Centralized Catalog, Faster Publishing: 40ParkLane’s Marketplace Success with CedCommerce

Reading Time: 4 minutesAbout the Brand: 40ParkLane LLC Studio40ParkLane is a design-led print-on-demand brand created…

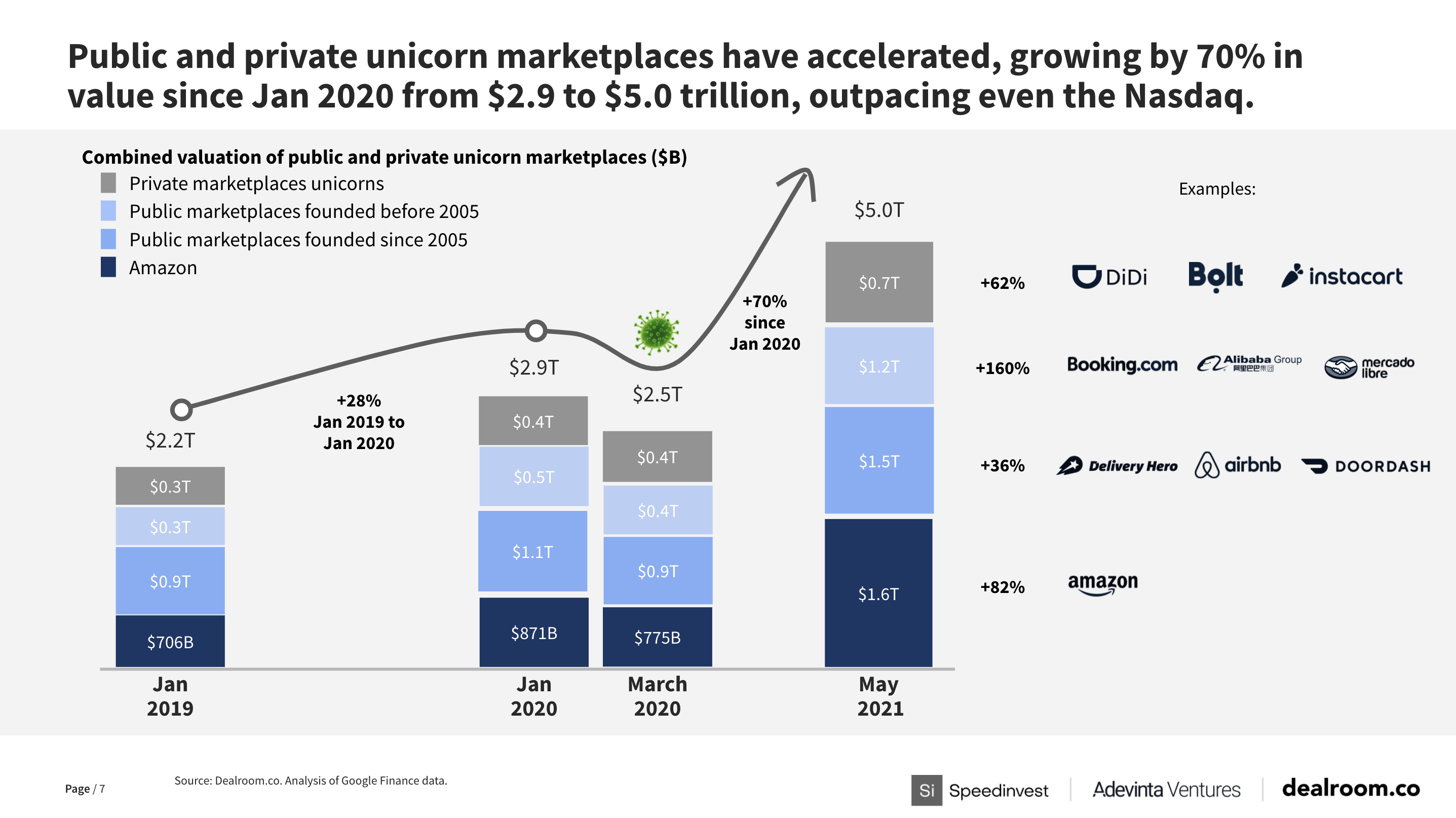

Marketplaces are growing in numbers in all niches. Consequently, so have marketplace funding and venture capitalists helping entrepreneurs raise funds for marketplaces. Furthermore, Public and private unicorn marketplaces have accelerated in value since January 2020. An increase in funding for online marketplaces has helped online marketplaces scale up. Moreover, a quarter of all unicorn startups enter the eCommerce industry as marketplaces.

Consequently, fashion marketplaces ranked first in substantial valuation growth during the pandemic at 142 percent. Meanwhile, food delivery marketplaces followed at 132% and digital health marketplaces at 120 percent.

Also read: Excelling fashion eCommerce for success in the fashion business

*All data has been sourced from the source.

Here’s a breakdown of everything you will find in this article:

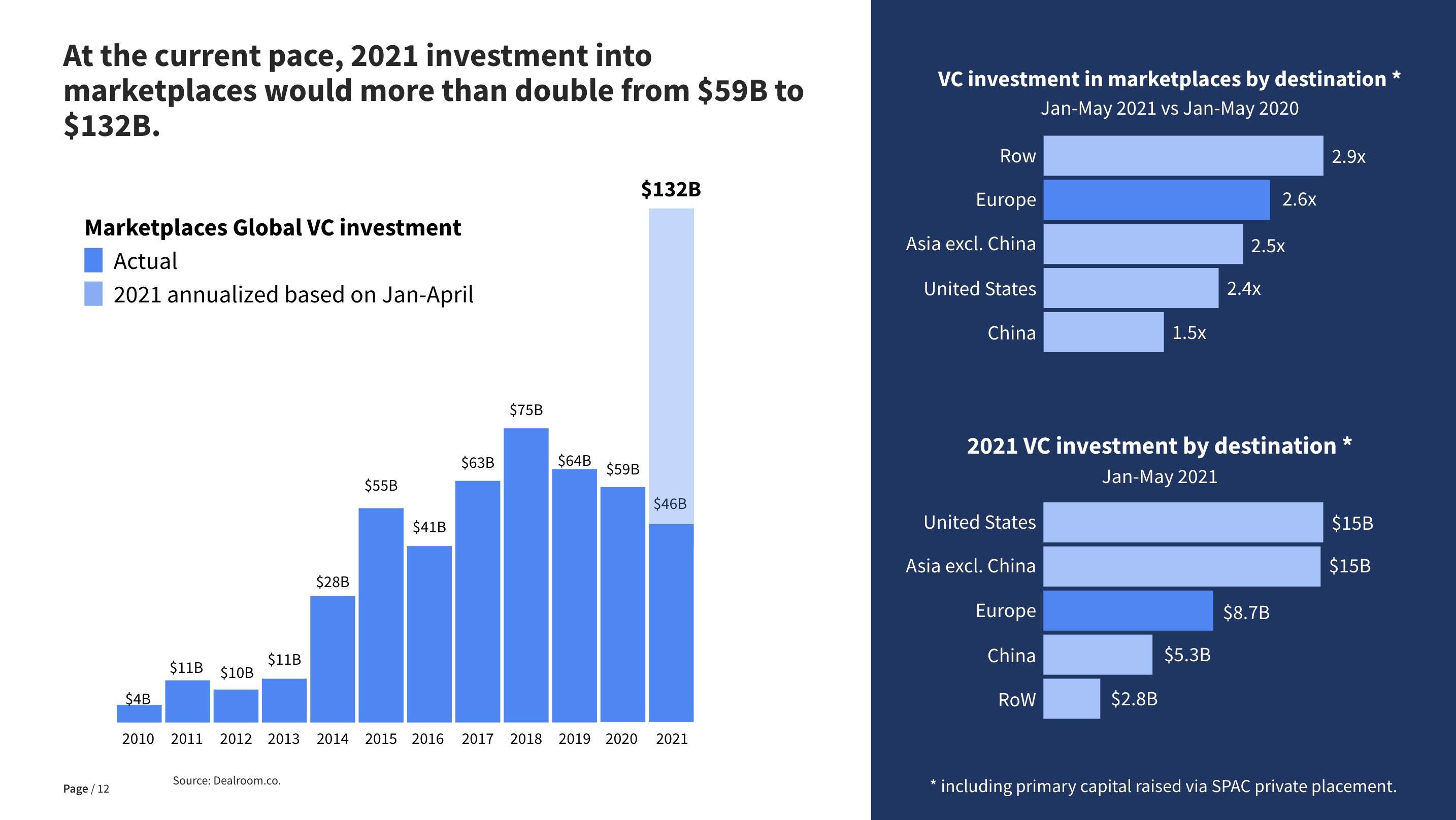

The 2021 report suggests that marketplaces continue catching huge investments in their basket. Furthermore, The most popular categories for online marketplaces investment include fashion, digital health, travel, real estate, and more. Thus, funding for online marketplaces is a must-have for turning an idea into a robust solution reaching millions of people globally.

Here’s a list of top investors in online marketplaces to help you find the most relevant venture capitalists for your marketplace funding in different countries:

|

Sr. No. |

Name of venture capitalists |

Country |

Other relevant information |

|

1. |

New Enterprise Associates |

USA |

Investment type includes debt, early-stage venture, late-stage venture, post-IPO, private equity, seed. Furthermore, investments include in the technology and healthcare sector |

|

2. |

Accel |

USA |

For instance, prior marketplace investments include BlaBlaCar, Delivroo, Etsy, Trulia |

| 3. |

A16Z crypto |

USA |

For instance, investment type includes early-stage ventures with investments made in crypto companies and protocols |

|

4. |

Action Capital |

Germany |

Prior marketplace investments include Expertlead and Lemonone |

|

5. |

FJ Labs |

USA |

Investment types: early-stage venture and seed with investment sectors, including online shops and consumer-facing startups |

|

6. |

Atomico |

United Kingdom |

Prior marketplace investment includes Jobandtalent |

| 7. |

Novator |

United Kingdom |

Investment types include early-stage venture, late-stage venture, private equity. In addition, investment sectors, include various tech startups |

|

8. |

Axel Springer |

Germany |

Prior marketplaces include big names such as Uber, Airbnb, Wunderflats, and WayUp |

|

9. |

Algebra Ventures |

USA |

Early-stage ventures with investments in fintech, healthcare, and blockchain technology |

| 10. |

Big Sur Ventures |

Spain |

Prior marketplace investments include Biddus and Celebrents |

Other well-known venture capitalists firms that can help in marketplace funding include Advancit Capital, Endeit Capital, Adevinta Ventures, Aventures, and more. Moreover, other big marketplaces that received funding from these venture capitalists include Lyft, Medwing, Fixico, Paulcamper, Outdoorsy, and more.

Fashion has become one of the hottest sectors for marketplace funding. In its last round of funding for online marketplaces, the second-hand clothes marketplace, Vinted valued at €3.5 billion (£3bn).

Moreover, Venture capitals are also backing up companies in the global social commerce market. For instance, Evermos, an Indonesian social commerce startup, raised $30 million in Series B marketplace funding. In November 2021, Facily, a Brazil-based social commerce marketplace, topped off its coffers with a $250 million Series D round in funding for online marketplaces.

Also read: Top 10 marketing strategies to promote your online grocery marketplace

Crowdfunding has become one of the most popular and most effective ways to raise funds for marketplaces or any type of business. Crowdfunding is an approach to raising funds through individual investors’ collective, community-based effort. Even if you have never heard of the term, you’ve probably seen several examples of raising funds online from a community.

Different platforms, including Kickstarter, Rockethub, and GoFundMe, have made the concept of strangers funding a business project more acceptable. In addition, entrepreneurs can use these and other crowdfunding platforms and run a campaign to raise funds for marketplaces. However, most crowdfunding platforms charge contributing transactions fees as well as a percentage of your overall earnings.

Furthermore, there are three types of crowdfunding:

It is one of the most outstanding solutions to get marketplace funding for online marketplaces. The business line of credit acts as a hybrid between a traditional bank loan and a business credit card. Moreover, the business line of credit is an excellent eCommerce funding solution for incremental business expenses. Furthermore, this marketplace funding method allows access to a fixed amount of capital to meet short-term business goals. Some of the basic information you need to apply for a business line of credit include the following:

Moreover, you can set aside a certain amount for spending on the most urgent requirements from a pre-approved amount. It helps you keep your business spending in check without getting into too much debt.

It explores equity-based fundraising for online marketplaces and other businesses. A popular marketplace funding method, venture capital funding proves extremely beneficial in cashing in high investments. Furthermore, venture capital firms invest in projects and ideas they believe can generate high returns in the future.

Startups receive private equity funding for online marketplaces. Moreover, venture capitalists get equity and the power to influence the direction of your company’s business operations in return for their investments.

Yet another great source to generate marketplace funding. Furthermore, also known as self-funding, you invest your money and the operating revenues of your startup. Since you rely on your savings and personal finances to fund your venture, you don’t have to provide investors with the decision-making right. Eventually, you have complete ownership of your online marketplace business.

Several new entrepreneurs have turned to incubator and accelerator programs to acquire funding for online marketplaces. Furthermore, US startups have used incubator and accelerator programs. In addition, this marketplace funding method is gaining traction globally, primarily due to online programs. Moreover, incubator and accelerator programs help you access plenty of resources, tools, guidance, and more from seasoned professionals.

Besides, business incubators and accelerators programs collaborate with venture capitalists to push startups through their early stages by providing marketing, networking, infrastructure, and financial assistance. In addition, an incubator and accelerator program allows you to learn how to build, scale, and manage your business.

Most importantly, you meet with investors and give out a pitch deck to persuade investors to acquire marketplace funding for your startup in the end. For instance, some of the most popular incubator programs include Y- Combinator, 500Startups, and Startupbootcamp.

A marketplace funding method for companies going through a period of unexpected growth. Furthermore, inventory financing fulfills short-term cash requirements. For instance, replenish low inventory. As the name suggests, inventory financing is particularly designed to meet business inventory requirements.

This marketplace funding method is most suitable for companies with irregular cash flow. Moreover, it’s quite normal to extend the pay-off time for B2B customers. Ultimately, it makes your cash flow uneven and affects your production.

Furthermore, in this method to raise funds for marketplaces, the investor provides you with an upfront cost between 70% to 90% of the outstanding invoice. Also, the invoices serve as collateral against the investment.

Early-stage companies attract more investment opportunities, particularly in the seed and pre-Series A rounds. However, companies already running can also receive huge marketplace funding from different sources. Furthermore, before you pitch for your online marketplace business, you should run a discovery phase, polish your business idea, create a solid pitch for investors, and raise funds for further development.

Here are some success stories of marketplace solution users from CedCommerce that helped them scale their business operations:

Here are some points entrepreneurs should consider before searching for funding for your marketplace.

The process of raising marketplace funding can prove complex and extremely challenging, particularly with the availability of several options for funding for online marketplaces. Additionally, different funding methods come with their share of benefits and drawbacks. Furthermore, selecting an investment source requires careful analysis on your part. Several factors can influence your choice of investment option, particularly your business type and model.

Create an online marketplace that investors want to invest in.

Reading Time: 4 minutesAbout the Brand: 40ParkLane LLC Studio40ParkLane is a design-led print-on-demand brand created…

Reading Time: 3 minutesAbout the Company Brand Name: David Protein Industry: Health & Nutrition (Protein…

Reading Time: 3 minutesOnline retail spending in Germany is entering a renewed growth phase after…

Reading Time: 4 minutesTikTok Shop has released a comprehensive Beauty and Personal Care Products Policy,…

Reading Time: 4 minutesTikTok Shop has formally outlined comprehensive requirements for expiration date labeling and…

Reading Time: 3 minutesTikTok Shop is raising its sales commission for merchants across five active…

Reading Time: 11 minutesBy now you have seen your BFCM 2025 numbers. The harder question…

Reading Time: 3 minutesAbout the Brand Name: Vanity Slabs Inc Industry: Trading Slabs- Vanity Slabs…

Reading Time: 2 minutesAbout the Brand Name: Ramjet.com Industry: Automotive Parts & Accessories Location: United…

Reading Time: 2 minutesAmazon is rolling out strategic referral fee reductions across five major European…

Reading Time: 4 minutesQuick Summary: Scaling Lifestyle Powersports on eBay with CedCommerce Challenge: Zero marketplace…

Reading Time: 4 minutesTikTok has surpassed 460 million users across Southeast Asia, reinforcing its position…

Reading Time: 3 minuteseBay has released its final seller news update for 2025, with a…

Reading Time: 3 minutesAmazon has clarified its stance regarding speculation around a potential breakup between…

Reading Time: 4 minutesWalmart is accelerating its push into next-generation fulfillment by expanding its drone…

Reading Time: 4 minutesFaire, the fast-growing wholesale marketplace connecting independent retailers with emerging brands, has…

Reading Time: 4 minutesB2B buying in the United States is undergoing a fundamental behavioral shift…

Reading Time: 3 minutesSummary Cyber Monday 2025 has officially become the largest online shopping day…

Reading Time: 2 minutesSummary Amazon kicked off December with two major developments shaping the future…

Reading Time: 2 minutesSummary Walmart has entered December with two major moves that signal a…