The 2025 Fulfillment Shift: How Amazon MCF Now Powers Shein, Walmart, and Shopify Orders

Reading Time: 11 minutesThe eCommerce shift you actually need to act on Multi-channel fulfillment has…

Shein’s UK arm posted pre-tax profits of £38.2 million in 2024—an eye-catching 56.5% increase—as revenues vaulted past £2 billion for the first time. This leap underscores Shein’s growing dominance in the fast-fashion market and bolsters its bid to list on the London Stock Exchange.

| Implication | Insight |

| Fast Fashion’s Offline Evolution | Shein’s blend of digital dominance with pop-up activations and tours reveals a shift toward hybrid retail strategies. |

| IPO as a Catalyst for Presence | Aggressive UK growth serves dual purposes—boosting sales and building credibility ahead of a potential IPO. |

| Regulatory Headwinds Remain Firm | Persistent concerns over supply chains and sourcing protocols continue to cloud IPO prospects. |

| Retail Industry Pressure Cooker | Shein’s rise piles more pressure on traditional UK retailers like Asos and Boohoo, and highlights tensions over low-tax imports and high street erosion. |

| Driver | Effect on Regulation |

| Surge in low-value imports | Fueling calls to scrap the £135 exemption to defend domestic markets. |

| Retailer advocacy | Pressure is building from high-street players demanding fair competition. |

| Global alignment | Following the US and EU in tightening fast-fashion import regimes. |

| Sustainability and ethics | Proposals for EPR, digital passports, and stricter claims aim to hold brands accountable. |

| Safety and modern slavery concerns | GBP-level changes and greenwashing checks hint at increasing scrutiny. |

| Environmental due diligence | New mechanisms under the Environment Act could reshape fashion supply chain responsibilities. |

The UK’s regulatory stance on fast-fashion imports is shifting decisively: from laissez-faire tolerance to proactive reform. Government review of the de minimis threshold, combined with ambitious NGO-led proposals around EPR and product passports, points to a future where fair competition, sustainability, and transparency become cornerstone principles in fashion trade policy.

Shein’s UK performance is turning heads: soaring profits, ambitious expansion, and ingenious omnichannel outreach mark a smart pivot as it eyes capital markets. Yet, its listing aspirations are no sure bet—the IPO narrative depends on overcoming regulatory skepticism, particularly around its supply chain and transparency.

Reading Time: 11 minutesThe eCommerce shift you actually need to act on Multi-channel fulfillment has…

Reading Time: 10 minutesBlack Friday Cyber Monday (BFCM) isn’t a weekend anymore; it’s a two-month…

Reading Time: 2 minuteseBay is quietly testing a new feature that could reshape how buyers…

Reading Time: 2 minutesAmazon is stepping into a new era of value commerce with the…

Reading Time: 11 minutesThe $240 Billion BFCM Opportunity & Why Operations Matter Every seller, business,…

Reading Time: 7 minutesTL;DR — Your 60-Second BFCM Battle Plan Time remaining: 3 weeks until…

Reading Time: 2 minutesChina’s Double 11 shopping festival — the world’s largest annual online retail…

Reading Time: 2 minutesAs the holiday season approaches, TikTok Shop has released its September 2025…

Reading Time: 3 minutesIn a continued effort to enable sellers and stimulate new product launches…

Reading Time: 2 minutesAs global trade enters a new phase of regulation and cost restructuring,…

Reading Time: 2 minutesOpenAI Turns to Amazon Web Services in $38 Billion Cloud Deal: What…

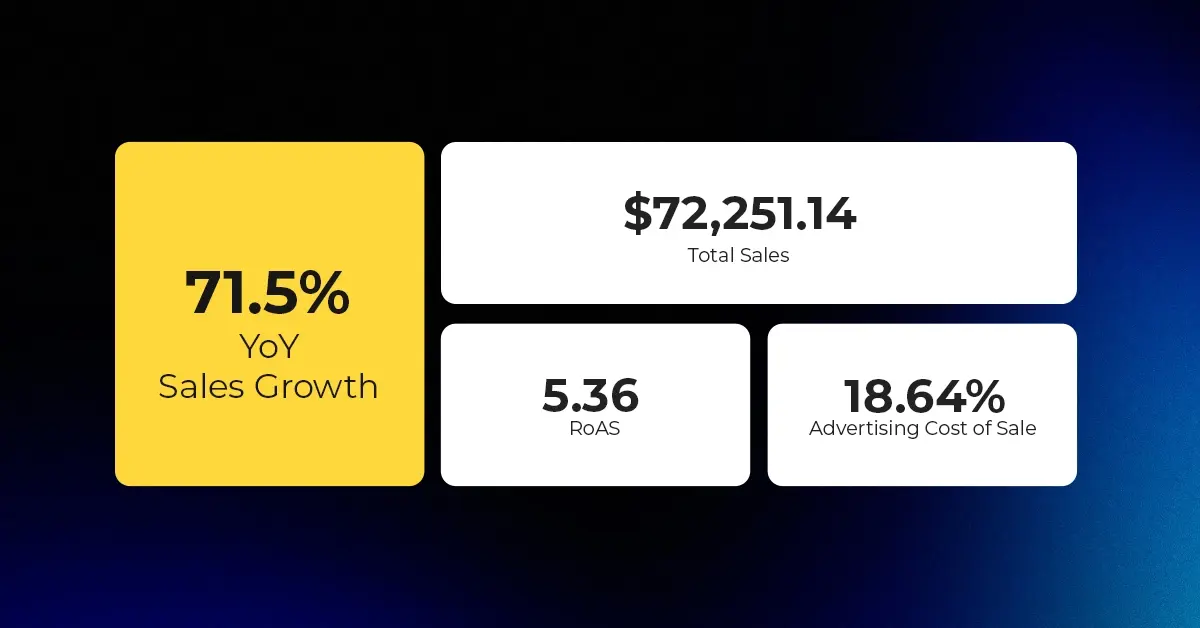

Reading Time: 4 minutesAbout the Client TMRG is a global health and wellness brand with…

Reading Time: 2 minutesAmazon Begins Quarterly Tax Reporting to China: A New Era of Cross-Border…

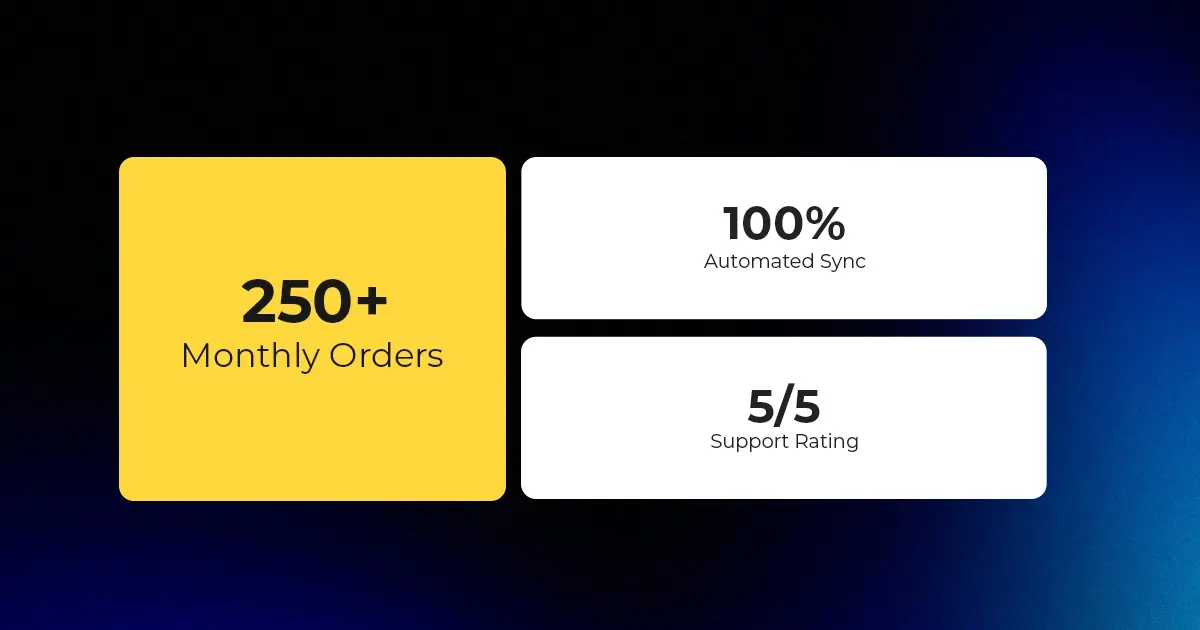

Reading Time: 2 minutesAbout the Brand Name: Stylecraft Industry: Home Décor & Lighting Location: US…

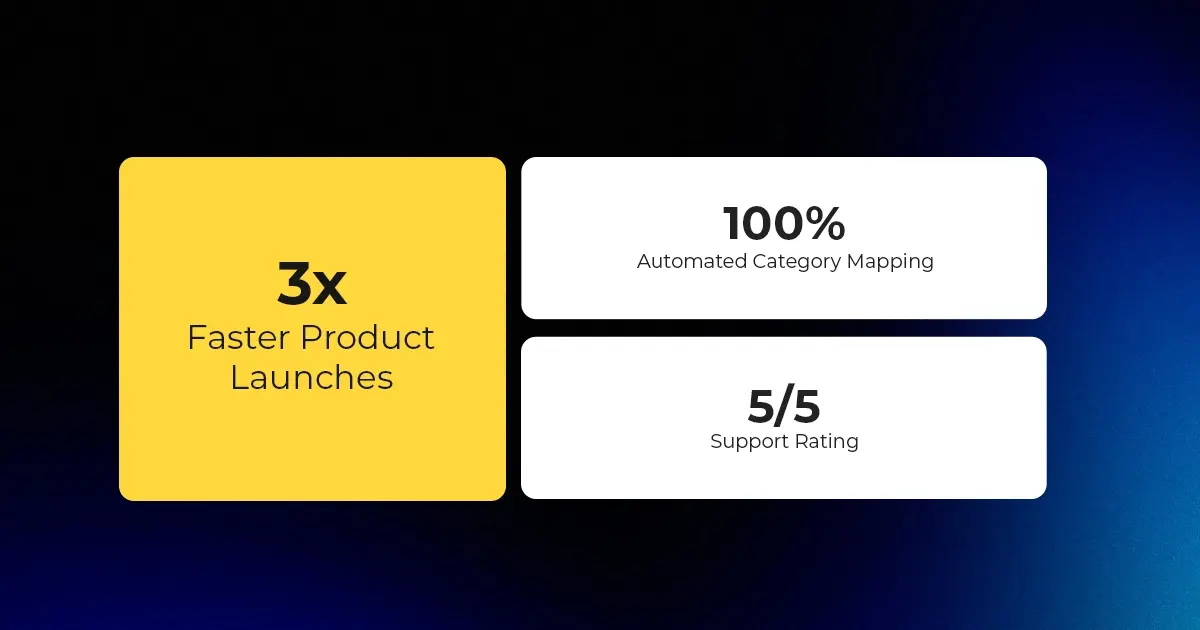

Reading Time: 2 minutesAbout the Brand Name: Flag Agency Industry: Digital Retail & Brand Management…

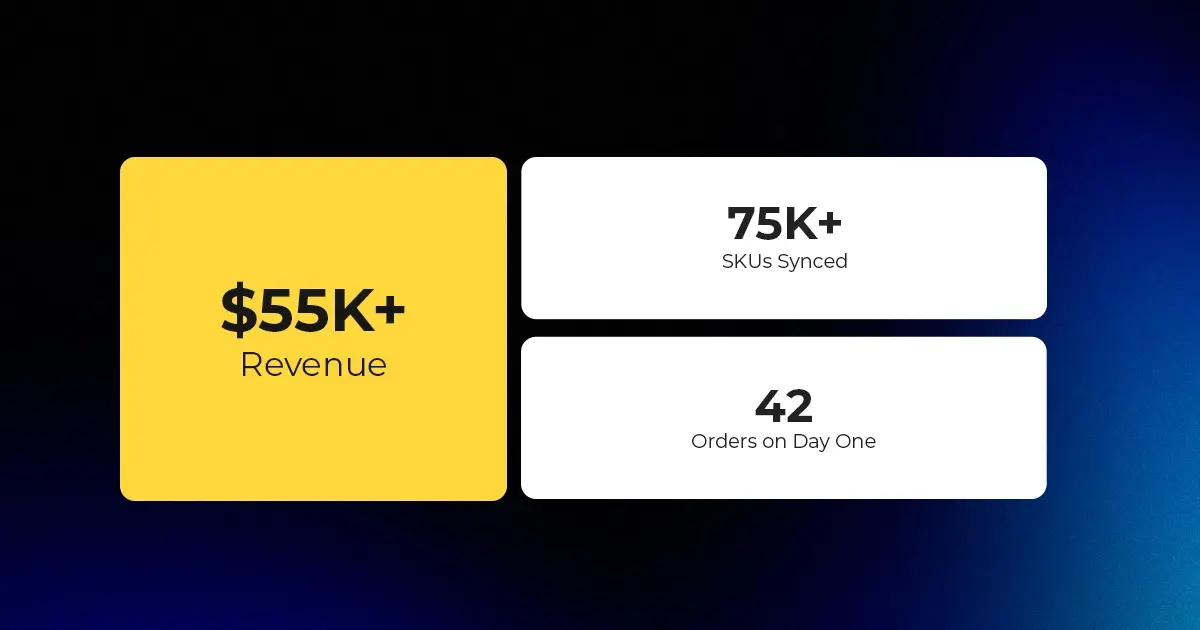

Reading Time: 2 minutesAbout the Brand Name: Stadium Goods Industry: Sneakers, Apparel & Collectibles Location:…

Reading Time: 11 minutesHalloween 2025: The Creative Seller’s Goldmine In the age of viral décor…

Reading Time: 2 minutesOverview AliExpress has launched a new global scheme — the Best Price…

Reading Time: 3 minutesEtsy, Inc. (“Etsy”) today announced two major developments: the appointment of Kruti…

Reading Time: 2 minuteseBay posted a strong performance in Q3 2025, with revenue and gross…