How to Sell Etsy Products on TikTok: TikTok Marketing for Etsy Sellers

If you’re wondering how to sell Etsy products on TikTok, the answer starts with treating

The upcoming holiday shopping season is projected to deliver steady gains for U.S. retailers, though growth is expected to normalize after the pandemic-driven spending surges of recent years. According to Deloitte’s 2025 holiday forecast, total retail sales between November and January are set to climb by 2.9% to 3.4%, reaching between $1.61 trillion and $1.62 trillion.

That growth translates to an estimated $40–$45 billion in additional spending compared to last year. While positive, it falls short of the 4.2% increase in 2024, signaling a return to pre-pandemic historical averages.

Deloitte attributes this year’s growth primarily to rising disposable incomes. The firm expects disposable personal income to expand between 3.1% and 5.4% during the holiday season, which it says is a reliable predictor of both retail and ecommerce performance.

“Steady income growth can help offset some economic uncertainty, including any labor market weakness and the burden of high credit card and student debt on consumer spending,” explained Akrur Barua, economist at Deloitte Insights, in releasing the report.

This resilience is particularly important given the ongoing pressures of elevated household debt levels and mixed signals in the job market. Deloitte’s model also factors in two anticipated interest rate cuts, which, while not immediately boosting disposable cash, are expected to lift consumer sentiment and support holiday shopping.

Digital channels remain the clear growth engine. Deloitte projects that holiday eCommerce sales will increase by 7% to 9%, reaching $305 billion to $310.7 billion.

This sustained double-digit growth rate for eCommerce contrasts with the slower expansion in total retail, underlining how consumers are increasingly favoring online shopping for convenience, promotions, and broader assortments.

Importantly, Deloitte stressed that this initial forecast is based on economic indicators, not consumer intention surveys. Its separate holiday spending survey, focused on shopper sentiment and behavioral trends, will be released in October.

While the overall spending outlook is positive, Deloitte cautions that retailers cannot rely on blanket consumer resilience.

“This year’s forecast of 2.9% to 3.4% growth is more in line with historical averages we used to see in holiday before the pandemic, when we really saw these bigger spikes in holiday spending,” said Brian McCarthy, Principal, Deloitte’s Retail Strategy & Analytics Practice.

McCarthy emphasized three priorities for retailers navigating this environment:

One recurring theme in recent holiday seasons has been the disconnect between consumer sentiment and actual spending. Despite reporting lower confidence amid inflation and debt pressures, shoppers have consistently spent more than expected.

Last year is a case in point: Deloitte’s 2024 forecast predicted growth between 2.3% and 3.3%, but actual sales climbed 4.2%.

“Consumers say that they feel a little less confident. And yet they continue to show up and they continue to spend,” McCarthy observed.

Still, early indicators point to potential headwinds. PwC’s 2025 holiday consumer intentions survey, released last week, found that for the first time since 2020, Americans plan to spend less than they did the previous year:

That generational shift could put pressure on categories like fast fashion, electronics, and entertainment, where Gen Z historically over-indexes. PwC cautioned that retailers may face a tougher battle for Gen Z’s discretionary dollars.

Ultimately, Deloitte’s forecast underscores a stabilization of holiday retail patterns after years of pandemic-driven volatility, stimulus-fueled spending, and inflationary spikes.

For retailers, the message is clear:

As Deloitte puts it, 2025 may mark a return to the holiday retail playbook of the past — one where steady growth rewards retailers that innovate while staying sharply focused on value.

If you’re wondering how to sell Etsy products on TikTok, the answer starts with treating

Amazon has sparked widespread alarm among electronics sellers across Europe after announcing new requirements that

Summary Pattern Group, one of the largest Amazon resellers and an e-commerce accelerator, has filed

Summary U.S. eCommerce spending grew 8% year over year in August, up from 7% in

Summary The EU’s Data Act (Regulation (EU) 2023/2854) is now legally effective as of 12

In a move that signals a major shift in the advertising world, Amazon Ads and

Mars Petcare UK has officially joined Temu, the fast-rising online marketplace that’s been disrupting global

In 2024, out-of-stock rates surged to 39% for high-demand SKUs by Day 2 of Cyber

News Summary Amazon has officially launched Virtual Multipacks (VMPs), a long-requested feature allowing sellers to

Temu, the fast-rising discount eCommerce marketplace owned by PDD Holdings, continues its rapid expansion in

The upcoming holiday shopping season is projected to deliver steady gains for U.S. retailers, though

Amazon is officially shutting down its long-running Prime Invitee program, a little-known but popular perk

Critical security alert for Adobe Commerce & Magento merchants. Adobe has issued an out-of-band emergency

Exciting news for WooCommerce sellers! WooCommerce 10.2 is officially launching on September 16, 2025, introducing

Effective: September 30, 2025 (U.S. & Canada) Amazon is overhauling its inventory recovery programs. Starting

TikTok has rolled out a set of new support tools for TikTok Shop creators, aiming

Amazon has launched FBA Damaged Inventory Ownership, a program that lets sellers take direct control

Alibaba Group has unveiled a sweeping restructuring of its consumer-facing operations, merging Taobao, Tmall, Ele.me,

Walmart is ramping up its efforts to recruit merchants from the United Kingdom and continental

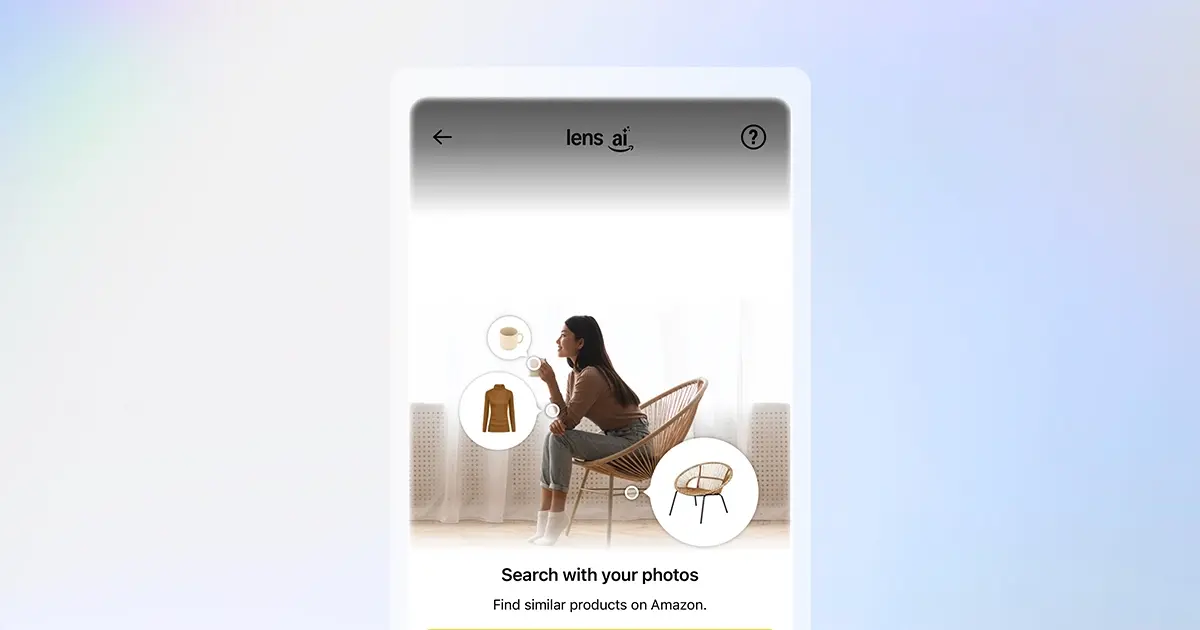

Amazon is doubling down on artificial intelligence in eCommerce with the launch of Lens Live,