Walmart Embraces Amazon MCF: A New Era of Cross-Platform Fulfillment for eCommerce

Walmart Embraces Amazon MCF: A New Era of Cross-Platform Fulfillment for eCommerce

Amazon’s Buy with Prime program is making waves once again, with a major upcoming expansion featuring Adidas as its latest partner. This move will allow Adidas customers to enjoy Prime’s signature fast, free shipping and seamless checkout experience directly on the Adidas website—a major shift in how top brands engage with online shoppers.

For both consumers and sellers, this update signals a broader industry trend where direct-to-consumer (DTC) brands leverage Amazon’s fulfillment power without being locked into the Amazon marketplace ecosystem. Here’s how this expansion is set to redefine eCommerce in 2025:

? Seamless Shopping, Faster Deliveries – Adidas customers will be able to checkout with their Prime account on Adidas’ official website, enjoying Amazon’s one-click payment and fast shipping benefits.

? More Trust in Brand Websites – Instead of shopping only on Amazon, customers get the reliability of Prime fulfillment while buying directly from Adidas, ensuring authenticity and a stronger brand connection.

? Fewer Cart Abandonments – High shipping costs and slow delivery often lead to abandoned carts. Buy with Prime tackles this by ensuring quick delivery, increasing conversion rates for brands.

? More Choices, Better Control – Unlike traditional Amazon listings, this approach allows customers to access exclusive Adidas products not necessarily available on Amazon, enhancing the brand’s independent online presence.

? A Shift in Marketplace Dependence – With Adidas adopting Buy with Prime, other large brands may follow suit, using Amazon’s logistics without fully committing to its marketplace.

? Better Customer Data Control for Brands – Unlike on Amazon’s main marketplace, brands keep full ownership of customer data, enabling stronger remarketing and personalization.

? More Sales Opportunities for Third-Party Sellers – As Amazon third-party sellers benefit from exposure on Amazon, brands leveraging Buy with Prime can get more traction on their sites by offering Prime advantages.

? Hybrid Selling Models Will Rise – Small and mid-sized sellers may explore both Amazon marketplace listings and Buy with Prime integration on their own websites to maximize reach.

? Higher Advertising Costs? – If more brands shift traffic off Amazon to their own sites, advertising costs on Amazon may rise as competition intensifies for in-platform visibility.

In another new development, Amazon is taking a bold step by testing a feature that directs shoppers from Amazon’s search results to a brand’s official website. This experiment, as reported by RetailDive, represents a major shift in Amazon’s traditional closed-ecosystem approach.

? How It Works: Instead of solely showcasing Amazon product listings, Amazon now provides direct links to a brand’s website when shoppers search for specific products.

? Why It Matters: This could increase website traffic for brands, allowing them to build direct relationships with customers while leveraging Amazon’s vast search traffic.

? Future Implications: If successful, this strategy may redefine Amazon’s role from a strict marketplace to a hybrid discovery-and-fulfillment platform, benefiting both consumers and major brands.

The Buy with Prime Adidas partnership represents a significant evolution in online shopping, bridging the gap between Amazon’s fulfillment efficiency and brand-owned eCommerce independence. As Amazon experiments with new ways to direct traffic to brand websites, the landscape for marketplace sellers, DTC brands, and third-party retailers will continue to shift in 2025. For brands, the message is clear: leveraging Amazon’s strengths while maintaining direct customer relationships is the future. Whether through Buy with Prime, direct site promotions, or hybrid selling models, eCommerce in 2025 will be more dynamic, consumer-driven, and competitive than ever.

Walmart Embraces Amazon MCF: A New Era of Cross-Platform Fulfillment for eCommerce

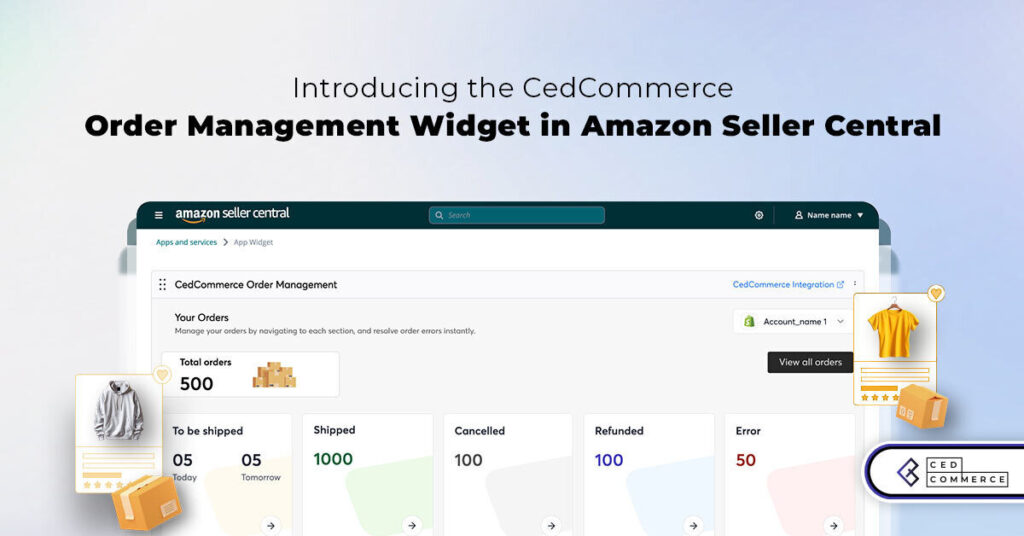

Order Management Redefined: A Centralized Solution for Amazon Sellers

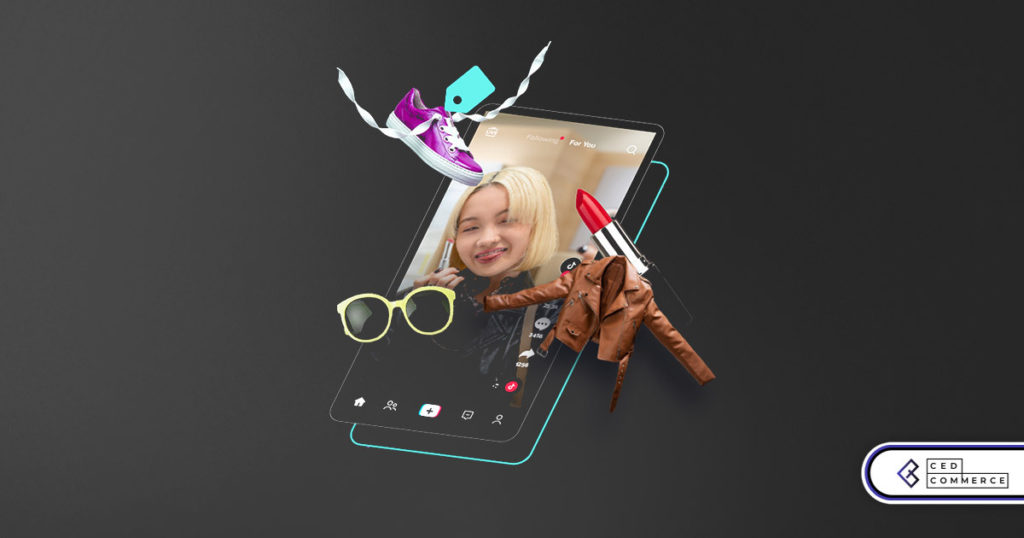

Maximizing TikTok Shop’s Regional Compatibility for US, UK, and EU Markets

Understanding U.S. Tariffs in 2025: What Sellers Need to Know and Do

Walmart’s Search Algorithm Decoded: How to Rank Higher & Sell More

TikTok Gets a 75-Day Reprieve in the USA as Trump Signals Hope for a Deal

TikTok Shop Introduces Category-Based Benchmarks for Product Listings – What Sellers Need to Know

Amazon FBA vs. FBM: Which Fulfillment Method Is Right for You?

Amazon Launches Another AI Tool for Sellers: AI Generated Product Enrichment

Top 10 Selling Items on eBay in 2025

Amazon launches AI Powered ‘Interests’ Feature to Improve Shopping Experience

Is TikTok Staying in the US? The State of TikTok Ban

Best Buy coming back to the US, Marketplace Relaunch and New Opportunities in Store!

Miravia PrestaShop Connector: Built for Smart Sellers

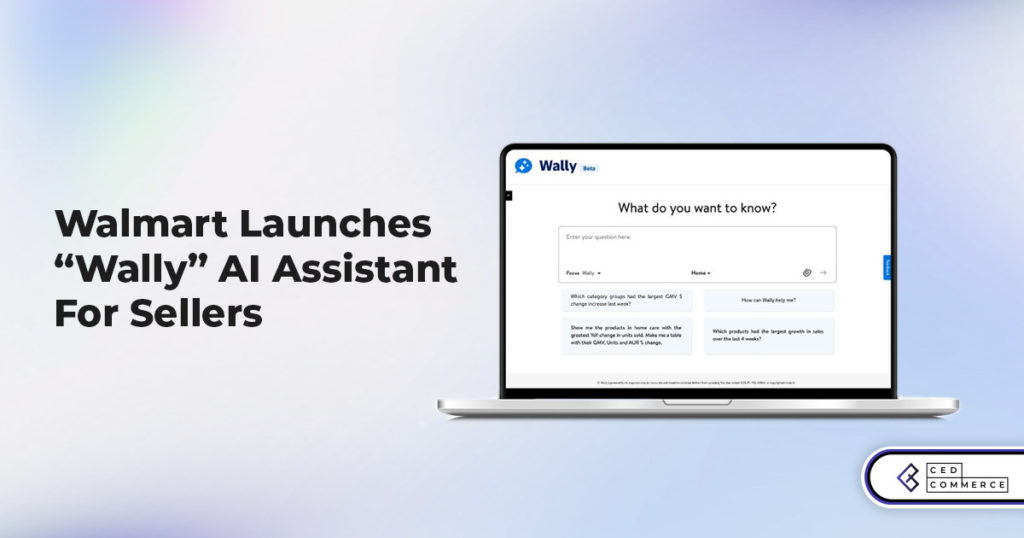

Walmart Launches “Wally”, AI Assistant For Merchants

TikTok Shop to Start Business in Germany, France, and Italy

TikTok Shop Surges as Americans Spend $700 Annually, Defying Regulatory Pressures

Amazon’s Longest Prime Day Ever: What You Need to Know

eCommerce Growth in the Netherlands: A 5% Surge in 2024 with Bright Prospects Ahead

CedCommerce Launches Shopee & Lazada Integration for WooCommerce on WordPress.com