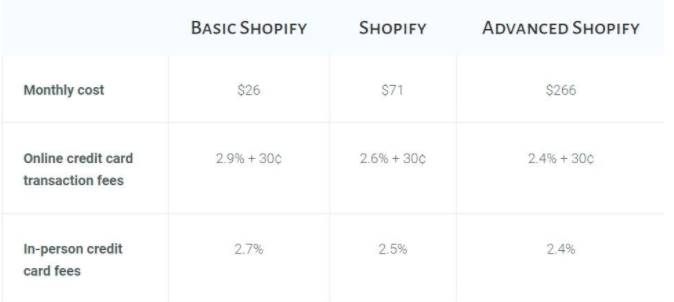

All other payment providers except charge a fee for all the processed transactions. But Shopify Payments only charge for transactions through credit cards. If you operate your Shopify store from any of these countries, then you can add it as a payment method –

Don’t worry if your store is elsewhere. Shopify’s ecosystem is loaded with third-party payment providers like PayPal, RazorPay, Paytm. Click here to see prominent payment gateways region-wise.

Make sure that you decide on your store currency. It is the currency that you price your product in, which is used in your reports. Here’s what you need to do –

You are required to disclose personal and business details. The purpose of collecting details is to comply with regulatory requirements for smooth transactions. Make sure your bank account is –

In the Business Details section, select the type of your business. Then, add your business number, EIN, or TIN, depending on your business’s country. If you set up as LLC or incorporation, then you need the name and date of birth of someone in the business listed under Personal Details.

Essentials of an online store are confined within Shopify’s platform, and you have to assemble each one of them as per requirements. Shopify Payments is an in-house payment solution that accepts all kinds of payments. Below are some highlighting features –

The pandemic gave us quite a few learnings. One of the lessons was not to underestimate the power of local shopping. A lot of shoppers are now looking forward to shopping with local online stores. As an online merchant, you can add either of the following local payment methods in your Shopify store –

Time is precious, and Shopify doesn’t want shoppers to waste their time entering the same billing and address information every time they shop online. Using accelerated checkout buttons, shoppers can skip the cart and go directly to the checkout from the product page. Below are the options in case you want to set accelerated checkouts. Please note – to activate accelerated checkouts; you need to start Shopify Payments in your store –

The pandemic has changed many things – one of them is how online shoppers are paying and what payment options are available to them. Basically, eCommerce is slowly moving from card to cloud – when it comes to paying online.

Don’t forget to catch up with the emerging payment trends!

Setting up a payment method in your Shopify store is not a step-by-step tutorial. It should rather be a time taking, decision-making process. Shopify allows you to be flexible, but you need to decide the adjustable rate depending on your niche.

You can always trust Shopify Experts for business advice.

Walmart Embraces Amazon MCF: A New Era of Cross-Platform Fulfillment for eCommerce

Order Management Redefined: A Centralized Solution for Amazon Sellers

Maximizing TikTok Shop’s Regional Compatibility for US, UK, and EU Markets

Understanding U.S. Tariffs in 2025: What Sellers Need to Know and Do

Walmart’s Search Algorithm Decoded: How to Rank Higher & Sell More

TikTok Gets a 75-Day Reprieve in the USA as Trump Signals Hope for a Deal

TikTok Shop Introduces Category-Based Benchmarks for Product Listings – What Sellers Need to Know

Amazon FBA vs. FBM: Which Fulfillment Method Is Right for You?

Amazon Launches Another AI Tool for Sellers: AI Generated Product Enrichment

Top 10 Selling Items on eBay in 2025

Amazon launches AI Powered ‘Interests’ Feature to Improve Shopping Experience

Is TikTok Staying in the US? The State of TikTok Ban

Best Buy coming back to the US, Marketplace Relaunch and New Opportunities in Store!

Miravia PrestaShop Connector: Built for Smart Sellers

Walmart Launches “Wally”, AI Assistant For Merchants

TikTok Shop to Start Business in Germany, France, and Italy

TikTok Shop Surges as Americans Spend $700 Annually, Defying Regulatory Pressures

Amazon’s Longest Prime Day Ever: What You Need to Know

eCommerce Growth in the Netherlands: A 5% Surge in 2024 with Bright Prospects Ahead

CedCommerce Launches Shopee & Lazada Integration for WooCommerce on WordPress.com