WooCommerce 10.2 Arrives September 16: A Simple Seller Guide

Exciting news for WooCommerce sellers! WooCommerce 10.2 is officially launching on September 16, 2025, introducing

The previous section dealt with Shopify Payments – the most flexible payment method for your Shopify store. But Shopify’s in-house payment solution is confined to some countries, which means that it is unavailable to all the stores. Does this mean that the best payment option for Shopify stores is available only to some merchants? No. There is an army of third-party payment providers that are a replica of Shopify Payments (in some ways). Since Shopify is in its growth stage, it might take some time to present its in-house payment solution. Till then, you can leverage other payment gateways for your Shopify store.

Third-party payment providers are financial institutions partnered with Shopify to help in the payment processing. Shopify has alliances with 150+ payment gateways to ensure that every store is equally qualified for cross-border trade. Below is a country-wise list of payment gateways for your Shopify store.

As of 2019, 54 countries in Africa are home to 1.3 billion people. The World Bank announced that Africa joined the league of fastest-growing continents.

DO NOT take Africa lightly on the grounds of eCommerce. Kenya & Uganda were the first countries to introduce mobile payments in 2000. Last year, 43% of South African consumers made their first grocery purchase, and 53% of consumers bought goods from an online pharmacy for the first time. While online shopping mushrooms in some countries, others remain underserved. Currently, only 20 African nations enacted online consumer protection and data management laws.

You can build a fully functional Shopify store and connect with online shoppers from 33 countries. There are third-party payment providers like PaySera, PaymentWall, PayPay Checkout, Skrill, 2Checkout that come in handy.

You can build a fully functional Shopify store and connect with online shoppers from 33 countries. There are third-party payment providers like PaySera, PaymentWall, PayPay Checkout, Skrill, 2Checkout that come in handy.

4.5 billion people live in 49 nations on the Asian continent. It is the fastest-growing economic region in the world. On one side, there is China – a leader in global innovations and a manufacturing hub. And on the other side India – the world’s emerging economy. In short, Asia is the sweet spot for global brands.

With its growing middle class and increasing internet penetration, Asia is at the forefront of global eCommerce dynamism. As per Statista, Asia’s revenue from online commerce is predicted to touch $1.92 trillion by 2024.

Shopify is present in 35 Asian nations and backed up with apex gateways like – iDEAL, RazorPay, PayPal, PayTM, etc. Asia has established a digital shopping culture and embraced eCommerce touchpoints from head to toe. Easy installments or payment through crypto – 21st century’s online shoppers have some crazy ways to make an online payment.

If you want to utilize the power of Asian eCommerce fully, be sure to make a list of the top 5 payment providers for your Shopify store and study them thoroughly. If you’re looking for expert advice, click on the button below to get in touch with an expert –

Europe’s retail industry struggled significantly last year, but the pandemic has also been a catalyst for eCommerce in Europe. Compared to the US or China, Europe’s acceptance of online marketplaces is a bit slow. But it is now becoming a lucrative route for global brands that want to tap the European shoppers.

Online marketplaces in Europe generated 59% (of the €143 million) of the spending on cross-border transactions in 2019. Germany dominates Europe in terms of online shopping and presents a significant opportunity for Shopify stores.

If you run a Shopify store in Europe, you can check up with payment gateways like – BitPay, FasterPay, Adyen, Asiabill, CyberSource, Wind Cave, iPayLink – for payment solutions.

eCommerce in the Middle East is booming – E&Y’s report said that 92% of UAE & Saudi Arabia shoppers had changed their shopping habits last year. This alone makes the Middle East region one of the fastest-growing eCommerce markets in the world. Online sales account for roughly 2% of the total retail revenue of the Middle East.

Digital payments in Latin America grew in leaps and bounds. As per the analysis made between April 2020 and March 2021 found out that 2 online payment methods are roaring among Americans – the payment processor (used in web pages) and the use of payment link.

40 million shoppers took leverage of the 2 payment methods to procure goods online. Other payment methods like digital wallets, debit cards helped eCommerce get a 32% growth in some countries.

The internationalization of eCommerce in Latin & North America is also reflected in some of the most trusted brands like Netflix, SHIEN, Amazon, AliExpress, and Shopify. Brazil is the largest market in Latin America, with a 25% jump in the number of online consumers last year.

North America’s eCommerce market is valued at around $912 billion, and it is growing at a rate of 13% annually. Average North-American spends around $3500 a year on online purchases & accounts for 14% of all retail sales.

In 2019, Australian eCommerce hit $32 billion spending – 20% more year-over-year. Australia is home to 25.3 million people – and 22.3 million people have access to the internet. Globally, Australia stands at the 10th spot in terms of revenue by online shopping.

Most Australians buy cross-border products. PayPal is the most common mode of online payment, while BNPL is rapidly increasing among millennial shoppers.

Apart from third-party payment gateways for your store, there are other ways to accept payments. One of them is – Cryptocurrency! This digital asset allows shoppers to pay without going through a bank or another institution.

Cryptocurrencies are not widely accepted, but this digital asset has just caught global attention. Let’s not forget about Elon Musk’s love for crypto and his focus on making Tesla cars open for sale through cryptocurrency as a payment method. Here is how cryptocurrencies are advantageous to the merchants –

You can enable one of the following payment providers to start accepting cryptocurrencies as payments from your customers. Once you enable either payment method, you can accept Bitcoins, Ethereum, Litecoin, and other 300+ digital currencies.

If you’re a Canadian merchant, you can allow shoppers to use email money transfer services like Interac to pay for their orders.

During checkout, you provide customers your email address and a secret question and answer as a password they use while transferring money. Once the customer sends you the money through email, you will get an email with instructions on how to transfer the money to your account.

Here’s how you can set up email money transfers in your Shopify store –

Cash on delivery is no hidden secret. But a majority of eCommerce stores have CoD as one of their payment methods. If you run a Shopify store from the Indian subcontinent, you can take advantage of Shopify’s Advanced Cash on Delivery app exclusively for India. Below are some of the prominent features of the app –

Click here to know more about Shopify’s Advanced Cash on the Delivery app.

You don’t make changes in your payment and shipping settings now and then, do you? Hence, it is strongly recommended to give payment settings as much time as possible. Who knows, you might miss out on an exciting opportunity that could benefit both your business and shoppers!

Even today, cards are the dominant online payment method in the US 47% of all eCommerce transactions are happening with the plastic card. The greatest challenge here is identifying a payment provider for your Shopify store that accepts prominent debit and credit cards with a decent transaction fee.

Contactless cards and other forms of payment are also emerging to be people’s favorite. If you want to develop a universally accepted payment procedure, you need to understand the ongoing payment trends and bring them to practice.

Setting up a payment method for your Shopify store shouldn’t be just another step-by-step activity. It should come out as a wise and planned decision. Either you move ahead with Shopify Payments or a third-party payment gateway – the aim should be one. Make your Shopify store available, accessible, and shippable to as many shoppers on the internet.

To get a full list of payment providers for your Shopify store, click here.

Exciting news for WooCommerce sellers! WooCommerce 10.2 is officially launching on September 16, 2025, introducing

Effective: September 30, 2025 (U.S. & Canada) Amazon is overhauling its inventory recovery programs. Starting

TikTok has rolled out a set of new support tools for TikTok Shop creators, aiming

Amazon has launched FBA Damaged Inventory Ownership, a program that lets sellers take direct control

Alibaba Group has unveiled a sweeping restructuring of its consumer-facing operations, merging Taobao, Tmall, Ele.me,

Walmart is ramping up its efforts to recruit merchants from the United Kingdom and continental

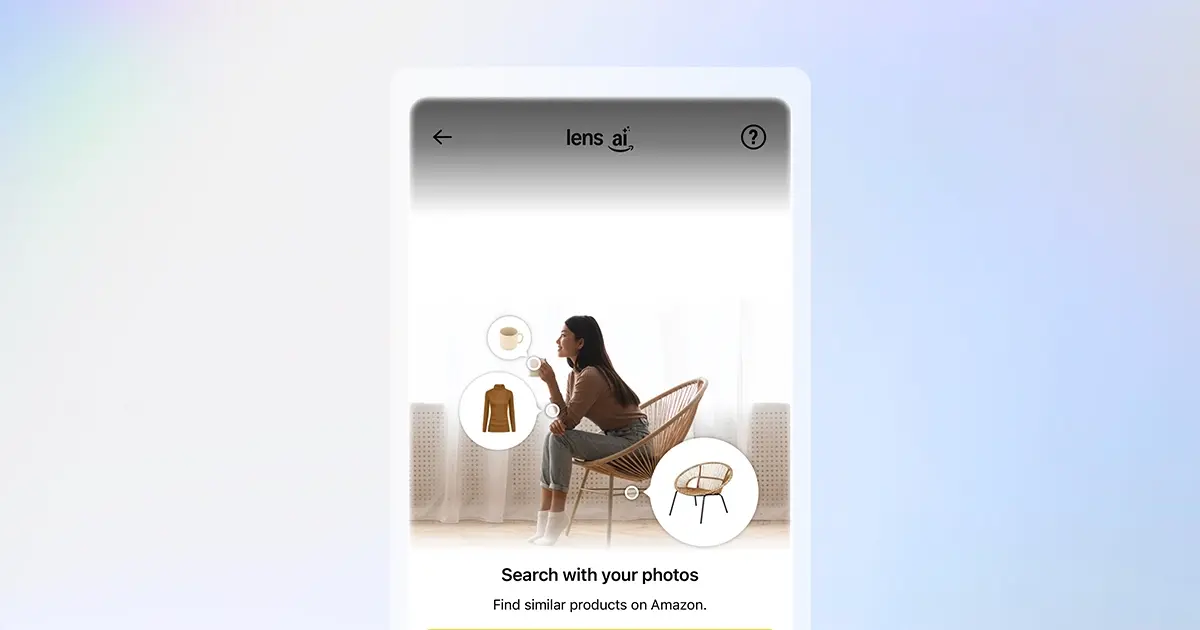

Amazon is doubling down on artificial intelligence in eCommerce with the launch of Lens Live,

For the first time since 2020, U.S. consumers are planning to cut back on holiday

Temu, the rapidly growing eCommerce platform, has announced the launch of its Local Seller Program

Etsy has announced important updates to its new Etsy Payments Policy, effective October 9, 2025,

Amazon has launched its first-ever “Second Chance Deal Days“ sales event in Europe, exclusively featuring

The Update Amazon has strategically resumed its Google Shopping ad campaigns across all international markets—

TikTok has updated its account policies, LIVE rules, monetization eligibility, and enforcement measures. The changes

Think Black Friday is when holiday shopping begins? Think again. Your future customers are already

eBay is rolling out eBay Live in the UK, offering sellers a new way to

eBay is giving its auto parts and accessories marketplace a tune-up, announcing the launch of

Walmart is set to revamp its Pro Seller Program at the end of September 2025,

Pinterest is diving headfirst into the burgeoning secondhand market with the launch of “Thrift Shop,”

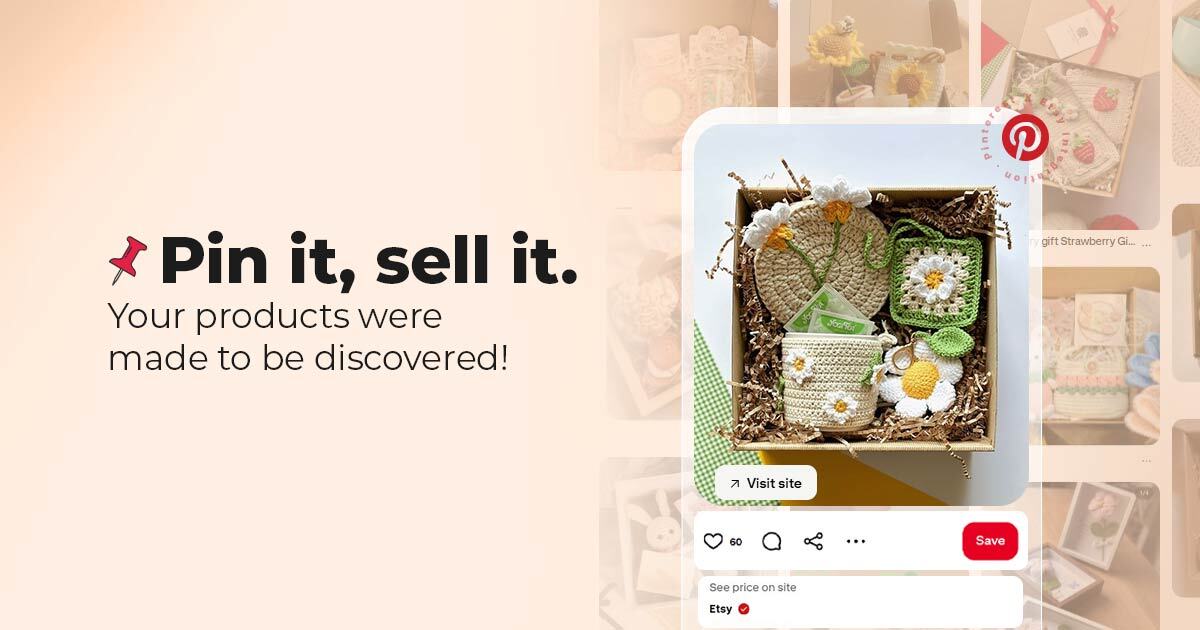

Why Pinterest Is a Growth Channel for Etsy Sellers Discovery drives eCommerce growth. With 482

In a strategic move to enable smaller businesses with global ambitions, international logistics giant DHL