From Low Visibility to 97% Buy Box Win Rate: How CedCommerce Scaled Vanity Slabs on Walmart

Reading Time: 3 minutesAbout the Brand Name: Vanity Slabs Inc Industry: Trading Slabs- Vanity Slabs…

Let’s begin straight away, to configure Sales Tax you require Tax Nexus, Shipping Sales Tax codes and shipping policy information.

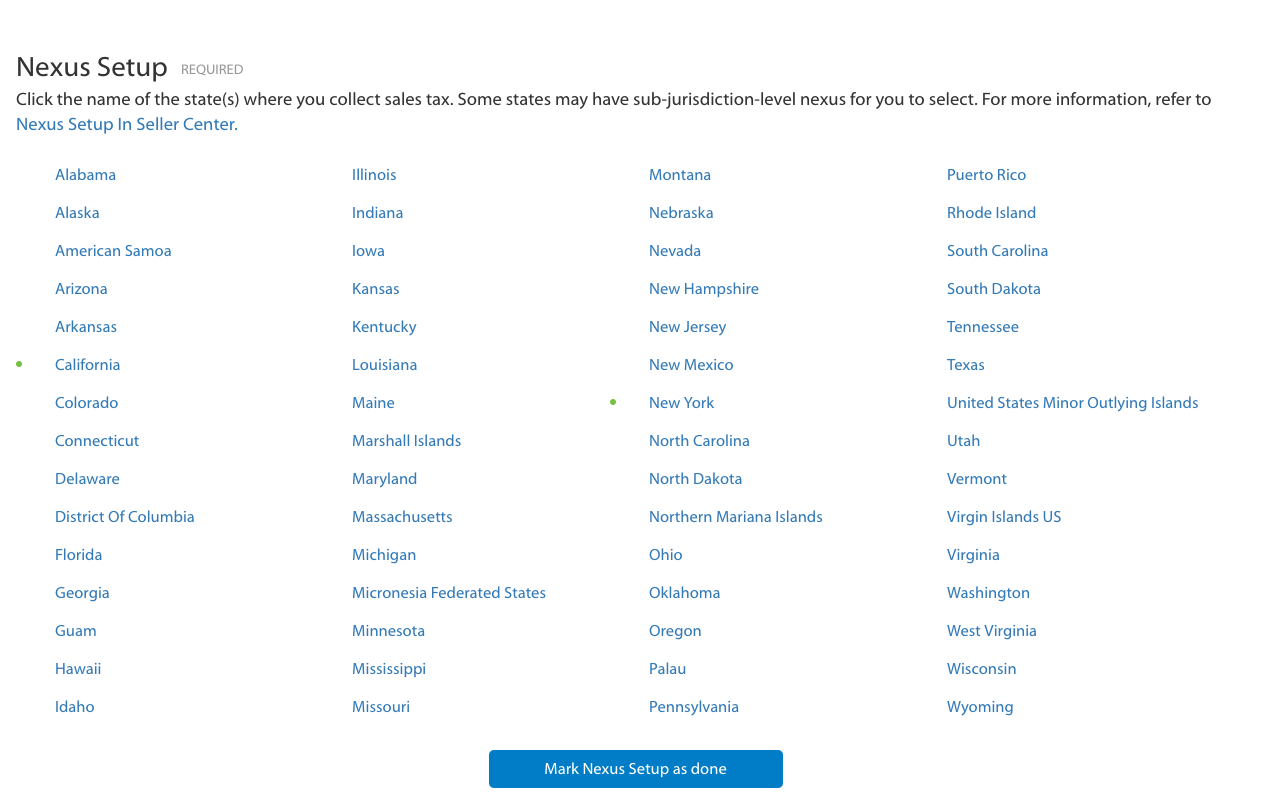

Set up Nexus:

On the taxes page, you see a Nexus section, displaying the name of all the States, and once you click on the states you can see all the cities and counties listed under it, there are known as Sub-States at Walmart.

A green dot appear against the name of the state, below is the image of Nexus, comprising 50 states and Puerto Rico.

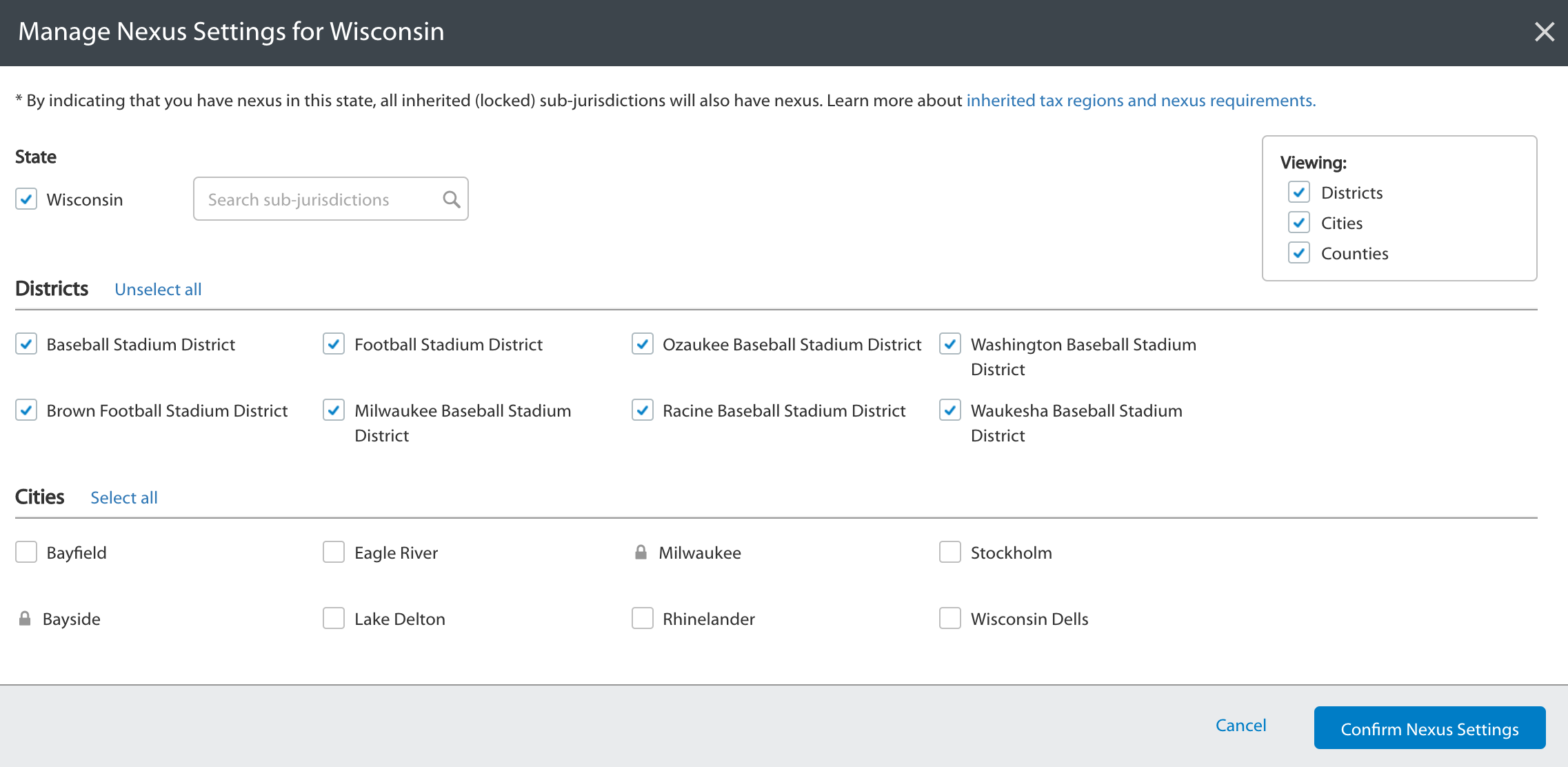

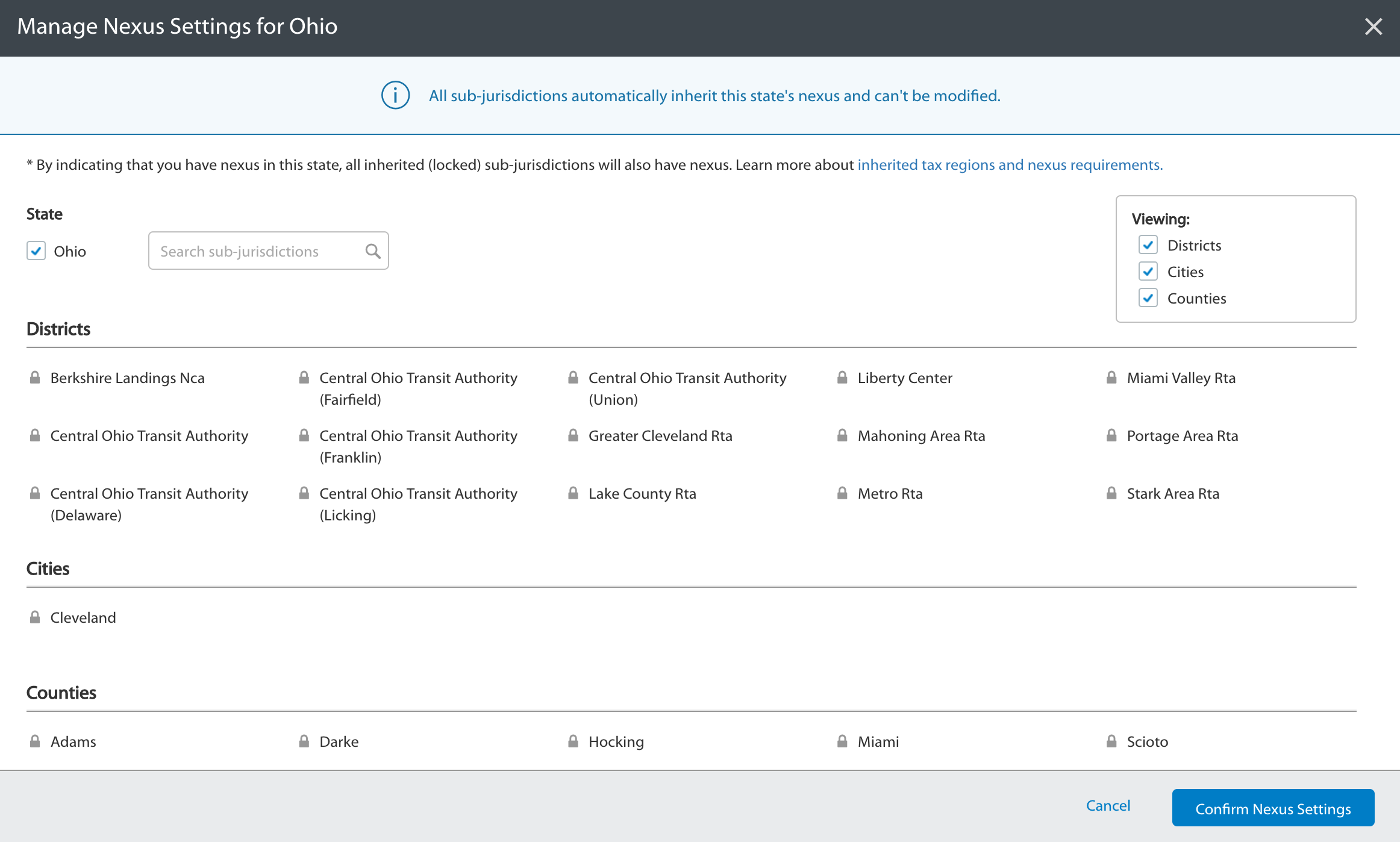

To set up nexus, click on the States, once you click on these there are three possibilities,

Some states have uniform tax policy through entire state, like Connecticut, so there are no sub state, and setting tax code for your items is easy

The State where Sub-state exists, the sub states are shown in the full page view, from where you can choose the sub-state you want nexus setup for. If you serve to all the areas, Check off the State and all the sub-states

It is also possible that all the sub-state inherits state’s nexus setting. In this scenario, once you click Confirm Nexus Setting, all the sub state will inherit all the settings.

Shipping Sales Codes:

Provide Sales Tax Code for each supported shipping method, this enables Walmart to determine what price to charge from Customers for Shipment. Walmart advises strongly to use single taxcode per shipping method.

Shipping Sales Tax Codes

This section is for you to tell customers about Your Sales Tax policy, State your policy but do not exceed 4000 character limit.

Once you’re done with setting up nexus, Shipping Sales tax products and Sales tax policy, click the button which states Mark Nexus Setup as Done.

Information Source: Walmart Knowledge Base

For other Walmart Related Blogs visit Multichannel listing app

Reading Time: 3 minutesAbout the Brand Name: Vanity Slabs Inc Industry: Trading Slabs- Vanity Slabs…

Reading Time: 2 minutesAbout the Brand Name: Ramjet.com Industry: Automotive Parts & Accessories Location: United…

Reading Time: 2 minutesAmazon is rolling out strategic referral fee reductions across five major European…

Reading Time: 4 minutesQuick Summary: Scaling Lifestyle Powersports on eBay with CedCommerce Challenge: Zero marketplace…

Reading Time: 4 minutesTikTok has surpassed 460 million users across Southeast Asia, reinforcing its position…

Reading Time: 3 minuteseBay has released its final seller news update for 2025, with a…

Reading Time: 3 minutesAmazon has clarified its stance regarding speculation around a potential breakup between…

Reading Time: 4 minutesWalmart is accelerating its push into next-generation fulfillment by expanding its drone…

Reading Time: 4 minutesFaire, the fast-growing wholesale marketplace connecting independent retailers with emerging brands, has…

Reading Time: 4 minutesB2B buying in the United States is undergoing a fundamental behavioral shift…

Reading Time: 3 minutesSummary Cyber Monday 2025 has officially become the largest online shopping day…

Reading Time: 2 minutesSummary Amazon kicked off December with two major developments shaping the future…

Reading Time: 2 minutesSummary Walmart has entered December with two major moves that signal a…

Reading Time: 2 minutesBlack Friday 2025 delivered the strongest U.S. eCommerce performance in history, as…

Reading Time: 13 minutesStill approaching BFCM with generic discounts, last-minute price cuts, or scattered promotions?…

Reading Time: 3 minutesTikTok Shop reached a major milestone during its largest U.S. “Global Black…

Reading Time: 3 minutesOpenAI has announced a new AI-powered shopping research tool designed to help…

Reading Time: 9 minutesIf your TikTok Shop listings often sit in review or your visibility…

Reading Time: 3 minutesAmazon has rolled out a new “Seller Challenge” feature for eligible Account…

Reading Time: 3 minutesWalmart Marketplace has sharpened its requirements around product classification (category, type group,…