The 2025 Fulfillment Shift: How Amazon MCF Now Powers Shein, Walmart, and Shopify Orders

Reading Time: 11 minutesThe eCommerce shift you actually need to act on Multi-channel fulfillment has…

Chinese fast-fashion giant Shein has gained over 15.2 million new monthly users in Europe between February and July 2025, solidifying its position as one of the region’s most dominant eCommerce platforms. According to disclosures required under the EU’s Digital Services Act (DSA), Shein served an average of 145.7 million European shoppers per month during this period—an 11.6% increase from the 130.5 million reported in the previous six months.

While rival Chinese marketplace Temu is growing at a slightly faster pace, Shein maintains a significant lead in total user base:

That leaves Shein with a 30 million user advantage over Temu in the EU. Despite this, both platforms still trail AliExpress, the largest Chinese marketplace in Europe, which averages around 190 million monthly users.

The figures highlight an intensifying contest among Chinese digital platforms to capture the loyalty of European consumers, many of whom are drawn by aggressive pricing, rapid product turnover, and mobile-first shopping experiences.

Shein’s popularity is not evenly distributed across the continent. The platform enjoys particularly strong traction in southern and western Europe:

The strong growth in Germany is particularly notable, as it reflects Shein’s ability to expand in a highly competitive market where established local and global eCommerce players dominate.

Although Germany ranks behind France, Spain, and Italy in user numbers, it has emerged as Shein’s most lucrative EU market. In 2023, Shein generated approximately €2 billion in revenue from Germany alone. The country’s growing adoption rate, combined with higher average spending, has made it central to Shein’s European strategy.

Across the English Channel, Shein has also found success: in the United Kingdom, its revenue rose 32% year-over-year, hitting €2.3 billion in 2024. The U.K., while no longer part of the EU, remains a critical market for Shein’s European expansion.

The data underscores several important dynamics:

Shein’s ability to maintain momentum in Europe will depend on balancing regulatory compliance, competition with Temu and AliExpress, and sustainability pressures. The EU market has become the battleground for Chinese eCommerce giants, and with Shein’s 15 million new users, it is currently the frontrunner in the fashion vertical.

As Germany and the U.K. emerge as revenue leaders, and southern Europe remains a user stronghold, Shein’s next challenge may be sustaining growth amid rising calls for greater transparency in supply chains and responsible business practices—issues European regulators and consumers are paying closer attention to.

Source: https://ecommercenews.eu/15-million-new-european-shein-users/

Reading Time: 11 minutesThe eCommerce shift you actually need to act on Multi-channel fulfillment has…

Reading Time: 10 minutesBlack Friday Cyber Monday (BFCM) isn’t a weekend anymore; it’s a two-month…

Reading Time: 2 minuteseBay is quietly testing a new feature that could reshape how buyers…

Reading Time: 2 minutesAmazon is stepping into a new era of value commerce with the…

Reading Time: 11 minutesThe $240 Billion BFCM Opportunity & Why Operations Matter Every seller, business,…

Reading Time: 7 minutesTL;DR — Your 60-Second BFCM Battle Plan Time remaining: 3 weeks until…

Reading Time: 2 minutesChina’s Double 11 shopping festival — the world’s largest annual online retail…

Reading Time: 2 minutesAs the holiday season approaches, TikTok Shop has released its September 2025…

Reading Time: 3 minutesIn a continued effort to enable sellers and stimulate new product launches…

Reading Time: 2 minutesAs global trade enters a new phase of regulation and cost restructuring,…

Reading Time: 2 minutesOpenAI Turns to Amazon Web Services in $38 Billion Cloud Deal: What…

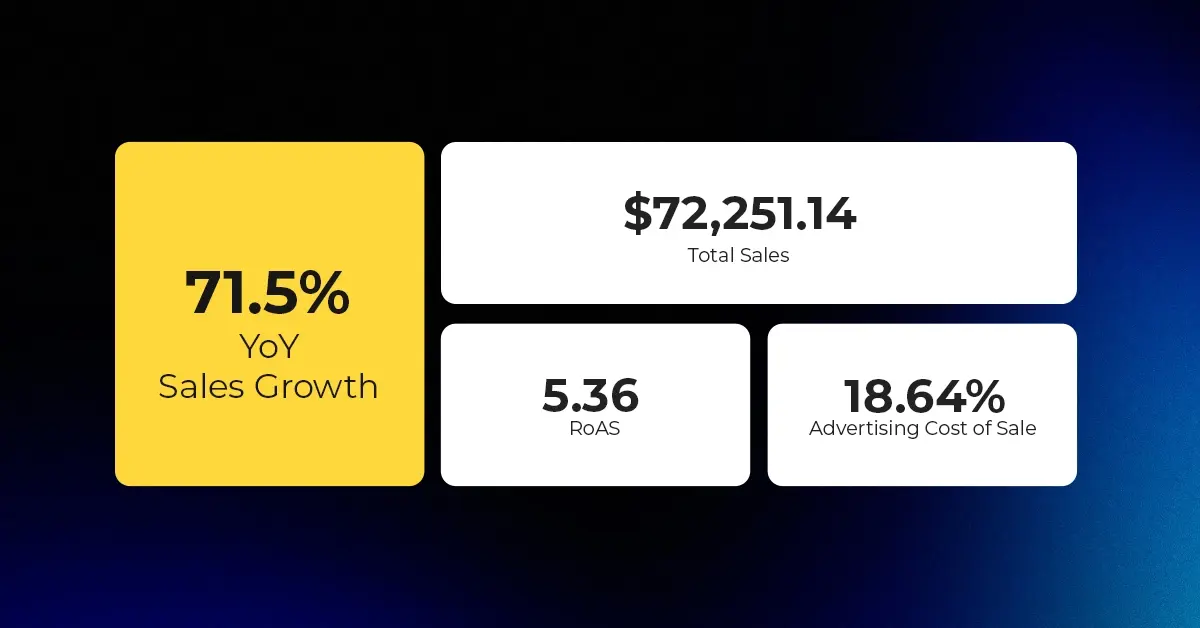

Reading Time: 4 minutesAbout the Client TMRG is a global health and wellness brand with…

Reading Time: 2 minutesAmazon Begins Quarterly Tax Reporting to China: A New Era of Cross-Border…

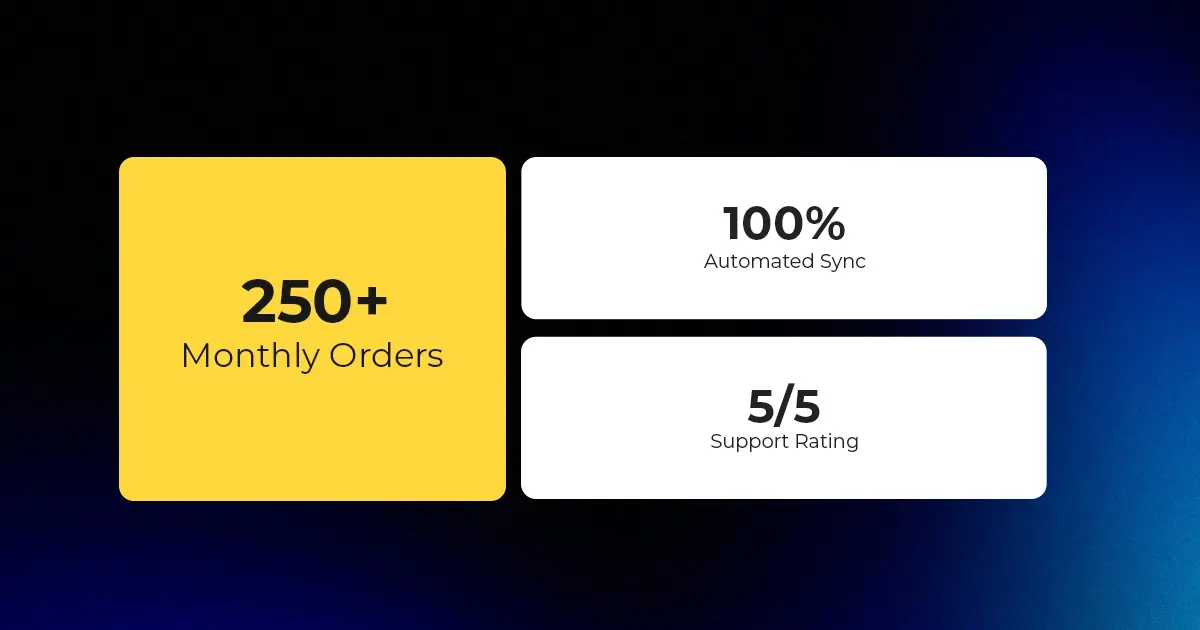

Reading Time: 2 minutesAbout the Brand Name: Stylecraft Industry: Home Décor & Lighting Location: US…

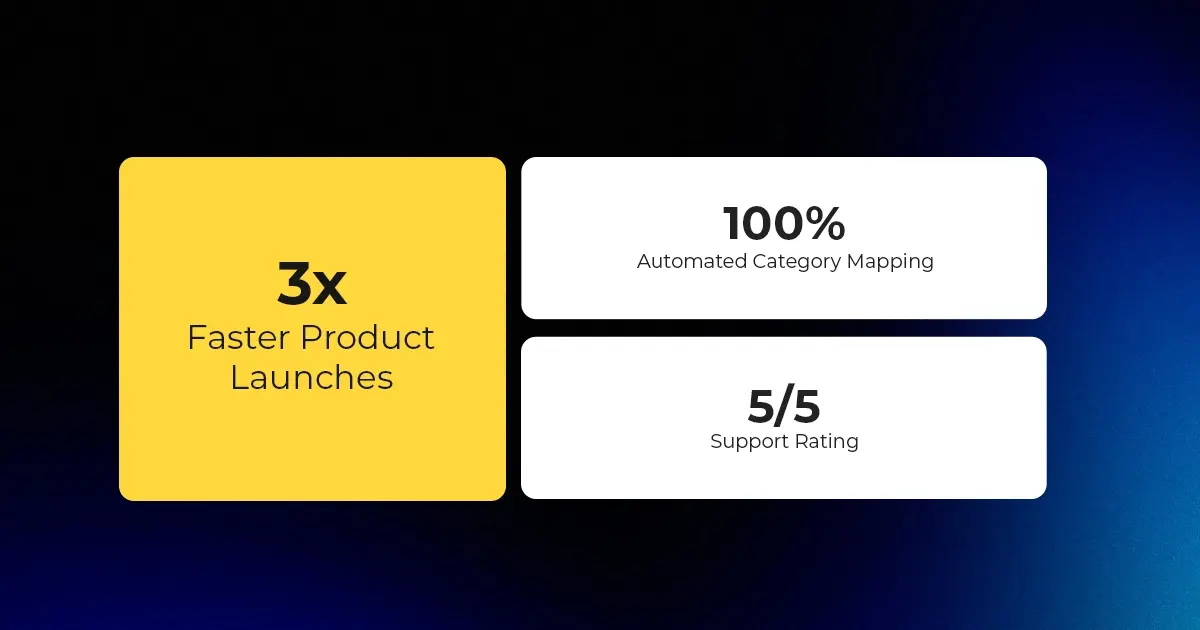

Reading Time: 2 minutesAbout the Brand Name: Flag Agency Industry: Digital Retail & Brand Management…

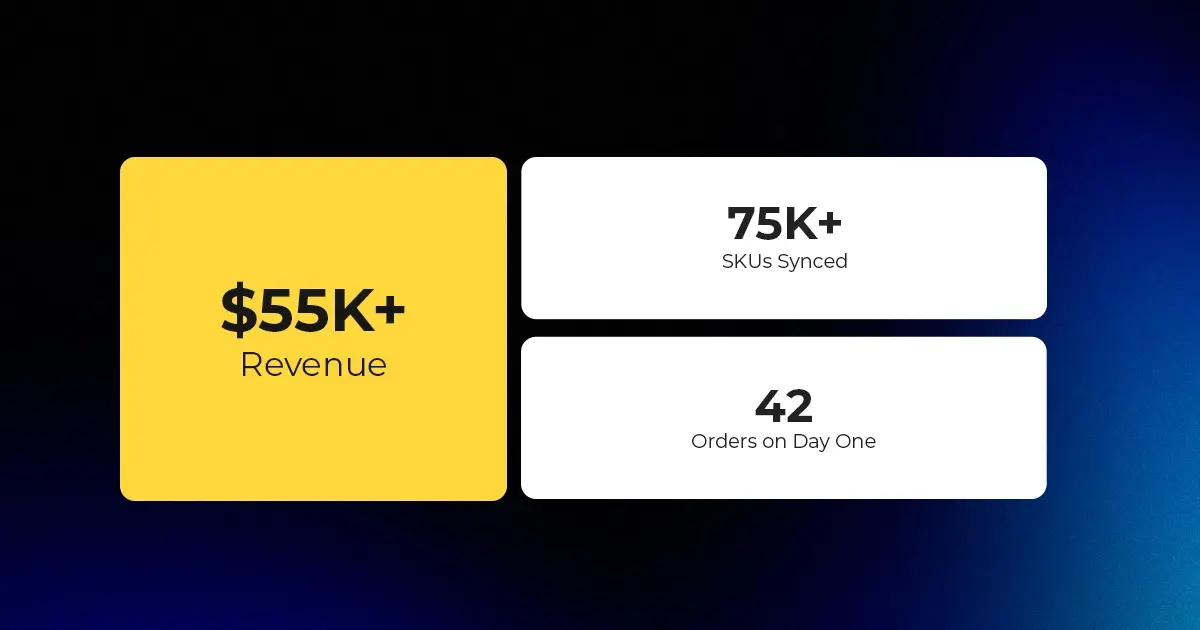

Reading Time: 2 minutesAbout the Brand Name: Stadium Goods Industry: Sneakers, Apparel & Collectibles Location:…

Reading Time: 11 minutesHalloween 2025: The Creative Seller’s Goldmine In the age of viral décor…

Reading Time: 2 minutesOverview AliExpress has launched a new global scheme — the Best Price…

Reading Time: 3 minutesEtsy, Inc. (“Etsy”) today announced two major developments: the appointment of Kruti…

Reading Time: 2 minuteseBay posted a strong performance in Q3 2025, with revenue and gross…