TikTok Shop Raises Seller Fees Across Europe as Platform Pushes for ‘Content-Driven Commerce’ Expansion

Reading Time: 3 minutesTikTok Shop is raising its sales commission for merchants across five active…

The upcoming holiday shopping season is projected to deliver steady gains for U.S. retailers, though growth is expected to normalize after the pandemic-driven spending surges of recent years. According to Deloitte’s 2025 holiday forecast, total retail sales between November and January are set to climb by 2.9% to 3.4%, reaching between $1.61 trillion and $1.62 trillion.

That growth translates to an estimated $40–$45 billion in additional spending compared to last year. While positive, it falls short of the 4.2% increase in 2024, signaling a return to pre-pandemic historical averages.

Deloitte attributes this year’s growth primarily to rising disposable incomes. The firm expects disposable personal income to expand between 3.1% and 5.4% during the holiday season, which it says is a reliable predictor of both retail and ecommerce performance.

“Steady income growth can help offset some economic uncertainty, including any labor market weakness and the burden of high credit card and student debt on consumer spending,” explained Akrur Barua, economist at Deloitte Insights, in releasing the report.

This resilience is particularly important given the ongoing pressures of elevated household debt levels and mixed signals in the job market. Deloitte’s model also factors in two anticipated interest rate cuts, which, while not immediately boosting disposable cash, are expected to lift consumer sentiment and support holiday shopping.

Digital channels remain the clear growth engine. Deloitte projects that holiday eCommerce sales will increase by 7% to 9%, reaching $305 billion to $310.7 billion.

This sustained double-digit growth rate for eCommerce contrasts with the slower expansion in total retail, underlining how consumers are increasingly favoring online shopping for convenience, promotions, and broader assortments.

Importantly, Deloitte stressed that this initial forecast is based on economic indicators, not consumer intention surveys. Its separate holiday spending survey, focused on shopper sentiment and behavioral trends, will be released in October.

While the overall spending outlook is positive, Deloitte cautions that retailers cannot rely on blanket consumer resilience.

“This year’s forecast of 2.9% to 3.4% growth is more in line with historical averages we used to see in holiday before the pandemic, when we really saw these bigger spikes in holiday spending,” said Brian McCarthy, Principal, Deloitte’s Retail Strategy & Analytics Practice.

McCarthy emphasized three priorities for retailers navigating this environment:

One recurring theme in recent holiday seasons has been the disconnect between consumer sentiment and actual spending. Despite reporting lower confidence amid inflation and debt pressures, shoppers have consistently spent more than expected.

Last year is a case in point: Deloitte’s 2024 forecast predicted growth between 2.3% and 3.3%, but actual sales climbed 4.2%.

“Consumers say that they feel a little less confident. And yet they continue to show up and they continue to spend,” McCarthy observed.

Still, early indicators point to potential headwinds. PwC’s 2025 holiday consumer intentions survey, released last week, found that for the first time since 2020, Americans plan to spend less than they did the previous year:

That generational shift could put pressure on categories like fast fashion, electronics, and entertainment, where Gen Z historically over-indexes. PwC cautioned that retailers may face a tougher battle for Gen Z’s discretionary dollars.

Ultimately, Deloitte’s forecast underscores a stabilization of holiday retail patterns after years of pandemic-driven volatility, stimulus-fueled spending, and inflationary spikes.

For retailers, the message is clear:

As Deloitte puts it, 2025 may mark a return to the holiday retail playbook of the past — one where steady growth rewards retailers that innovate while staying sharply focused on value.

Reading Time: 3 minutesTikTok Shop is raising its sales commission for merchants across five active…

Reading Time: 11 minutesBy now you have seen your BFCM 2025 numbers. The harder question…

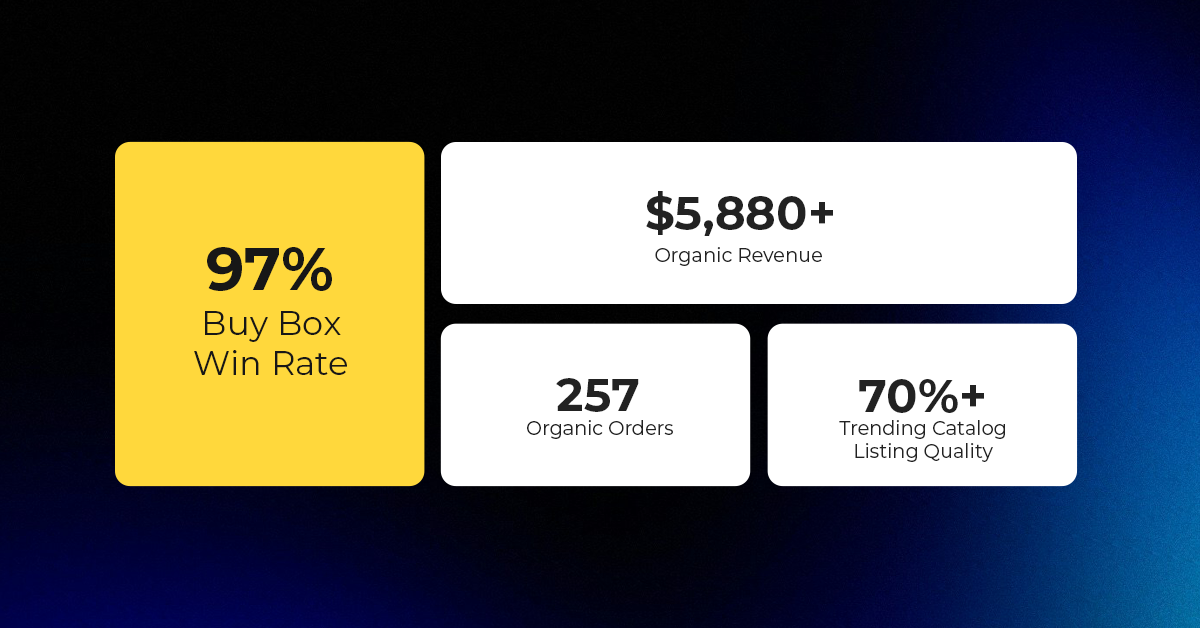

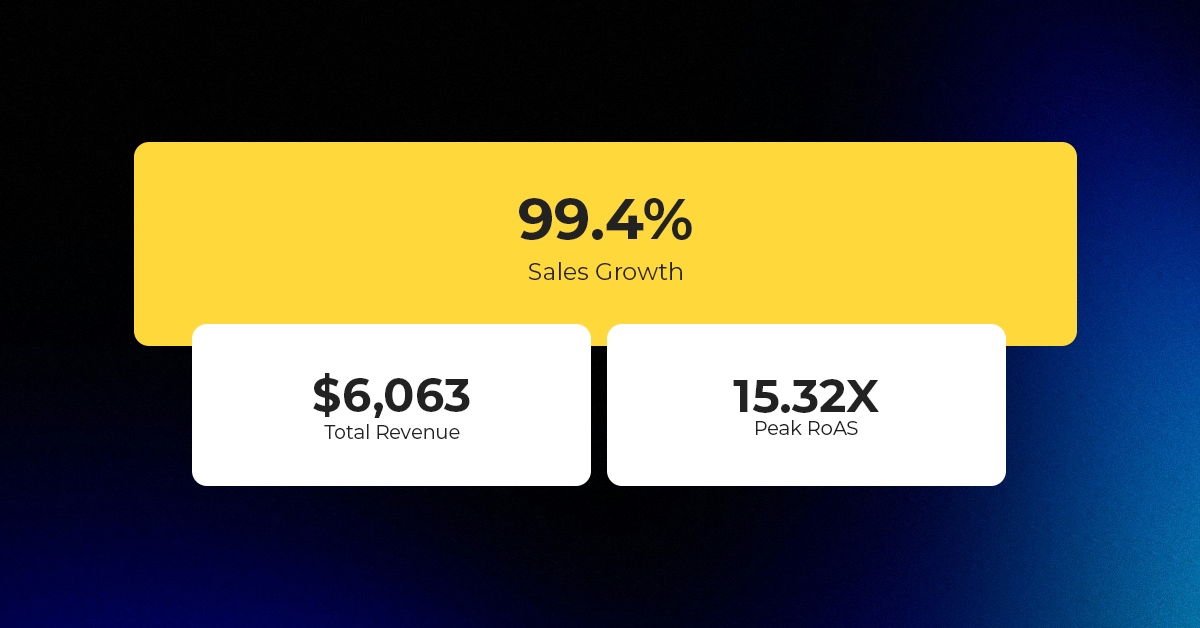

Reading Time: 3 minutesAbout the Brand Name: Vanity Slabs Inc Industry: Trading Slabs- Vanity Slabs…

Reading Time: 2 minutesAbout the Brand Name: Ramjet.com Industry: Automotive Parts & Accessories Location: United…

Reading Time: 2 minutesAmazon is rolling out strategic referral fee reductions across five major European…

Reading Time: 4 minutesQuick Summary: Scaling Lifestyle Powersports on eBay with CedCommerce Challenge: Zero marketplace…

Reading Time: 4 minutesTikTok has surpassed 460 million users across Southeast Asia, reinforcing its position…

Reading Time: 3 minuteseBay has released its final seller news update for 2025, with a…

Reading Time: 3 minutesAmazon has clarified its stance regarding speculation around a potential breakup between…

Reading Time: 4 minutesWalmart is accelerating its push into next-generation fulfillment by expanding its drone…

Reading Time: 4 minutesFaire, the fast-growing wholesale marketplace connecting independent retailers with emerging brands, has…

Reading Time: 4 minutesB2B buying in the United States is undergoing a fundamental behavioral shift…

Reading Time: 3 minutesSummary Cyber Monday 2025 has officially become the largest online shopping day…

Reading Time: 2 minutesSummary Amazon kicked off December with two major developments shaping the future…

Reading Time: 2 minutesSummary Walmart has entered December with two major moves that signal a…

Reading Time: 2 minutesBlack Friday 2025 delivered the strongest U.S. eCommerce performance in history, as…

Reading Time: 13 minutesStill approaching BFCM with generic discounts, last-minute price cuts, or scattered promotions?…

Reading Time: 3 minutesTikTok Shop reached a major milestone during its largest U.S. “Global Black…

Reading Time: 3 minutesOpenAI has announced a new AI-powered shopping research tool designed to help…

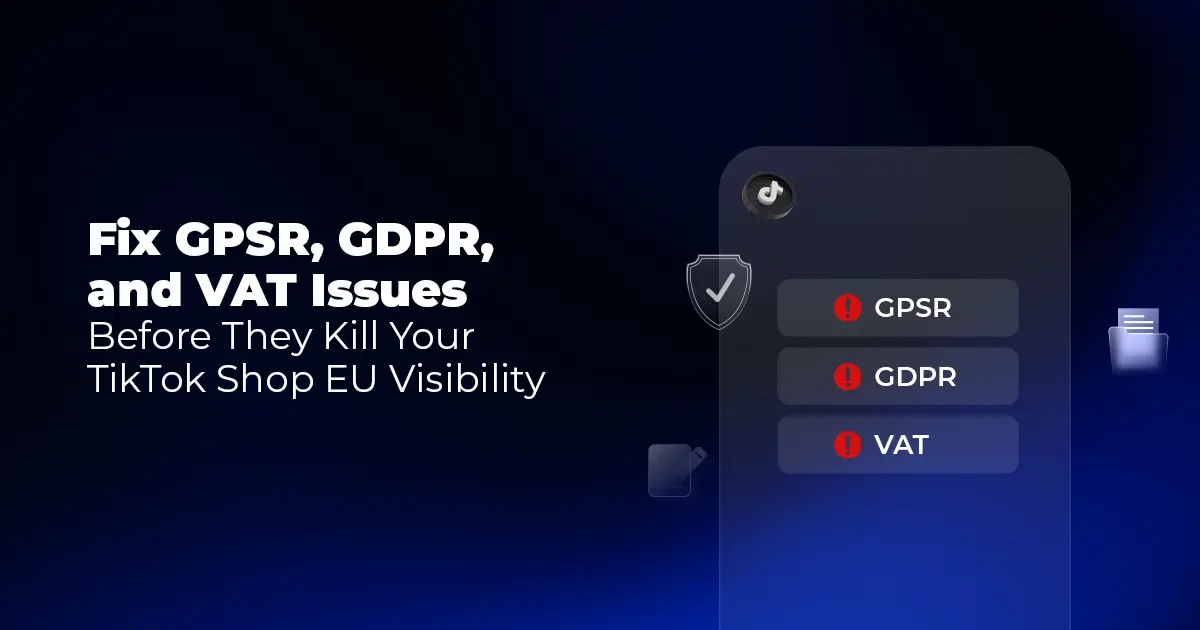

Reading Time: 9 minutesIf your TikTok Shop listings often sit in review or your visibility…