Cyber Monday 2025 eCommerce Shatters Records

Reading Time: 3 minutesSummary Cyber Monday 2025 has officially become the largest online shopping day…

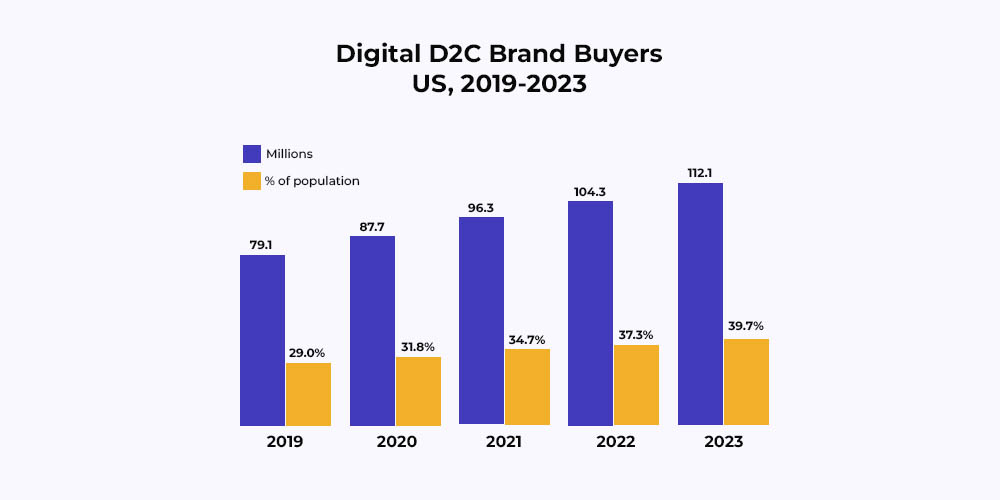

Direct-to-consumer commerce model has shown staggering growth in recent years. So, before we get into the definition, details, challenges, and solutions surrounding the DTC eCommerce model, let’s look at these 3 stats (Insider Intelligence):

Once you understand the above data, it suggests that more and more brands are adopting the DTC (or direct-to-consumer)way of commerce or eCommerce.

But why?

The answer lies in the way the DTC model works. The model brings a brand closer to its customer (66% of online shoppers purchase directly from brands).

While the DTC model empowers sellers with greater control over profits, messaging, and branding, there are some underlying challenges for the sellers.

This article aims to explore common challenges encountered by DTC brands and provide potential solutions to address and overcome them effectively.

Simply put, the D2C (or DTC or direct-to-consumer) commerce model empowers the seller to directly sell the products to the customers, eliminating the middleman/wholesaler.

Above all, the three key elements of the model are:

As DTC brands strive to provide a seamless and efficient customer experience, managing the shipping and fulfillment process becomes crucial. All in all, the major challenge is optimizing logistics and ensuring timely delivery. Sellers often face complexities in coordinating inventory across multiple channels, integrating with shipping carriers, and choosing the most cost-effective shipping methods. Also, handling returns and exchanges can add to the challenge as DTC brands typically navigate the process independently, which requires effective reverse logistic management.

With an increasingly crowded marketplace and fierce competition, standing out and capturing the attention of potential customers is a challenging task. All things considered, DTC brands often need help building brand awareness and establishing credibility, mainly if they are new or less known. Limited marketing budgets and resources increase the challenge, as they must find cost-effective ways to reach and engage their target audience.

Additionally, it can be difficult to identify the right customer segments and tailor marketing messages to resonate with them. DTC sellers also face the hurdle of convincing customers to switch from traditional retail channels to buying directly from them.

As DTC brands have complete control over the manufacturing and distribution process, ensuring high product quality and safety standards becomes their responsibility. Maintaining consistency and reliability in product quality can be challenging, especially as brands scale and introduce new product lines. This involves transparent communication about ingredients, manufacturing processes, and safety certifications. Additionally, managing product recalls or addressing potential safety issues requires efficient communication channels and proactive customer support.

As the direct-to-consumer model gains popularity, more brands enter the space, intensifying customer attention and loyalty competition. Standing out requires a deep understanding of the target audience and their unique needs, allowing DTC brands to offer compelling value propositions and personalized experiences. The competition extends beyond similar DTC brands, including traditional retailers and e-commerce giants.

Unlike established brands that have already built a reputation and brand equity, D2C brands often start from scratch and face the uphill task of creating brand awareness and establishing themselves in the market. Building a brand requires consistent messaging, storytelling, and a strong value proposition that resonates with the target audience. They must carefully craft their brand image, develop a solid online presence, and engage with customers through various channels to build trust and loyalty. Brand building takes time and effort, however, if you focus on authenticity, innovation, and creating a memorable customer experience, you can easily build your brand’s reputation

As the number of customers increases on different digital platforms, effective data collection and organizing it can emerge as a challenge for DTC brands. Managing vast amounts of data can be complex and requires investment in data infrastructure, analytics tools, and skilled personnel. Furthermore, ensuring data privacy and security is paramount.

Social ads are advertisements specifically designed and targeted for social media platforms. These ads appear within users’ feeds or timelines and can take various formats, including images, videos, carousels, and sponsored posts.

Buy with Prime is a program that allows direct-to-consumer (DTC) sellers to leverage social ads to boost their visibility and enhance the customer experience. By incorporating Buy with Prime into their social media advertising strategy, DTC sellers can tap into the vast customer base and streamlined fulfillment services that Amazon Prime offers.

Selling directly to consumers undoubtedly offers numerous advantages, such as avoiding hefty commissions to large retailers and preserving profit margins by bypassing wholesalers.

However, it’s important to note that you’re open to more than an all-or-nothing approach when it comes to DTC. Test the waters, be proactive, speak to your customer base, and build your brand. And if you are looking for an expert to help you to overcome the challenges faced as a DTC eCommerce owner, click and connect here with CedCommerce.

Reading Time: 3 minutesSummary Cyber Monday 2025 has officially become the largest online shopping day…

Reading Time: 2 minutesSummary Amazon kicked off December with two major developments shaping the future…

Reading Time: 2 minutesSummary Walmart has entered December with two major moves that signal a…

Reading Time: 2 minutesBlack Friday 2025 delivered the strongest U.S. eCommerce performance in history, as…

Reading Time: 13 minutesStill approaching BFCM with generic discounts, last-minute price cuts, or scattered promotions?…

Reading Time: 3 minutesTikTok Shop reached a major milestone during its largest U.S. “Global Black…

Reading Time: 3 minutesOpenAI has announced a new AI-powered shopping research tool designed to help…

Reading Time: 9 minutesIf your TikTok Shop listings often sit in review or your visibility…

Reading Time: 3 minutesAmazon has rolled out a new “Seller Challenge” feature for eligible Account…

Reading Time: 3 minutesWalmart Marketplace has sharpened its requirements around product classification (category, type group,…

Reading Time: 3 minutesJust ahead of Black Friday, Amazon is enforcing tighter controls on its…

Reading Time: 11 minutesWhere holiday prep of past years focused on legacy channels like Amazon,…

Reading Time: 11 minutesThe eCommerce shift you actually need to act on Multi-channel fulfillment has…

Reading Time: 10 minutesBlack Friday Cyber Monday (BFCM) isn’t a weekend anymore; it’s a two-month…

Reading Time: 2 minuteseBay is quietly testing a new feature that could reshape how buyers…

Reading Time: 2 minutesAmazon is stepping into a new era of value commerce with the…

Reading Time: 11 minutesThe $240 Billion BFCM Opportunity & Why Operations Matter Every seller, business,…

Reading Time: 7 minutesTL;DR — Your 60-Second BFCM Battle Plan Time remaining: 3 weeks until…

Reading Time: 2 minutesChina’s Double 11 shopping festival — the world’s largest annual online retail…

Reading Time: 2 minutesAs the holiday season approaches, TikTok Shop has released its September 2025…