Reading Time: 11 minutesWhere holiday prep of past years focused on legacy channels like Amazon, Walmart, and DTC stores, now an entire cohort of emerging marketplaces demands seller attention. TikTok Shop (only launched in the US in 2023) now boasts quarterly volumes comparable to eBay. SHEIN marketplace is expanding beyond fast-fashion into home, beauty & lifestyle. Temu, already known for ultra-discount deals, is inviting volume-driven sellers into the mix and expanding rapidly.

For sellers, the question is no longer just “Should I be present here?” but “How do I stay profitable and protect my brand while playing here?” This blog steps you through a full BFCM playbook for SHEIN, Temu, and TikTok Shop: marketplace fit, margins, tactics, content, and risk.

Marketplace Snapshot 2025: What’s New Since Last Year?

TikTok Shop – From organic playground to paid growth engine

- Latest third-quarter figures estimate TikTok Shop’s global GMV at ~$19 billion, with the U.S. contributing $4–4.5 billion (≈125 % growth quarter-on-quarter). (thekeyword.co)

- Analysts now position it alongside eBay’s ~$20.1 billion for the same period—a startling leap for a social-commerce newcomer. (WIRED)

- Seller sentiment signals a clear shift: the “free virality” era is fading. Community posts on Reddit/LinkedIn repeatedly mention that organic reach is lower, and that visibility now depends on ad spend, Spark Ads sponsorships, and creator affiliate programs.

- Fraud, counterfeit, and policy-compliance risk are accelerating. More sellers report suspension or removal due to AI-generated listings or policy misalignment. (Business Insider)

- BFCM-specific note: While livestream selling remains strong in Southeast Asia, in the Western market, short-form shoppable clips plus creator collabs dominate for Q4.

Seller Takeaway: If you can create native-feeling short-video content, manage creator/affiliate ops, and absorb paid media spend, TikTok Shop is a high-growth opportunity. If you rely purely on passive listings or assume Amazon-style organic traffic, you’ll likely underperform.

Also Read: How to sell on TikTok Shop in 2025

Temu – The Ultra-discount engine

- Temu offers a compelling proposition: lower platform fees than Amazon, and a model constructed around extremely aggressive discounting. (sellersprite.com)

- Sellers frequently ask: how to differentiate when price is the main lever? And how to manage returns when your margin is already thin?

- The platform’s nature appeals to sub-$20 / impulse purchase segments, especially gift goods, novelty items, small home décor, and gadgets.

- Apart from self fulfillment, Temu primarily uses a centralized, platform-controlled fulfillment model where sellers ship inventory to Temu-designated warehouses, and Temu manages packing, shipping, and delivery to customers.

Seller Takeaway: If your model is high-volume, low-margin with simple fulfilment and low brand-premium risk, Temu is worth a serious look. If your average order value (AOV) is higher, or you prioritise brand experience, you’ll need to weigh the trade-offs carefully.

Also Read: How to sell on Temu UK in 2025

SHEIN Marketplace – High-volume fashion & lifestyle play with a higher entry bar

- According to recent registration guides: US-based brands wishing to sell on SHEIN Marketplace may be expected to have annual revenues around US$5 million, shipping from domestic warehouses, and professional seller operations. (Source: SHEIN Marketplace)

- Category expansion: Beyond fast-fashion apparel, SHEIN is increasingly pushing lifestyle, beauty, and home goods, indicating broader BFCM opportunity. (Source: CedCommerce LinkedIn Post)

- For BFCM, the platform remains potent because of high user traffic and strong mobile-app demand clusters, but seller margins must account for heavy discounting and participation in platform-led promotional campaigns.

Seller Takeaway: If you’re a mid-to-large brand with operational readiness and want access to fast-fashion-driven traffic, SHEIN is compelling. If you’re a smaller SKU count brand or value margin/brand control, you may need to treat it as a selective channel (e.g., for new-customer acquisition) rather than core.

Also Read: How to sell on SHEIN in 2025

Marketplace Fit Matrix: Which Platform for Which SKU?

| Platform |

Ideal Product Category |

Typical Price Band |

Best Seller Profile |

Why It Works |

Rated Risk |

| TikTok Shop |

Beauty, fashion accessories, impulse tech |

US$15–50 |

Brands with content/creator capacity |

Native video + impulse buy dynamic |

Medium-High |

| Temu |

Low-ticket home décor, novelty gadgets, gifts |

US$5–20 |

High-volume, low-margin sellers |

Price-first model drives volume |

High |

| SHEIN Marketplace |

Trend-fast fashion, beauty, home-lifestyle |

US$20–70 |

Established brands/wholesalers |

Strong traffic + brand-adjacent platform |

Medium |

Use this matrix to prioritise where to allocate budget, whether to test or scale, and what product strategy to lean into.

Margin Math 2025 for Emerging Marketplaces: Worked Examples & Minimum Viable Discount

Example: TikTok Shop

- Assume AOV US$30, cost of goods $10, marketplace commission + transaction + creator fee = ~$8.

- You run a discount of 30% (US$9) plus platform co-funding of US$3 => net revenue ~$18.

- Gross margin = $18 − $10 = $8 = ~26 %.

- If you stack higher discounts or heavy ad spend, the margin compresses rapidly.

Example: Temu

- AOV US$12, cost $4, lower fee structure perhaps $2 (referral/listing/closing fees).

- Discounting is heavy; awareness drives may include coupons or free gift stacking.

- Net revenue ~$10 → margin ~$6 = ~50 %.

- Volume becomes the lever. But return/fulfilment risk may reduce effective margin.

Example: SHEIN Marketplace

- AOV US$50, cost $20, fee ~10 % (US$5) plus platform promotion involvement.

- You accept a discount of 25% (US$12.5) + flash-deal participation of US$4.

- Net revenue ~$33.5 → margin ~$13.5 = ~27 %.

- The higher baseline AOV helps, but promotional expectations are steep

Minimum viable discount rule: Before BFCM, decide your absolute lowest margin you’ll accept after all fees + discount + ad/creator cost. Protect SKUs where you cannot reduce below that. Use others as volume drivers.

Want to stay on top of your SKU repricing capabilities during BFCM? → Check out our integrations for SHEIN, Temu, and TikTok Shop.

Platform-by-Platform BFCM Strategy Playbooks for Emerging Marketplaces 2025

TikTok Shop Playbook

- Content formats: short 8–12 sec “product in use” clips, UGC by micro-creators, live-selling bursts for bestsellers.

- Posting cadence: 3-5 videos/day during BFCM week; 1-2 live sessions targeting high-intent audiences.

- Creators/affiliates: seed 10-15 micro-creators, set performance KPIs (views, clicks, conversions), amplify best winners with Spark Ads.

- Paid strategy: Start warm-up ads 2-3 weeks ahead; allocate ~15-20 % of budget for pre-BFCM awareness, remaining for high-intent bursts during Black Friday & Cyber Monday.

Checklist for sellers:

- Complete account governance review (store policies, IP, prohibited items).

- Build 20 video assets ahead of time.

- Schedule live-selling slots.

- Reserve 10 % extra inventory for viral bursts.

- Map creator content → purchase funnel.

Temu Playbook

- Product strategy: Focus on low-ticket, high-impulse items (<US$20) that convert quickly.

- Store branding: Since price is the main hook, make sure store identity, review volume, and customer communication reduce “cheap/no-quality” perception.

- Promo mechanics: Leverage coupons, bundle discounts, and time-limited deals. Example: “Buy-1-Get-1 or Gift” for sub-$15 SKU.

- Operations: Pre-plan for return spikes – ensure fulfilment and customer service bandwidth.

Checklist for sellers:

- Choose 3–5 hero SKUs for BFCM.

- Pre-set discount ladders.

- Package clearly labelled for US or UK customers (to avoid local-seller mistrust).

- Prepare “quality assurance” photos/videos to use in listings.

- Set up a review-generation campaign ahead of time.

SHEIN Marketplace Playbook

- Collection drop strategy: Mirror fast-fashion cycles – announce BFCM capsule collections 2–3 weeks ahead. Stay tuned for any other festive program offerings by SHEIN.

- Visual creative: Multi-image lifestyle galleries + mobile-optimized listings.

- Price/promo discipline: Align with SHEIN’s promotional calendar; expect flash-sales, app-only deals, bundle offers.

- Brand-safe approach: Use SHEIN for acquisition/new-customer funnel. Protect core SKUs on your DTC or premium channels.

Checklist:

- Verify eligibility for SHEIN Marketplace (US-based, revenue threshold, warehouse shipping) – see seller guide. (CedCommerce SHEIN User Guide)

- Pre-load inventory into the US-warehouse or fulfillment center.

- Map promotions into SHEIN’s event calendar.

- Audit packaging/unboxing to maintain brand quality perception.

- Monitor listing visibility and price control daily during BFCM surge.

How to Multi-Marketplace BFCM Operations on Emerging Marketplaces?

Inventory Sync & Avoiding Overselling

One-in-ventory-pool logic: If you sell on Shopify + Amazon + Temu + TikTok Shop, ensure real-time stock sync to avoid overselling during viral spikes.

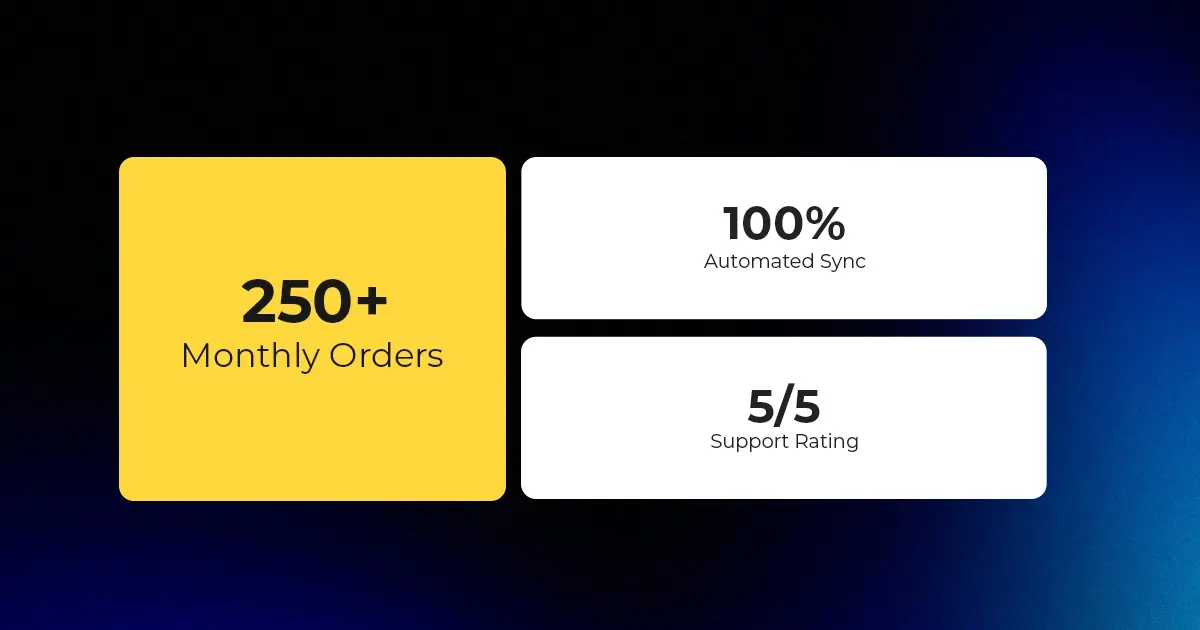

Explore UniCon by CedCommerce: a conversational tool that helps you maintain listing accuracy, real-time data syncing, and order fulfillment across multiple channels from a single dashboard.

Price Parity & Channel Conflict Prevention

- Discounts on emerging marketplaces may undercut your core DTC or Amazon Buy Box. Define guard-rails: e.g., never list hero SKUs at >40 % discount on Temu or risk cannibalising your main channel.

Logistics & Fulfilment: Common Breakpoints

- TikTok Shop: fast-moving viral SKUs may require extra buffer inventory and fulfilment speed.

- Temu: higher return rates and warranty claims among ultra-discount items – embed cost buffers.

- SHEIN Marketplace: US-based shipping often required; missing SLAs can result in listing suppression or fees. (seller-us.shein.com)

Also Read: BFCM 2025 fulfillment optimization tips for sellers.

BFCM 2025 Risk Checklist (Seller Protection Framework) for Emerging Marketplaces

- Conduct brand monitoring and SKU distribution across all marketplaces.

- Set up an alert system for listing takedowns and policy violations (especially TikTok Shop’s AI-fraud surge).

- Prepare a backup storefront/fulfilment channel in case one platform becomes unavailable.

- Verify your pricing and promotion stack doesn’t violate marketplace rules or create cross-channel conflict.

- Review data collection & first-party audience building: if TikTok Shop goes through regulatory trouble, you’ll want a portable audience.

- Pre-test your customer service protocols: returns, refunds, and packaging quality during high-volume events.

Did you know? By covering all the above pointers of the checklist, CedCommerce ensures that your business runs smoothly across multiple channels, even during peak season. This is how we do it!

High-Converting Content & Creative Templates for SHEIN, Temu, and TikTok Shop

TikTok Shop Templates

- Script: “Here’s how I solved X problem in 10 sec” → show product → swipe-up link.

- Live show flow: Hook in 30 sec, show hero SKU, offer 20 % off + limited quantity, close with creator call-to-action.

- Spark Ads structure: 15-sec UGC → 10-sec product demo → “Buy now – BFCM deal”.

Temu Templates

- Listing banner: “Black Friday Grab – 50 % off” + countdown timer.

- Bundle offer card: “Gift pack – 2 for US$18” + high-quality lifestyle photo.

- Review-badge overlay: “Over 5,000 reviews – 4.8★” to combat trust issues.

SHEIN Marketplace Templates

- Multi-image carousel: Street-style photo → lifestyle image → product detail close-up.

- Collection launch email: “SHEIN BFCM Exclusive Drop – 48 h only.”

- Packaging insert copy: “Thank you for joining our new SHEIN range – show it off on TikTok and tag us.”

Learn more about content ideas, creator economy, and discoverability on TikTok Shop.

TL;DR Complete BFCM Checklists for TikTok Shop, Temu, & SHEIN

How to Win on TikTok Shop During BFCM: A Quick Checklist

- Confirm account governance/compliance.

- Secure 20 video assets pre-launch.

- Plan and strategize live TikTok sessions.

- Recruit 8–10 micro-creators with UGC-ready briefs.

- Allocate pre-BFCM ad budget and creator budget (min 15 %).

- Set inventory buffer (20 % extra).

- Define minimum viable margin for SKUs.

- Map purchase funnel from video → product page → conversion.

- Monitor live performance hourly.

- Post-BFCM debrief: evaluate CPA, ROAS, repeat-purchase.

- Choose a reliable 3P solution provider for data syncing, listing improvement, and end-to-end account growth management.

How to Win on Temu Shop During BFCM 2025: A Quick Checklist

- Choose hero sub-US$20 SKUs.

- Audit listing visuals for premium feel.

- Set coupon + bundle stack early.

- Enhance review-generation (pre-BFCM).

- Confirm fulfilment partner readiness.

- Monitor return rate daily.

- Control pricing across channels.

- Pre-set time-limited deal windows.

- Design gift-pack offer for post-Black Friday.

- Post-BFCM margin review: cost + returns + shipping.

- Choose a reliable 3P solution provider for data syncing, listing improvement, and end-to-end account growth management.

How to Win on SHEIN during BFCM 2025: A Checklist

- Ship inventory to US, UK, or local warehouse fulfilment centres.

- Build a 30-style collection for fast-fashion drop.

- Map discount promo calendar with SHEIN events.

- Use a multi-image lifestyle listing format.

- Ensure packaging/unboxing aligns with brand quality.

- Monitor price control daily.

- Protect core SKUs (sell elsewhere at higher margin).

- Generate press or influencer content tied to SHEIN drop.

- Post-BFCM: unlink performance from DTC brand allignment.

- Choose a reliable 3P solution provider for data syncing, listing improvement, and end-to-end account growth management.

FAQs

Q1. Is TikTok Shop still profitable for sellers in BFCM 2025?

Yes, TikTok Shop can be highly profitable during BFCM 2025 only if you actively manage content creation, creator partnerships, Spark Ads, and your discount margins. Sellers relying solely on organic reach typically underperform.

Q2. What are the seller fees on Temu in 2025?

Temu’s seller fees vary by category but remain consistently lower than Amazon’s, making it attractive for low-ticket, high-volume sellers. This lower fee structure supports deep discounting while still keeping margins workable.

Q3. What do I need to sell on SHEIN Marketplace in the US?

You need a US-registered business, domestic fulfilment capability, and, based on recent seller guides, an annual revenue around ~$5M. SHEIN expects operational maturity, stable supply, and full compliance with its strict pricing and listing standards. Missing an eligibility criteria? Connect with our SHEIN growth consultant to get a CedCommerce referral.

Q4. Which categories perform best on each platform during BFCM?

TikTok Shop: Beauty, fashion accessories, skincare, UGC-friendly gadgets

Temu: Under-$20 gifts, novelty items, home décor, small electronic accessories

SHEIN Marketplace: Trend-led fashion, beauty, lifestyle, and home categories

Each platform rewards products that match its discovery model and audience expectations.

Q5. Can I rely on organic reach on TikTok Shop for BFCM 2025?

No. Organic reach has dropped significantly as competition has grown. For BFCM 2025, you should expect to use paid amplification (Spark Ads) and affiliate creators to ensure visibility and strong conversions. (Source: Beehiiv)

Q6. How do returns impact profitability on Temu during BFCM?

Returns can severely affect profitability because Temu’s model is already low-margin and high-volume. During BFCM, when return rates typically spike, margin erosion increases making quality control and accurate listings essential. For legacy sellers on Amazon, Walmart, eBay, etc., should see Temu as a way to diversify their sales.

Q7. How do I protect my brand when selling on ultra-discount marketplaces?

Use these channels mainly for customer acquisition or volume, not core brand representation. Keep premium SKUs on DTC or higher-end marketplaces, strengthen packaging, maintain review quality, and enforce tight QC to avoid brand dilution.

Q8. What’s the best order of marketplace priority if I already sell on Amazon/Walmart/Shopify?

Prioritize based on product category + margin strength + business model:

- TikTok Shop for beauty, fashion, accessories, and creator-driven categories

- Temu for fast-moving SKUs (preferably low priced)

- SHEIN for trend-led fashion and lifestyle brands with strong fulfilment

Start with the channel most aligned with your product economics, test lightly, then scale where you see traction. Have questions about choosing the right marketplace mix for your business in 2025 and beyond? Book a 1:1 call with our marketplace consultation experts today!

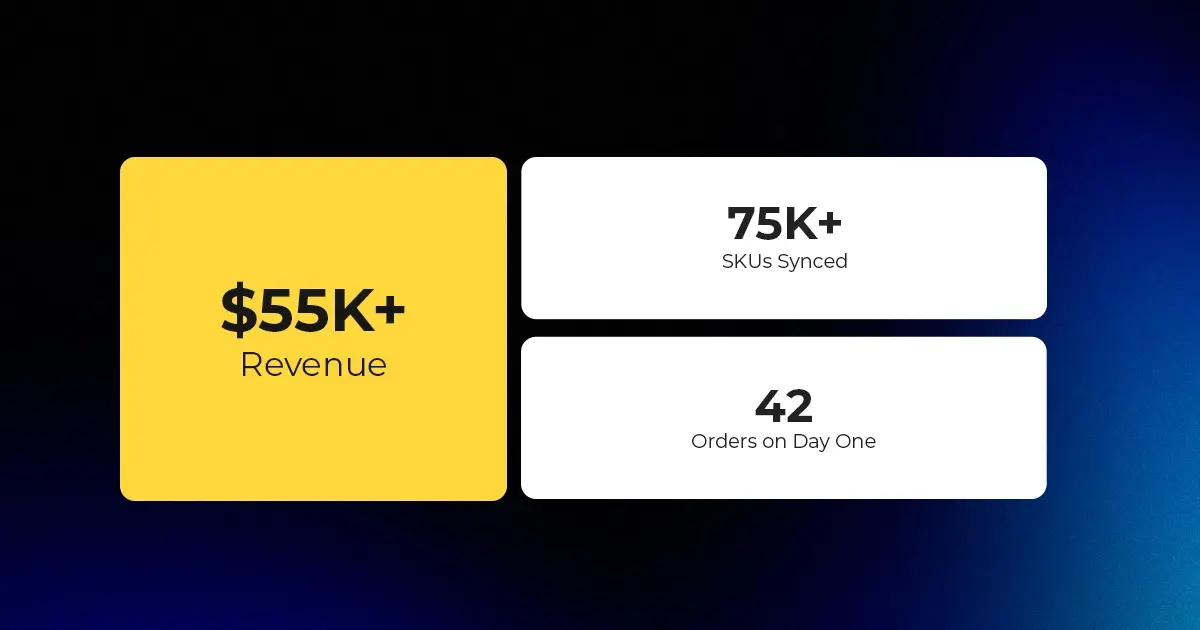

Why CedCommerce is your Growth Partner on Emerging Marketplace

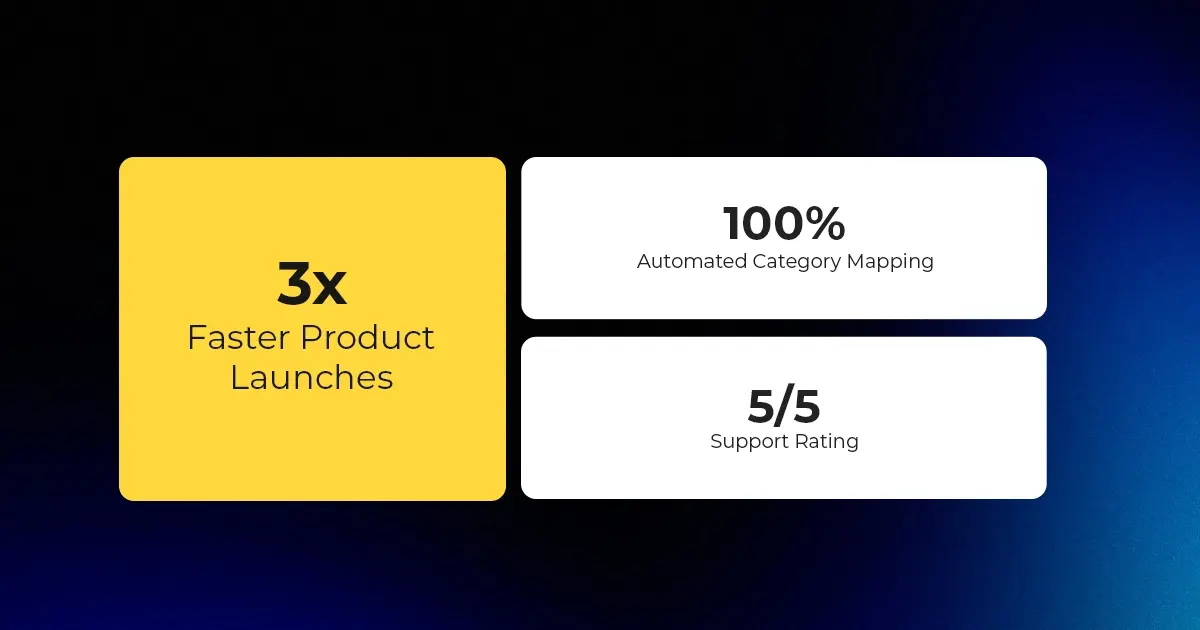

At CedCommerce, we specialise in enabling sellers to launch, scale and protect their presence across Temu, SHEIN Marketplace and TikTok Shop – alongside Amazon, Walmart and Shopify.

- Single-pane listing, inventory & order sync across all channels

- Platform-specific onboarding, content & creator frameworks

- Promotional modelling and margin simulation tools

- Brand protection and compliance monitoring

Book a demo today and let us help you build your BFCM 2025 Emerging Marketplace Growth Plan.

Notes & Data Sources

- TikTok Shop global GMV ~$19 billion Q3 2025 + US $4–4.5 billion. (thekeyword.co)

- TikTok Shop seller statistics (475K US shops, global >15 M merchants) and GMV H1 2025 data. (resourcera.com)

- Temu vs Amazon seller fee & margin comparisons. (AMZScout)

- SHEIN marketplace seller requirements including revenue thresholds. (CedCommerce)

- SHEIN US seller onboarding guidelines. (seller-us.shein.com)

- TikTok Shop’s strict compliances against fraud and policy risks context. (Business Insider)