The 2025 Fulfillment Shift: How Amazon MCF Now Powers Shein, Walmart, and Shopify Orders

Reading Time: 11 minutesThe eCommerce shift you actually need to act on Multi-channel fulfillment has…

Let’s begin straight away, to configure Sales Tax you require Tax Nexus, Shipping Sales Tax codes and shipping policy information.

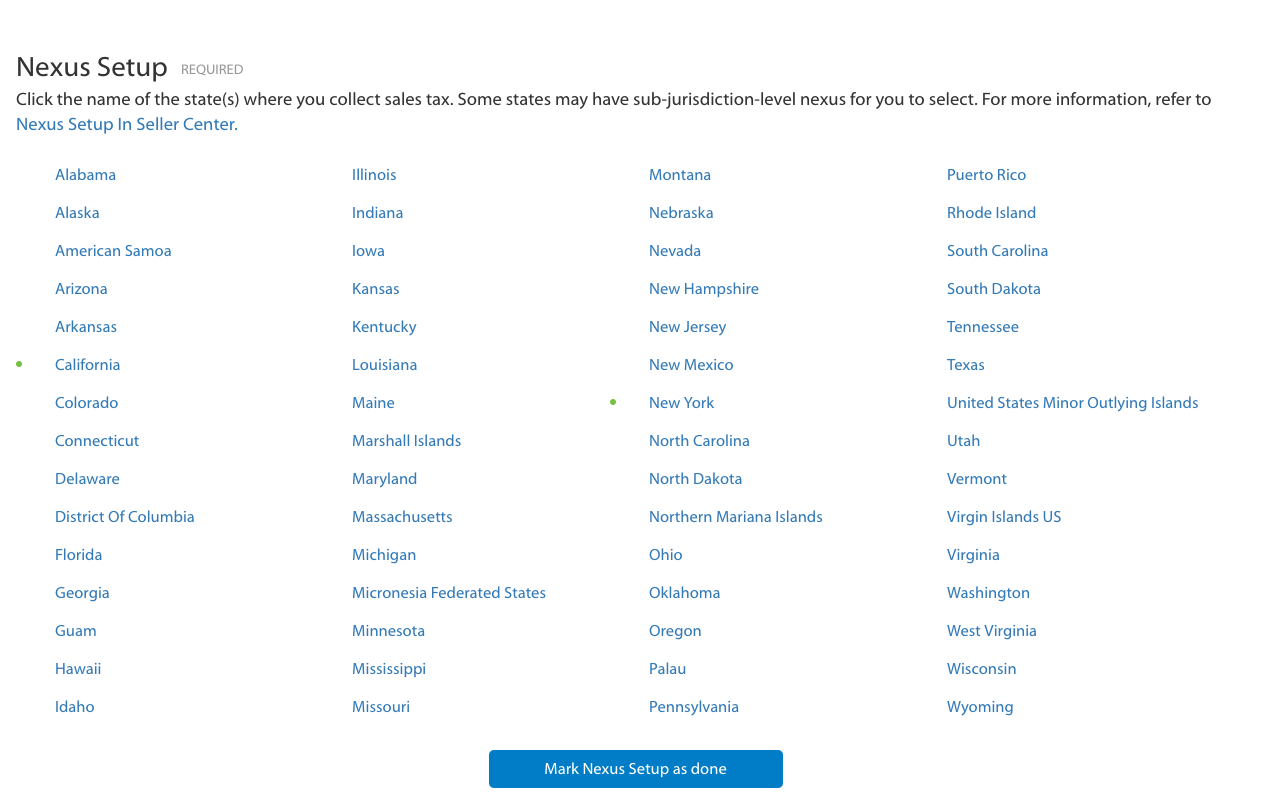

Set up Nexus:

On the taxes page, you see a Nexus section, displaying the name of all the States, and once you click on the states you can see all the cities and counties listed under it, there are known as Sub-States at Walmart.

A green dot appear against the name of the state, below is the image of Nexus, comprising 50 states and Puerto Rico.

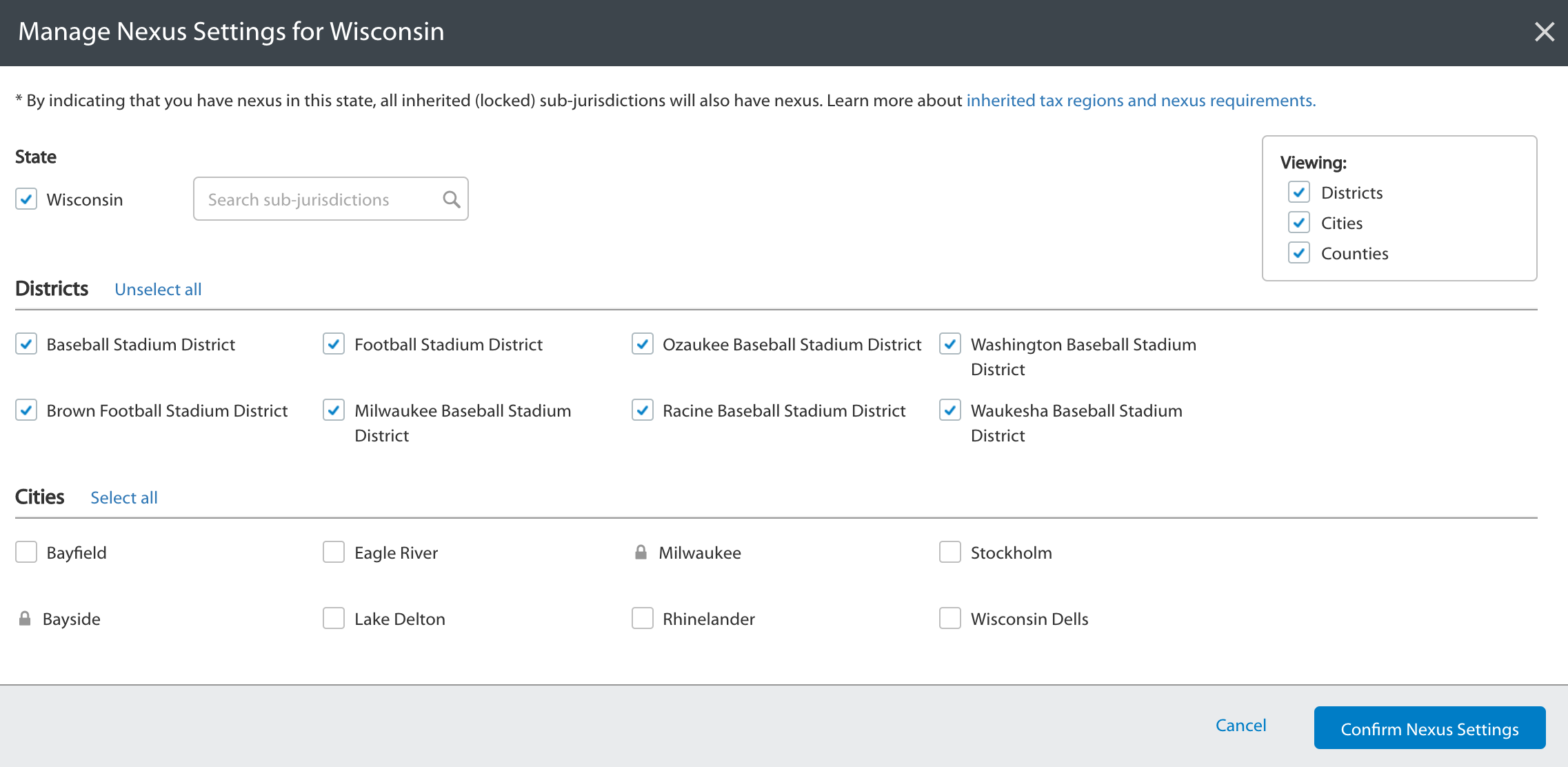

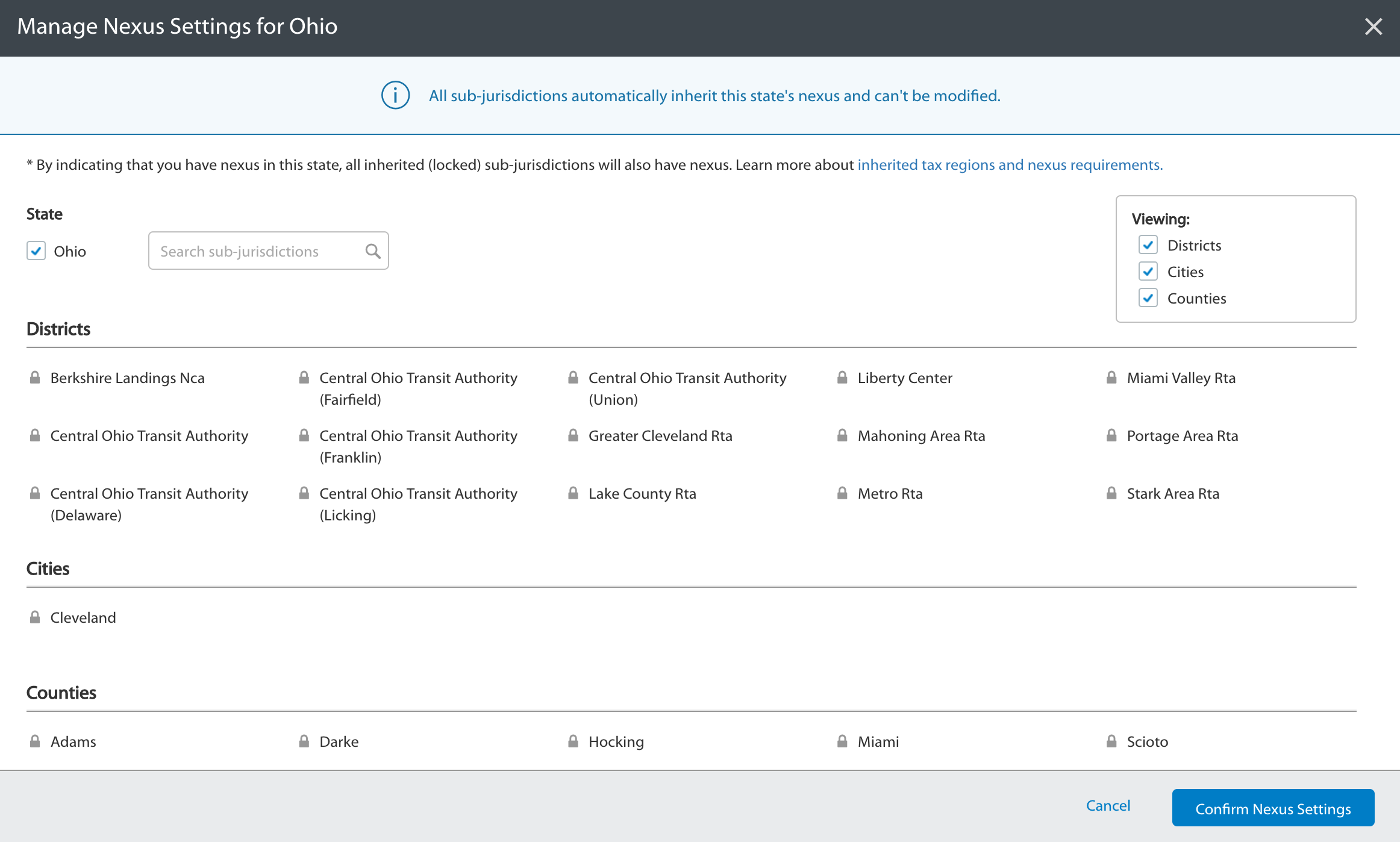

To set up nexus, click on the States, once you click on these there are three possibilities,

Some states have uniform tax policy through entire state, like Connecticut, so there are no sub state, and setting tax code for your items is easy

The State where Sub-state exists, the sub states are shown in the full page view, from where you can choose the sub-state you want nexus setup for. If you serve to all the areas, Check off the State and all the sub-states

It is also possible that all the sub-state inherits state’s nexus setting. In this scenario, once you click Confirm Nexus Setting, all the sub state will inherit all the settings.

Shipping Sales Codes:

Provide Sales Tax Code for each supported shipping method, this enables Walmart to determine what price to charge from Customers for Shipment. Walmart advises strongly to use single taxcode per shipping method.

Shipping Sales Tax Codes

This section is for you to tell customers about Your Sales Tax policy, State your policy but do not exceed 4000 character limit.

Once you’re done with setting up nexus, Shipping Sales tax products and Sales tax policy, click the button which states Mark Nexus Setup as Done.

Information Source: Walmart Knowledge Base

For other Walmart Related Blogs visit Multichannel listing app

Reading Time: 11 minutesThe eCommerce shift you actually need to act on Multi-channel fulfillment has…

Reading Time: 10 minutesBlack Friday Cyber Monday (BFCM) isn’t a weekend anymore; it’s a two-month…

Reading Time: 2 minuteseBay is quietly testing a new feature that could reshape how buyers…

Reading Time: 2 minutesAmazon is stepping into a new era of value commerce with the…

Reading Time: 11 minutesThe $240 Billion BFCM Opportunity & Why Operations Matter Every seller, business,…

Reading Time: 7 minutesTL;DR — Your 60-Second BFCM Battle Plan Time remaining: 3 weeks until…

Reading Time: 2 minutesChina’s Double 11 shopping festival — the world’s largest annual online retail…

Reading Time: 2 minutesAs the holiday season approaches, TikTok Shop has released its September 2025…

Reading Time: 3 minutesIn a continued effort to enable sellers and stimulate new product launches…

Reading Time: 2 minutesAs global trade enters a new phase of regulation and cost restructuring,…

Reading Time: 2 minutesOpenAI Turns to Amazon Web Services in $38 Billion Cloud Deal: What…

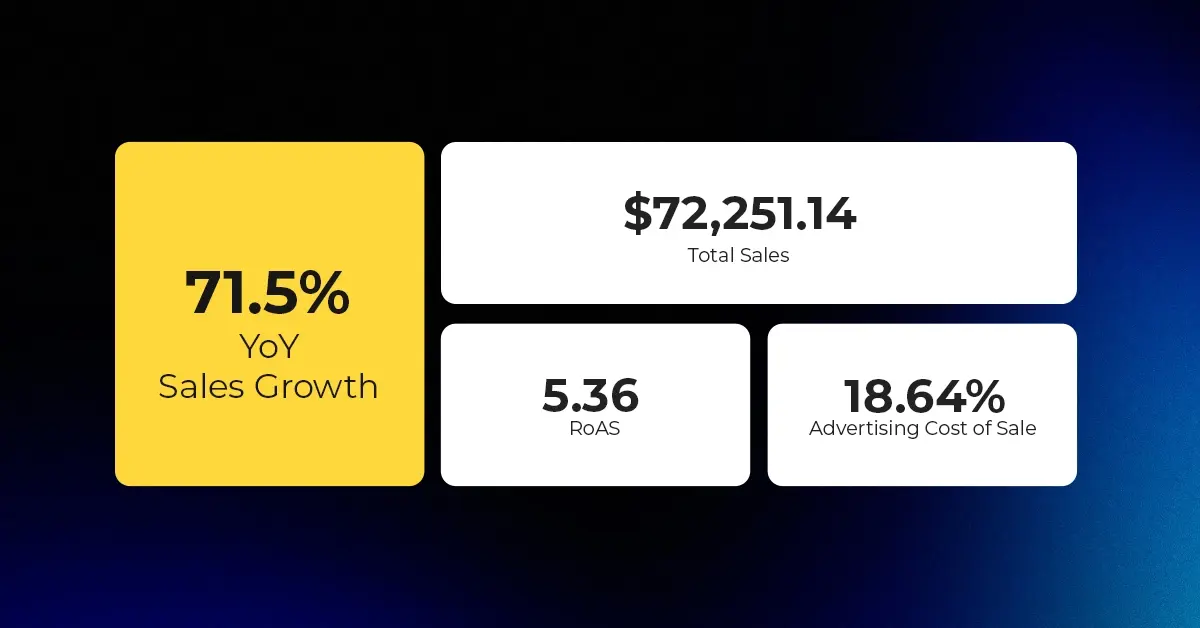

Reading Time: 4 minutesAbout the Client TMRG is a global health and wellness brand with…

Reading Time: 2 minutesAmazon Begins Quarterly Tax Reporting to China: A New Era of Cross-Border…

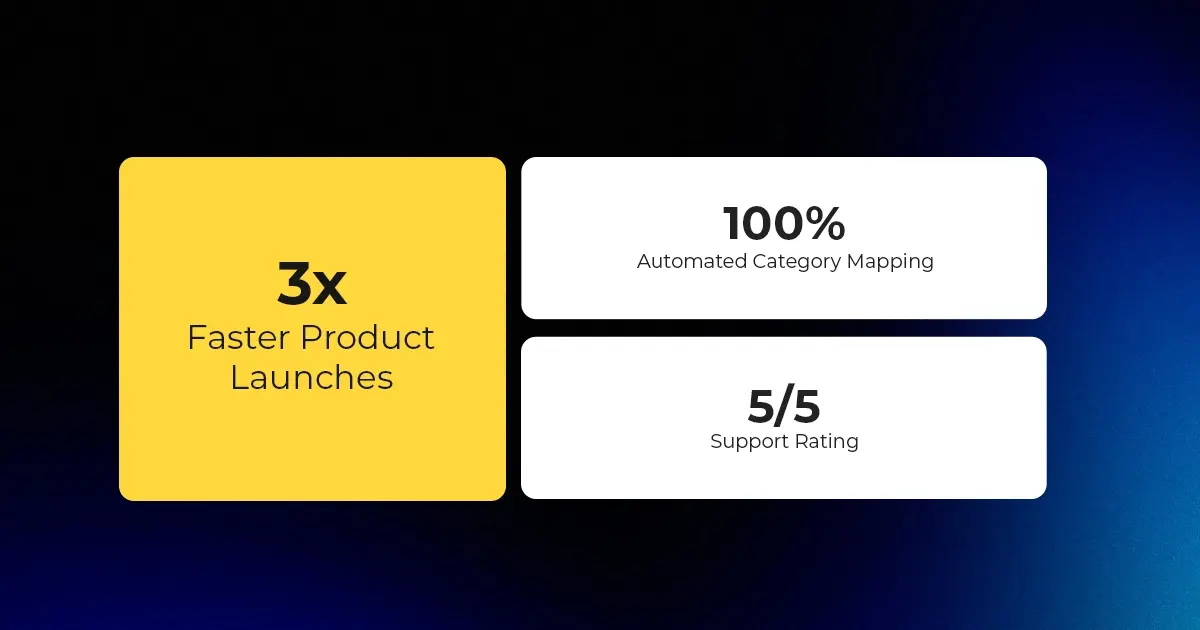

Reading Time: 2 minutesAbout the Brand Name: Stylecraft Industry: Home Décor & Lighting Location: US…

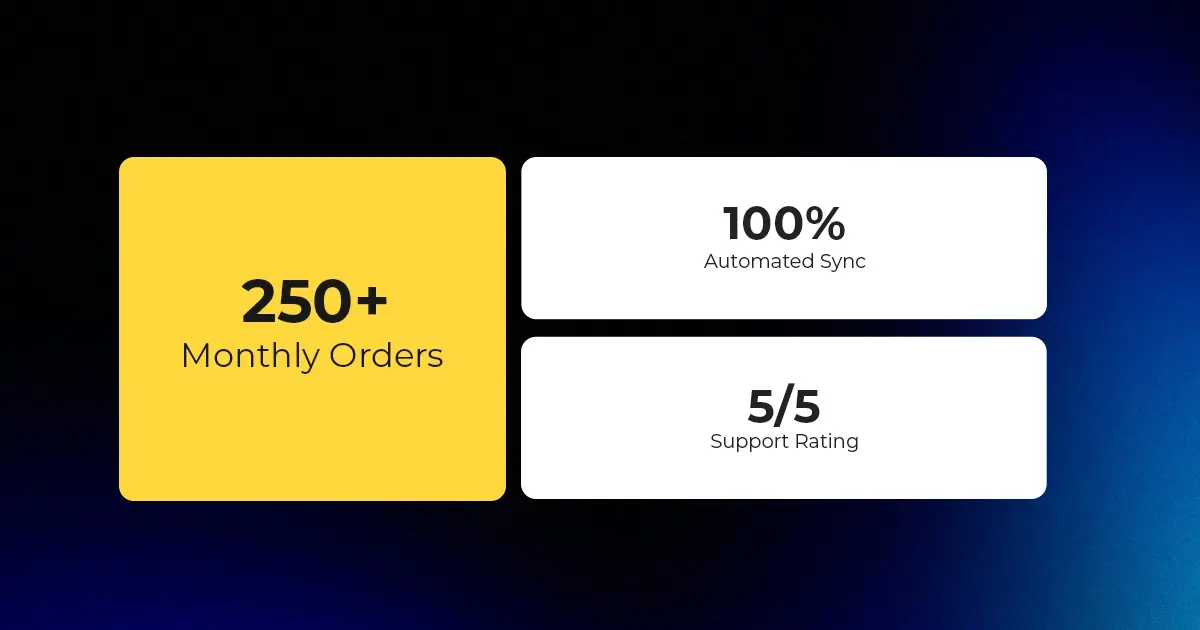

Reading Time: 2 minutesAbout the Brand Name: Flag Agency Industry: Digital Retail & Brand Management…

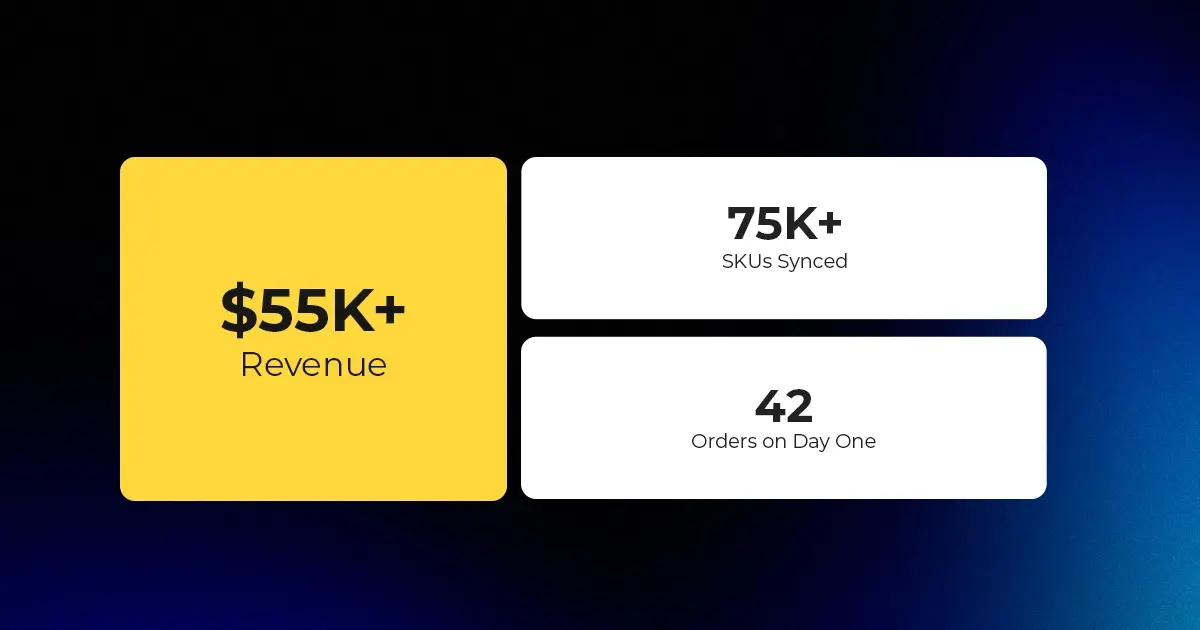

Reading Time: 2 minutesAbout the Brand Name: Stadium Goods Industry: Sneakers, Apparel & Collectibles Location:…

Reading Time: 11 minutesHalloween 2025: The Creative Seller’s Goldmine In the age of viral décor…

Reading Time: 2 minutesOverview AliExpress has launched a new global scheme — the Best Price…

Reading Time: 3 minutesEtsy, Inc. (“Etsy”) today announced two major developments: the appointment of Kruti…

Reading Time: 2 minuteseBay posted a strong performance in Q3 2025, with revenue and gross…