BFCM Conversion Tactics: Smart Bundles, Flash Sales & Scarcity Marketing

Reading Time: 13 minutesStill approaching BFCM with generic discounts, last-minute price cuts, or scattered promotions?…

While merchants are taking a breather from summer sale events like Amazon Prime Day, the holiday season is already speeding up to them. Notably, these summer events have already claimed an estimated 15% of overall 2024 holiday season sales, siphoning consumer attention away from the biggest shopping events of the year – Black Friday and Cyber Monday. How can eCommerce merchants effectively gain customer attention and boost sales during the holiday season 2024?

The changing dynamics of the retail giants are impacting consumer behavior as seen in the aftermath of the summer sale 2024 events, extending far beyond July and August. This blog post will help online merchants analyze and understand the impact of summer sale 2024 events by retail giants like Amazon, TikTok, and Walmart. Furthermore, it will also provide insights on what you can expect from the upcoming holiday season to shape your eCommerce strategies for success.

As predicted by eMarketer, the US eCommerce holiday sales are predicted to reach $1.353 trillion. Additionally, over 16% of US shoppers have already started shopping for the upcoming holiday season, kickstarting the spending earlier compared to 2023. With the advent of the sales events in October, eCommerce merchants should lay the groundwork early for the holiday season to ensure they don’t get left behind.

Hence, the first step to ensure your holiday season is a success is to recognize patterns in the summer sales 2024 events by leading marketplaces.

Amazon’s Prime Day 2024 witnessed unprecedented success. Why ‘unprecedented’? We’ll discuss this in the later section of the blog. (A hint: eCommerce industry critics claim that other retailers attempted to get their share of success by challenging Prime Day).

The summer Prime Day event drove a record $14.2 billion in sales, by featuring deep discounts and steal deals ensuring boosted customer engagement and sales. Sales data reports from Jungle Scout showcased how these curated offers not only gained traction during but also post Prime Day. This notoriously famous event was held on the 16th and 17th of July, observing higher AOV (average order values) and increased participation from third-party sellers.

CedCommerce, a leading multichannel enabler helped its merchants process over 40K orders on Amazon during the Prime Day 2024 event. Click here to check out how this happens:

Reading Time: 13 minutesStill approaching BFCM with generic discounts, last-minute price cuts, or scattered promotions?…

Reading Time: 3 minutesTikTok Shop reached a major milestone during its largest U.S. “Global Black…

Reading Time: 3 minutesOpenAI has announced a new AI-powered shopping research tool designed to help…

Reading Time: 9 minutesIf your TikTok Shop listings often sit in review or your visibility…

Reading Time: 3 minutesAmazon has rolled out a new “Seller Challenge” feature for eligible Account…

Reading Time: 3 minutesWalmart Marketplace has sharpened its requirements around product classification (category, type group,…

Reading Time: 3 minutesJust ahead of Black Friday, Amazon is enforcing tighter controls on its…

Reading Time: 11 minutesWhere holiday prep of past years focused on legacy channels like Amazon,…

Reading Time: 11 minutesThe eCommerce shift you actually need to act on Multi-channel fulfillment has…

Reading Time: 10 minutesBlack Friday Cyber Monday (BFCM) isn’t a weekend anymore; it’s a two-month…

Reading Time: 2 minuteseBay is quietly testing a new feature that could reshape how buyers…

Reading Time: 2 minutesAmazon is stepping into a new era of value commerce with the…

Reading Time: 11 minutesThe $240 Billion BFCM Opportunity & Why Operations Matter Every seller, business,…

Reading Time: 7 minutesTL;DR — Your 60-Second BFCM Battle Plan Time remaining: 3 weeks until…

Reading Time: 2 minutesChina’s Double 11 shopping festival — the world’s largest annual online retail…

Reading Time: 2 minutesAs the holiday season approaches, TikTok Shop has released its September 2025…

Reading Time: 3 minutesIn a continued effort to enable sellers and stimulate new product launches…

Reading Time: 2 minutesAs global trade enters a new phase of regulation and cost restructuring,…

Reading Time: 2 minutesOpenAI Turns to Amazon Web Services in $38 Billion Cloud Deal: What…

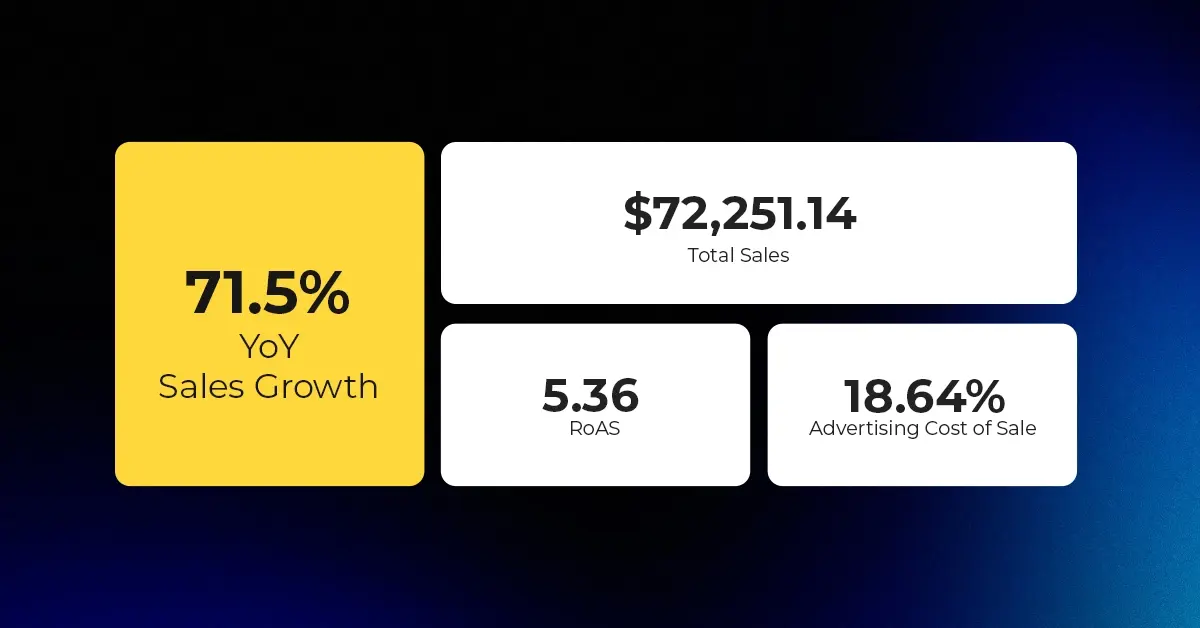

Reading Time: 4 minutesAbout the Client TMRG is a global health and wellness brand with…

Good analysis of the main summer sales events. I would also like to see your insights on the SEA region marketplaces and their upcoming sale events.

Leave a Reply