Etsy Expands Payments Policy Globally; Instant Transfers Go Live for US Sellers

Reading Time: 3 minutesWhat’s changed Etsy has rolled out major updates to its Etsy Payments…

In a significant move to support eCommerce sellers and entrepreneurs, Shopify has announced Shopify Finance suite, designed to address the challenges faced by those underserved by traditional banking institutions. This innovative offering includes capital funding, commercial credit cards, sales tax management, and a bill-pay system, providing an integrated solution that simplifies financial management for online sellers.

A recent Shopify-Gallup survey revealed that nearly 40% of entrepreneurs cite financial risk as a significant barrier to starting their businesses. Recognizing this pain point, Shopify aims to bridge the financial services gap by introducing Shopify Finance. As the company states, “Needlessly complicated finances should not overshadow the dream of running a business.” With this new suite, sellers and entrepreneurs can focus on growth and innovation rather than being bogged down by financial complexities.

These new financial tools create numerous opportunities for eCommerce sellers. By simplifying access to capital and streamlining financial processes, Shopify Finance enables sellers to invest in inventory, marketing, and expansion. Moreover, it also helps sellers get rid of the usual hurdles associated with traditional financing. The integrated approach helps save time and reduces stress, allowing Shopify sellers to focus on their core business activities.

While these services provide great benefits, sellers should be aware of a few critical components:

Source: Digital Commerce 360

Reading Time: 3 minutesWhat’s changed Etsy has rolled out major updates to its Etsy Payments…

Reading Time: 2 minutesWhat’s changed Walmart has introduced a new Shipping Score metric within its…

Reading Time: 3 minutesWhat’s changed Amazon has announced an additional $35 billion investment in India…

Reading Time: 4 minutesAbout the Brand: 40ParkLane LLC Studio40ParkLane is a design-led print-on-demand brand created…

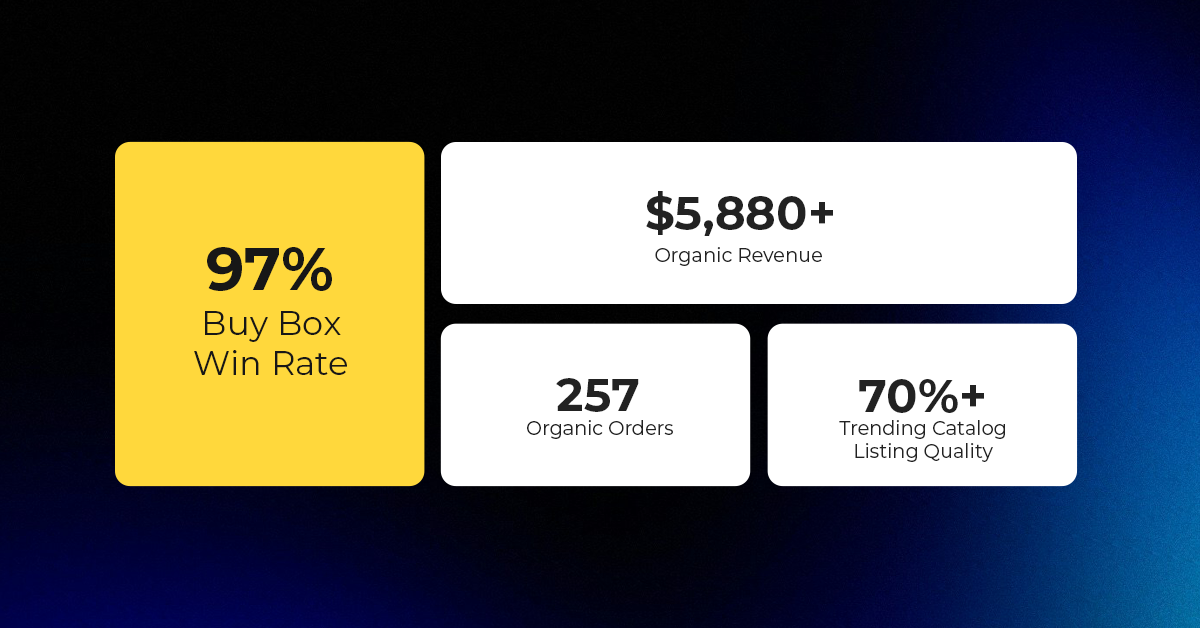

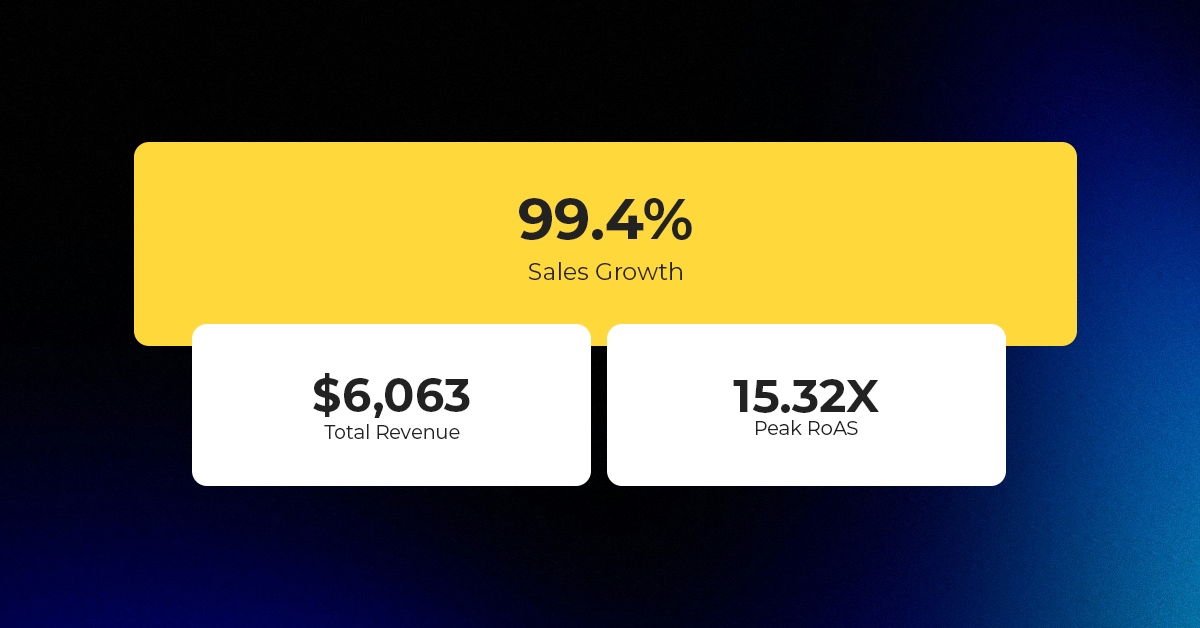

Reading Time: 3 minutesAbout the Company Brand Name: David Protein Industry: Health & Nutrition (Protein…

Reading Time: 3 minutesOnline retail spending in Germany is entering a renewed growth phase after…

Reading Time: 4 minutesTikTok Shop has released a comprehensive Beauty and Personal Care Products Policy,…

Reading Time: 4 minutesTikTok Shop has formally outlined comprehensive requirements for expiration date labeling and…

Reading Time: 3 minutesTikTok Shop is raising its sales commission for merchants across five active…

Reading Time: 11 minutesBy now you have seen your BFCM 2025 numbers. The harder question…

Reading Time: 3 minutesAbout the Brand Name: Vanity Slabs Inc Industry: Trading Slabs- Vanity Slabs…

Reading Time: 2 minutesAbout the Brand Name: Ramjet.com Industry: Automotive Parts & Accessories Location: United…

Reading Time: 2 minutesAmazon is rolling out strategic referral fee reductions across five major European…

Reading Time: 4 minutesQuick Summary: Scaling Lifestyle Powersports on eBay with CedCommerce Challenge: Zero marketplace…

Reading Time: 4 minutesTikTok has surpassed 460 million users across Southeast Asia, reinforcing its position…

Reading Time: 3 minuteseBay has released its final seller news update for 2025, with a…

Reading Time: 3 minutesAmazon has clarified its stance regarding speculation around a potential breakup between…

Reading Time: 4 minutesWalmart is accelerating its push into next-generation fulfillment by expanding its drone…

Reading Time: 4 minutesFaire, the fast-growing wholesale marketplace connecting independent retailers with emerging brands, has…

Reading Time: 4 minutesB2B buying in the United States is undergoing a fundamental behavioral shift…