Amazon Launches “Seller Challenge” for Enhanced Enforcement Appeals via Account Health Assurance

Reading Time: 3 minutesAmazon has rolled out a new “Seller Challenge” feature for eligible Account…

Amazon has introduced a new FBA multi-unit discount for Amazon Business orders, and for once, it’s an update that can actually improve your margins. By aligning discounts with reduced fulfillment fees, sellers now have a way to earn more while offering buyers better deals.

Effective September 24, 2025, you can access the Amazon Business Fulfillment by Amazon (FBA) fee discount to help you grow your business sales.

If you set at least a 3% Business Pricing or Quantity Discount, Amazon applies a per-unit fulfillment fee reduction on multi-unit Business orders.

Example calculation:

Instead of losing margin to a 3% discount, you actually gain +$0.90 per unit compared to no discount.

This program isn’t just about small savings—it creates strategic advantages:

To capture these benefits, act fast:

Amazon rarely gives sellers an opportunity to boost profits while discounting prices. This update does exactly that—if you leverage it correctly. Sellers who dismiss it as minor will miss out; those who integrate it into their pricing and inventory planning can strengthen both profitability and competitiveness in the Amazon B2B ecosystem.

Source: Amazon Seller Central

Reading Time: 3 minutesAmazon has rolled out a new “Seller Challenge” feature for eligible Account…

Reading Time: 3 minutesWalmart Marketplace has sharpened its requirements around product classification (category, type group,…

Reading Time: 3 minutesJust ahead of Black Friday, Amazon is enforcing tighter controls on its…

Reading Time: 11 minutesWhere holiday prep of past years focused on legacy channels like Amazon,…

Reading Time: 11 minutesThe eCommerce shift you actually need to act on Multi-channel fulfillment has…

Reading Time: 10 minutesBlack Friday Cyber Monday (BFCM) isn’t a weekend anymore; it’s a two-month…

Reading Time: 2 minuteseBay is quietly testing a new feature that could reshape how buyers…

Reading Time: 2 minutesAmazon is stepping into a new era of value commerce with the…

Reading Time: 11 minutesThe $240 Billion BFCM Opportunity & Why Operations Matter Every seller, business,…

Reading Time: 7 minutesTL;DR — Your 60-Second BFCM Battle Plan Time remaining: 3 weeks until…

Reading Time: 2 minutesChina’s Double 11 shopping festival — the world’s largest annual online retail…

Reading Time: 2 minutesAs the holiday season approaches, TikTok Shop has released its September 2025…

Reading Time: 3 minutesIn a continued effort to enable sellers and stimulate new product launches…

Reading Time: 2 minutesAs global trade enters a new phase of regulation and cost restructuring,…

Reading Time: 2 minutesOpenAI Turns to Amazon Web Services in $38 Billion Cloud Deal: What…

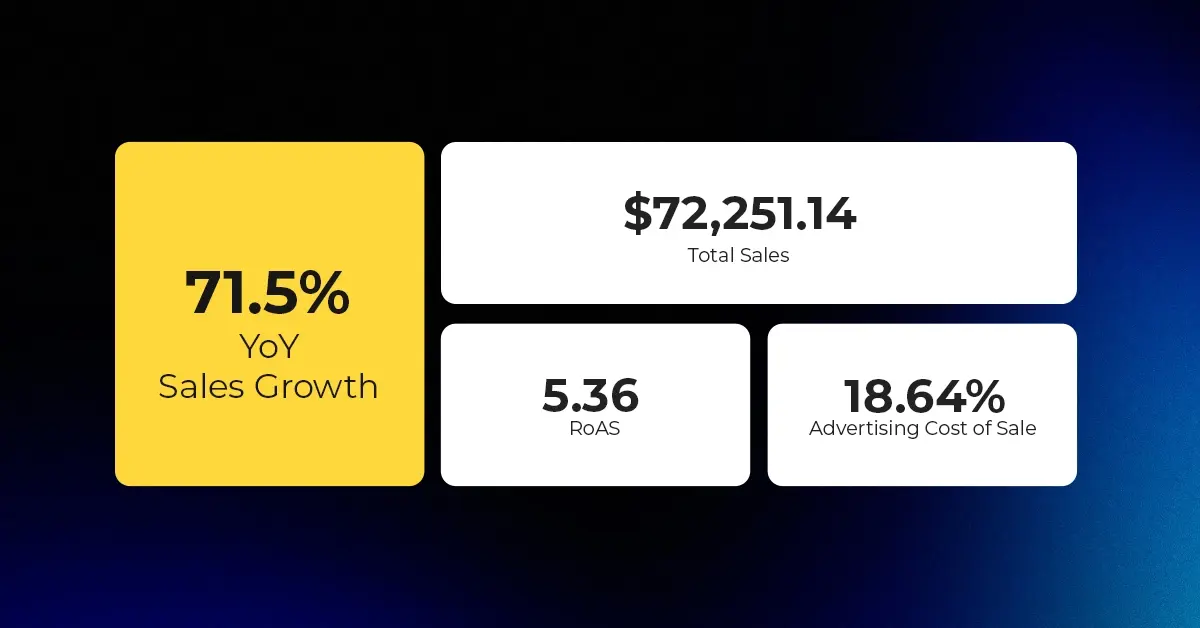

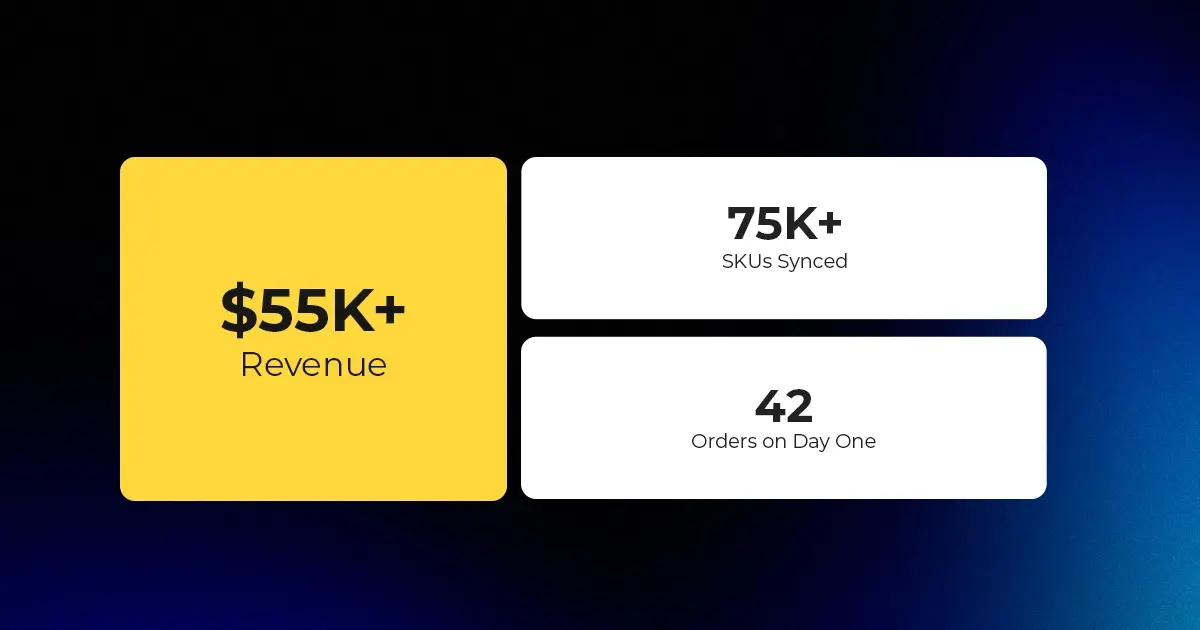

Reading Time: 4 minutesAbout the Client TMRG is a global health and wellness brand with…

Reading Time: 2 minutesAmazon Begins Quarterly Tax Reporting to China: A New Era of Cross-Border…

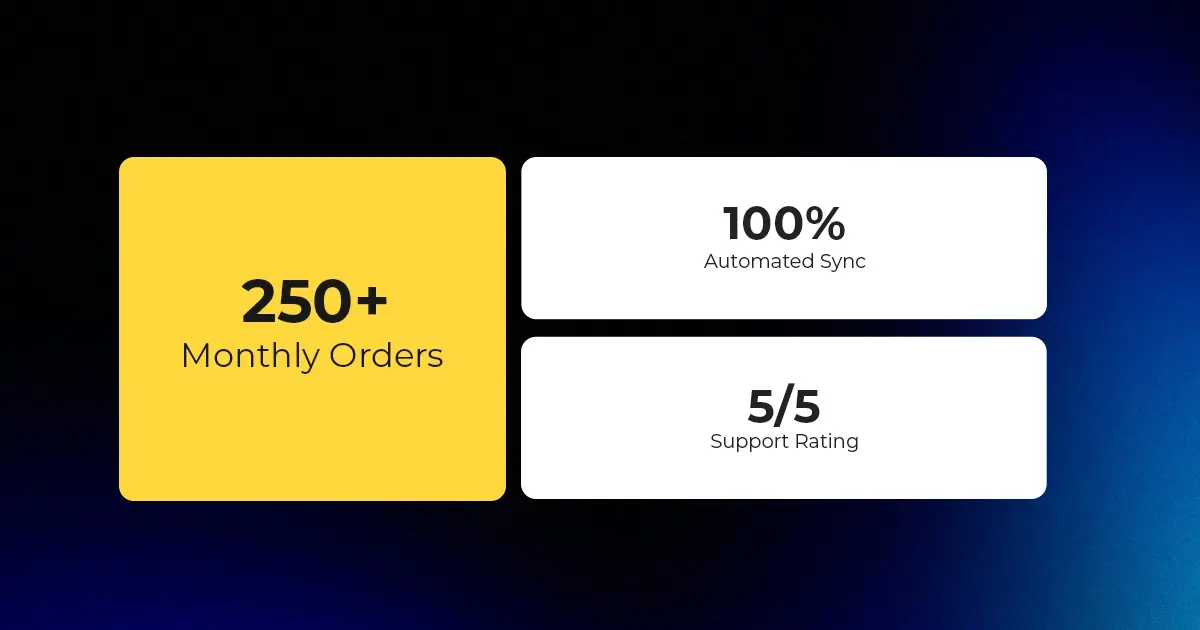

Reading Time: 2 minutesAbout the Brand Name: Stylecraft Industry: Home Décor & Lighting Location: US…

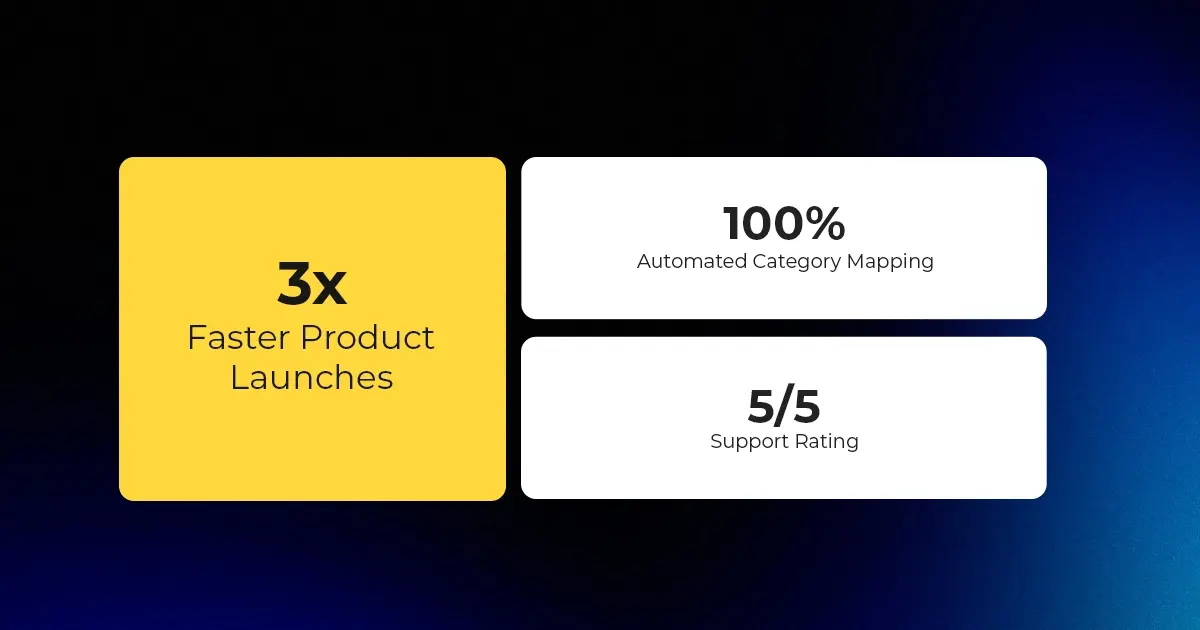

Reading Time: 2 minutesAbout the Brand Name: Flag Agency Industry: Digital Retail & Brand Management…

Reading Time: 2 minutesAbout the Brand Name: Stadium Goods Industry: Sneakers, Apparel & Collectibles Location:…