Cyber Monday 2025 eCommerce Shatters Records

Reading Time: 3 minutesSummary Cyber Monday 2025 has officially become the largest online shopping day…

This post is to make you aware about the new WooCommerce extension by CedCommerce named Ship Per Product.

Ship Per Product is a WooCommerce extension created by CedCommerce, allows you to define shipping cost per item for customer location. This extension calculates shipping charges according to customer location. You can define multiple shipping class for every product.

Ship Per Product extension will allow you to set different shipping cost for every product. You can define shipping cost of every product based on customer location. The extension has fallowing features.

Can set default shipping cost to products if not available for any customer location.

Can Include/Exclude tax from shipping cost.

You can add product wise shipping rates by csv file and can export them too.

You can make different shipping rates for every product which can vary destination wise.

Can restrict shipping to only specific countries.

Cost for simple and variable product can be set product wise.

Just configure the setting accordingly and save the changes to see the effect of the extension.

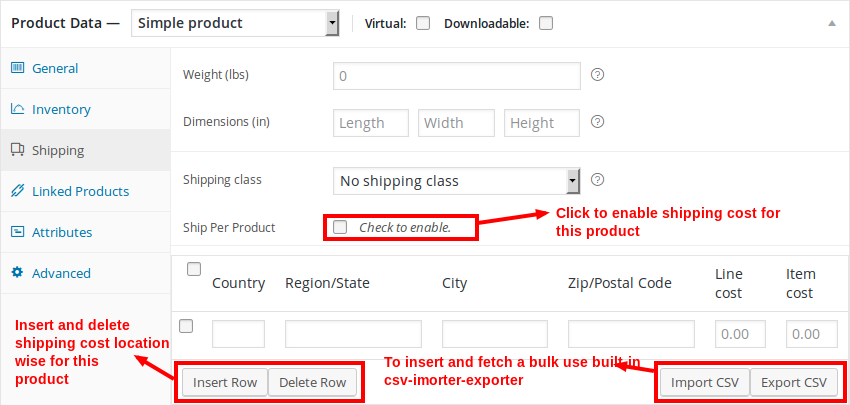

In “Ship-Per-Product-Table” tab you can insert shipping detail location-wise or can download or import it from csv file.

First of all edit your product > Go to Shipping tab > Check the box Ship per product to enable per product shipping for the product. You can add your shipping cost there for that product by either manually entering or by importing csv file.

Shipping Cost is displayed on the cart page

I have tried to explain all the details about Ship Per Product extension by CedCommerce Team.

Thanks for reading this blog.

How do you like the POST? Feel free to express your ideas with us in the comment section. Any suggestions or opinions would be greatly appreciated. 🙂

Have a look at other WooCommerce extensions by CedCommerce.

If you like this post, share it with your friends!!

Reading Time: 3 minutesSummary Cyber Monday 2025 has officially become the largest online shopping day…

Reading Time: 2 minutesSummary Amazon kicked off December with two major developments shaping the future…

Reading Time: 2 minutesSummary Walmart has entered December with two major moves that signal a…

Reading Time: 2 minutesBlack Friday 2025 delivered the strongest U.S. eCommerce performance in history, as…

Reading Time: 13 minutesStill approaching BFCM with generic discounts, last-minute price cuts, or scattered promotions?…

Reading Time: 3 minutesTikTok Shop reached a major milestone during its largest U.S. “Global Black…

Reading Time: 3 minutesOpenAI has announced a new AI-powered shopping research tool designed to help…

Reading Time: 9 minutesIf your TikTok Shop listings often sit in review or your visibility…

Reading Time: 3 minutesAmazon has rolled out a new “Seller Challenge” feature for eligible Account…

Reading Time: 3 minutesWalmart Marketplace has sharpened its requirements around product classification (category, type group,…

Reading Time: 3 minutesJust ahead of Black Friday, Amazon is enforcing tighter controls on its…

Reading Time: 11 minutesWhere holiday prep of past years focused on legacy channels like Amazon,…

Reading Time: 11 minutesThe eCommerce shift you actually need to act on Multi-channel fulfillment has…

Reading Time: 10 minutesBlack Friday Cyber Monday (BFCM) isn’t a weekend anymore; it’s a two-month…

Reading Time: 2 minuteseBay is quietly testing a new feature that could reshape how buyers…

Reading Time: 2 minutesAmazon is stepping into a new era of value commerce with the…

Reading Time: 11 minutesThe $240 Billion BFCM Opportunity & Why Operations Matter Every seller, business,…

Reading Time: 7 minutesTL;DR — Your 60-Second BFCM Battle Plan Time remaining: 3 weeks until…

Reading Time: 2 minutesChina’s Double 11 shopping festival — the world’s largest annual online retail…

Reading Time: 2 minutesAs the holiday season approaches, TikTok Shop has released its September 2025…