WooCommerce 10.2 Arrives September 16: A Simple Seller Guide

Exciting news for WooCommerce sellers! WooCommerce 10.2 is officially launching on September 16, 2025, introducing

The global pet care market is booming, with projections estimating it will hit $236.1 billion by 2030 (Grand View Research). From gourmet pet treats to smart collars and subscription boxes, pet parents are spending more than ever on their furry companions.

But here’s the challenge: while demand surges, competition is intensifying, compliance is complex, and scaling a pet supply business takes strategic moves. This guide explores the trends shaping pet commerce in 2025 and gives you a step-by-step roadmap to start, grow, and scale your pet supply business online.

Pet commerce is evolving differently across regions, creating unique opportunities and challenges for online sellers. Whether you’re based in APAC, North America, or Europe, understanding the market’s state is critical for building a profitable strategy.

The Asia-Pacific pet care eCommerce market is projected to reach $28.6 billion by 2030, growing at a CAGR of ~9% from 2025 (Grand View Research).

Key Drivers:

Seller Insight: APAC offers fertile ground for niche products like eco-friendly accessories, pet tech, and organic treats, especially as consumers shift toward premium options.

Visual Brief:

North America remains the global leader in pet care revenue, with industry sales estimated at $151 billion in 2024 (Statista). Online channels now represent a significant share of this, thanks to Amazon and Chewy dominating pet commerce.

Key Trends:

Seller Insight: For North American sellers, differentiation and value-added services are key to winning in a crowded market.

Visual Brief:

Bar graph showing North America’s revenue share vs other regions

Europe’s pet care market is growing steadily, though at a slower CAGR of 2–3% compared to APAC (Market Data Forecast). Strict regulations (like REACH and CE marking) make compliance critical.

Key Trends:

Seller Insight: Focus on compliance, localization (language, currency), and sustainability messaging to succeed.

Latin America’s pet commerce is expanding, led by Brazil. E-commerce penetration is increasing, but infrastructure challenges persist.

Seller Insight: Early entrants can capture market share by focusing on affordable, locally relevant products and leveraging platforms like Mercado Libre.

Visual Brief:

Trying to sell everything to everyone is a losing game in pet commerce. Niche sellers consistently outperform generalists by building authority and loyalty.

Examples of niches:

Pet Commerce Business Models at a Glance

|

Business Model |

Pros |

Cons |

|

Dropshipping |

Low startup cost, no inventory |

Less control, longer shipping times |

|

Private Label |

Strong branding, higher margins |

Requires larger investment, sourcing |

|

Inventory-based |

Full control, better fulfillment |

Higher overhead, storage management |

Pain Point: “How do I source quality products without overcommitting?”

Solution: Start lean with flexible suppliers and test demand. Scale into private label or your own inventory once your niche gains traction.

Your platform choice and listing strategy can make or break your pet supply business.

With pet commerce’s global growth, sellers need a platform strategy that aligns with their audience. Should you build your own store, leverage marketplaces, or combine both?

Own Store vs Marketplace: The Hybrid Advantage

|

Approach |

Pros |

Cons |

|

Own Store |

Full brand control, customer data ownership |

Requires traffic-building efforts |

|

Marketplace |

High traffic exposure, trusted platforms |

Listing fees, limited brand control |

|

Hybrid |

Combines reach and branding |

Complex inventory management |

Which Marketplace Should You Sell Your Pet Products on?

|

Region |

Key Marketplaces |

Notes |

|

Asia-Pacific |

Shopee, Lazada, Rakuten, JD.com |

Fast growth, younger buyers, price-sensitive |

|

North America |

Amazon, Chewy, Walmart Marketplace |

Premiumization trend, subscription potential |

|

Europe |

Zooplus, Bol.com, Allegro |

Sustainability focus, strong compliance rules |

|

Latin America |

Mercado Libre, Dafiti |

Growing audience, logistics challenges |

|

Global DTC |

Shopify, WooCommerce |

Ideal for brand building and international reach |

Visual Brief:

Decision tree graphic: “Where should I sell my pet products?” (inputs: region + product type → outputs: suggested platforms)

Pet parents are detail-oriented buyers. A single missing detail can cost you the sale.

Checklist for High-Performing Listings:

Selling pet products online isn’t risk-free. Each region has specific compliance requirements, especially for food, supplements, and electronics.

Key Regulations by Product Type

|

Product Type |

USA |

UK/EU |

|

Food/Treats |

FDA, AAFCO standards, labeling |

DEFRA, EU feed regulations |

|

Toys/Accessories |

Consumer Product Safety rules |

REACH, CE, GPSD compliance |

|

Pet Tech |

FCC certifications |

CE marking, RoHS compliance |

Actionable Checklist:

Acquiring customers in pet commerce is only the first step. The real profit lies in keeping those customers loyal, because pet parents are some of the most repetitive buyers in eCommerce. About 78% of Chewy’s revenue comes from repeat purchases and auto-ship subscriptions (Chewy Annual Report).

But how do you build a system that attracts new pet parents and keeps them coming back? Here’s your playbook.

|

Platform |

Hot Niches for Acquisition |

Retention Strategies |

|

Shopify/D2C |

Premium pet foods, smart pet gadgets |

Product bundles, subscriptions, loyalty programs |

|

Amazon |

Grooming kits, pet supplements |

Auto-ship offers, personalized reorder reminders |

|

Etsy |

Handmade collars, artisan pet apparel |

Custom reorder options, thank-you notes with each order |

|

Shopee/Lazada |

Affordable toys, eco-friendly litter |

Flash sales for existing buyers, mobile app loyalty coupons |

|

Chewy |

Vet-approved diets, organic treats |

Auto-ship discount programs, pet birthday gifts |

Seller Insight:

Platforms like Amazon and Shopee help you get visibility fast, but owning a D2C store allows you to upsell, bundle, and retain customers at a higher AOV (Shopify pet stores average $115 AOV, while Amazon pet purchases average closer to $52 (Shopify Data, Amazon Insights)).

Visual Brief: Table with platform logos + niche product illustrations

This quick checklist helps you avoid common pitfalls and build a solid foundation for your pet business:

|

Action Step |

Why It Matters |

|

Build your D2C store for higher AOV |

Control branding, upsell bundles, own customer data |

|

Diversify channels early (don’t rely on one marketplace) |

Reduces risk and expands reach |

|

Offer subscription models for consumables |

Locks in recurring revenue and boosts retention |

|

Focus on mobile optimization |

68% of pet owners prefer mobile shopping (Statista) |

|

Implement loyalty programs and VIP perks |

Encourages repeat purchases and advocacy |

|

Maintain excellent customer service |

Builds trust and long-term relationships |

Visual Brief: Checklist infographic with pet-themed icons (paw prints, toys, collars)

Scaling a pet supply business takes more than just great products; you need the right technology, integrations, and marketing muscle.

Here’s how CedCommerce supports your journey:

With 10,000+ merchants worldwide, CedCommerce helps sellers sell smarter, scale faster, and create brands pet parents trust.

Visual Brief: Flowchart showing CedCommerce support across the seller journey: Store → Listings → Marketing → Scaling

Yes. The global pet industry is projected to reach $350B by 2027 (Grand View Research). Sellers with a strong niche and retention strategy see consistent profits.

Begin with dropshipping or an online store. Focus on low-overhead models and research compliance for food/accessories in your region.

In the US, FDA/AAFCO approval is needed. In UK/EU, follow DEFRA/EU feed regulations. Always check your country’s laws.

Leverage multi-channel integrations, localize content for each region, and partner with 3PLs for smooth fulfillment.

Top performers include premium foods, eco-friendly accessories, grooming tools, and tech gadgets like GPS collars.

From store creation to marketplace integrations and marketing, CedCommerce offers end-to-end solutions for global sellers.

Exciting news for WooCommerce sellers! WooCommerce 10.2 is officially launching on September 16, 2025, introducing

Effective: September 30, 2025 (U.S. & Canada) Amazon is overhauling its inventory recovery programs. Starting

TikTok has rolled out a set of new support tools for TikTok Shop creators, aiming

Amazon has launched FBA Damaged Inventory Ownership, a program that lets sellers take direct control

Alibaba Group has unveiled a sweeping restructuring of its consumer-facing operations, merging Taobao, Tmall, Ele.me,

Walmart is ramping up its efforts to recruit merchants from the United Kingdom and continental

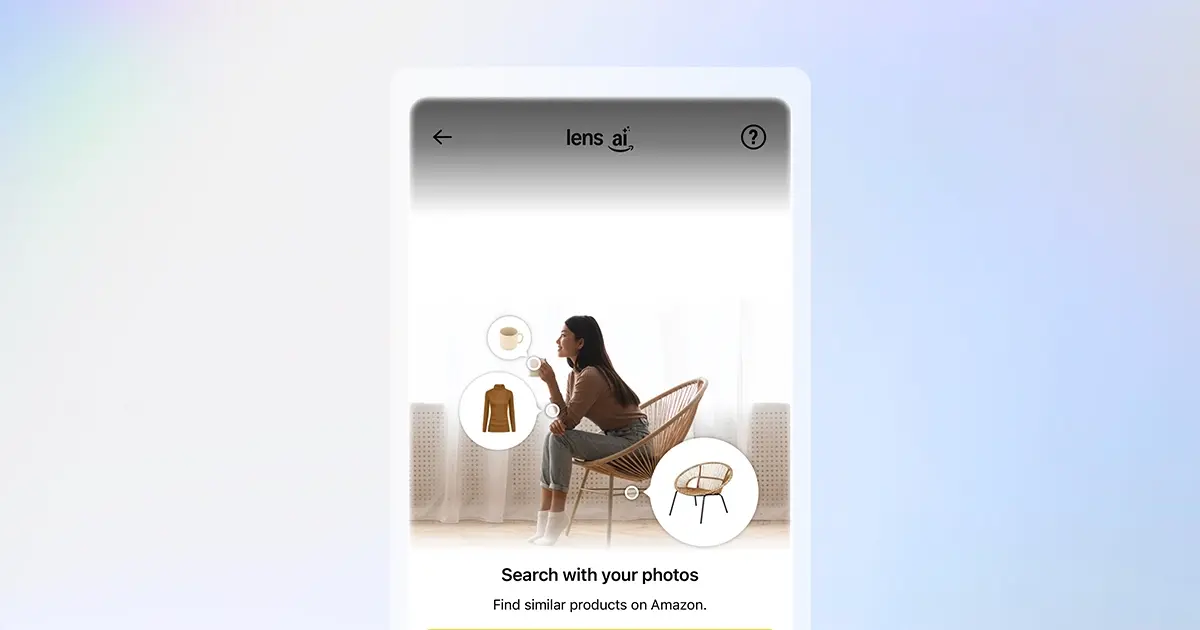

Amazon is doubling down on artificial intelligence in eCommerce with the launch of Lens Live,

For the first time since 2020, U.S. consumers are planning to cut back on holiday

Temu, the rapidly growing eCommerce platform, has announced the launch of its Local Seller Program

Etsy has announced important updates to its new Etsy Payments Policy, effective October 9, 2025,

Amazon has launched its first-ever “Second Chance Deal Days“ sales event in Europe, exclusively featuring

The Update Amazon has strategically resumed its Google Shopping ad campaigns across all international markets—

TikTok has updated its account policies, LIVE rules, monetization eligibility, and enforcement measures. The changes

Think Black Friday is when holiday shopping begins? Think again. Your future customers are already

eBay is rolling out eBay Live in the UK, offering sellers a new way to

eBay is giving its auto parts and accessories marketplace a tune-up, announcing the launch of

Walmart is set to revamp its Pro Seller Program at the end of September 2025,

Pinterest is diving headfirst into the burgeoning secondhand market with the launch of “Thrift Shop,”

Why Pinterest Is a Growth Channel for Etsy Sellers Discovery drives eCommerce growth. With 482

In a strategic move to enable smaller businesses with global ambitions, international logistics giant DHL