Managing Etsy Taxes Is An Important Part Of Your Business. Here’s How To Get It Right

Running short of time? Get PDF of the blog in your mail.

|

Play Now

|

Dealing with Etsy taxes is perhaps the last thing on your mind when starting an Etsy Shop for the first time. And we completely understand why. Especially as the owner of a new business, you have to take on so many different roles and responsibilities at the same time.

Then all of a sudden, it’s time to file your taxes. And it can become stressful real quick because you are unsure of so many things when it comes to paying taxes as an Etsy Seller.

How much tax do I need to pay? Which tax forms do I need? Can I get tax deductions on my business expenses? Do I need to pay self-employment taxes?

We’re here to tell you that you don’t need to stress about it. This short but complete guide will tell you everything you need to know about Etsy taxes. After reading this, you’ll realize that dealing with taxes as an Etsy Seller is not that complicated at all.

Is this a Legal Advice?

In a word, No. This is simply a piece of advice from eCommerce experts, not legal advice. So you should consider seeking consultation from a professional tax and legal advisor when you’re filing your taxes. But having said that, it shouldn’t stop you from knowing as much as you can about dealing with taxes so that you can be the best advocate for your business.

Etsy Taxes when your shop is classified as a Hobby vs. a Business.

IRS – the revenue service for the United States federal government, which is responsible for collecting taxes and administering the Internal Revenue Code – classifies your Etsy shop either as a hobby or as a business.

Being considered a hobby might not be to your benefit because if the IRS doesn’t see your Etsy shop as a business, you can’t deduct your business expenses from your selling income. This means you’ll pay more tax and possibly even out of your own pockets if you’re not making profits.

However, if the IRS sees your shop as a business, you can deduct your business expenses from your selling income. Even if the expenses are more than the income, making it a loss in business, you can deduct these losses from any other sources of income you might have besides your Etsy Shop.

So what makes the IRS classify your shop as a business?

You should have made a profit in 3 out of the last 5 consecutive tax years. The IRS does this to ensure that you can’t deduct your expenses if you have no intention of being a business.

So, if you run your shop in a businesslike manner, you’ll be able to reduce your total taxable income, which will help you in the long run.

Sole Proprietorships vs. LLC

Whether your business entity is a sole proprietorship or an LLC makes a huge difference when it comes to filing taxes and running your business. But it also makes a huge difference to your privacy.

Registering as a sole proprietor requires you to use your Social Security Number for your business. In contrast, registering as an LLC requires using your Employer Identification Number.

Business owners prefer the latter because of reasons like identity theft. Whenever a business sends you a 1099 form, they’ll either need your SSN or your EIN on that form.

If your EIN gets leaked (rare but not impossible), it’s unlikely to be useful for anyone. But your SSN, on the other hand, is tied to your credit and your identity.

There are also some things to consider when you talk about the business side of things. Being a sole proprietor, all your business income is your personal income. Any business debts you might have are also your personal debts, and your personal assets, such as your home and your vehicles, are at risk if you fail to pay back the debts.

Having said all that, you should think about it very carefully before registering your business.

Tax Advantages of being a single-member LLC

Registering your business entity as a single-member LLC has quite a few benefits for small businesses. They give you some level of control, like in a sole proprietorship and the corporation’s tax benefits.

Let’s take a look at what benefits we’re talking about –

- A single-member LLC is legally a separate entity from its owner, which means your personal assets are safe from any business liabilities such as debts.

- LLCs avoid paying double taxes by default because the IRS considers a single-member LLC as a disregarded entity. The IRS simply ignores the business for tax purposes. Instead, the tax is collected from the owner through their personal income tax filings. So you are paying taxes just like a sole proprietorship by default.

- You can choose how you want your business to be taxed. In the previous point, we said that LLCs have a tax status of a sole proprietorship. But that’s only by default. The business owner can choose to pay taxes as a corporation if they want. They need to fill out some forms to make that election with the IRS.

- LLCs are allowed to claim The Qualified Business Income Deduction (QBI). This allows you to get extra deductions other than the deductions for business expenses or losses.

What are the taxes you may owe as an Etsy Seller?

As we said before, it’s difficult to understand taxes when starting a small business. Especially what type of taxes you owe. We’re going to lay it out for you as easily as possible.

Annual Income Taxes (to be paid annually)

Let’s get the most obvious stuff out of the way. Annual income taxes have to be paid by absolutely everyone who earns an income. This is the tax you’ll be most familiar with as an adult.

For Etsy sellers, this income is considered self-employed income, and you have to pay the tax on the net profit from all your Etsy sales. Since you are a small business, you need to fill out the Schedule C – Profit or Loss From Business – form to report your business income and expenses. The Schedule C form has to be filled out by all sole proprietors and single-member LLCs.

Estimated Quarterly Taxes (to be paid each quarter)

The United States has a “pay as you go” income tax policy, which means you have to pay the income tax as you earn your income, rather than paying just once every year. And this brings us to the Estimated Quarterly Taxes, which have to be paid every quarter if you meet the requirements.

This is why employees get tax-deducted salaries (withholdings) so that the employer can pay these taxes on time.

How to know if you need to pay the Estimated Quarterly Tax?

It’s quite simple; as a small business owner, if you expect to owe more than $1000 in taxes for the current year, the IRS expects you to pay the Estimated Quarterly Taxes. You can either use the 1040-ES form or file electronically with the EFTPS (Electronic Federal Tax Payment System) to pay this tax.

For example, if you expect to owe $2000 in taxes, you should pay $500 each quarter.

There are other criteria to decide if you have to pay these taxes, but they don’t apply to self-employed people, so you don’t need to know them.

However, the real question is, how can you tell ahead of time how much tax you will owe by the end of the year? The truth is, you can’t, which is why they’re called Estimated taxes in the first place.

You also can’t know the actual deductible business expenses or losses. And for this reason, the IRS will not hand you any penalties as long as you pay an equal amount of tax as you did last year.

But if you do end up paying less or more than you expected, you can adjust your Estimated Taxes when filing for the next quarter. However, in this case, when you’ll file your annual return, you’ll need to explain why you didn’t pay equal estimated taxes using the ‘IRS form 2210’.

State Income Taxes (to be paid annually and quarterly)

The amount of State Income Tax you need to pay varies from one state to another, so you need to check what is applicable where you live. These taxes are also due annually, and in some states, you also need to pay estimated quarterly taxes as a self-employed small business owner.

Some states charge income tax at a fixed rate, while others charge a progressive rate like the Federal Income Tax. Some states don’t charge any State Income Tax at all. So you should seek professional advice to help you stay on top of your taxes.

Self-employment taxes

As an Etsy seller, you must also pay self-employment tax if your net income is $400 or more. This tax is divided into Social Security and Medicare Tax. As of 2021, you need to pay 12.4% for Social Security and 2.9% for Medicare.

To pay the self-employment tax, you need to fill out the Schedule SE form and mention this amount in the “Other Taxes” section of the 1040 form. This is how the IRS differentiates between your Income Tax and the Self-employment tax.

However, there are a few things you need to know about the self-employment tax –

- You get to reduce the self-employment income by half of the self-employment tax before applying the tax rate.

For example –

Self-employment Income = $5000

Apply the 15.3% Self-employment tax rate= $765

Half the tax amount = $382.5

Reduce this amount from your Self-employment Income = $5000 – $382.5 = $4617.5

So you will pay 15.3% of the self-employment tax rate on $4617.5 rather than on $5000, which comes out to be around $706 instead of $765.

- You can claim 50% of your self-employment tax as a deduction on your taxable income.

In the previous example, we calculated that your self-employment tax is $706. So you can deduct 50% of this amount from your taxable income.

Etsy Sales Tax

Sales tax laws have changed considerably as more and more retail takes place over the internet. As a result, online businesses, including Etsy Shops, are responsible for collecting sales tax when shipping their products to a certain location within the United States.

In the US, 45 states impose a general sales tax which, in the past, you would need to collect and send to the appropriate authorities depending on where you live.

However, Etsy has taken this responsibility on its own as they now automatically calculate, collect, and remit sales tax on your behalf. Check out where and since when Etsy collects sales tax.

Etsy Sellers in the US can use the Etsy sales tax tool to provide a tax rate for each US state. Using the Etsy Sales Tax tool is easy; just follow the steps given below –

- Go to this location on your Etsy shop, Shop Manager > Finances > Payment settings. Then go to the Sales Tax tab.

- Select a US state where you ship your products.

- Enter the tax rate for the selected state in a decimal format.

- Repeat these steps for all the states where you want to collect the sales tax.

- Save your settings, and you’re done.

From this point on, any new listing you create on Etsy will have the tax rate applied by default. If you need to remove the sales tax from any particular item, just uncheck the box when creating the listing.

Custom Tax or Duties

When you’re shipping your products to a different country, you may need to collect any import taxes or customs duties imposed by the destination country from your buyers.

As an Etsy Seller, you are responsible for complying with the laws of the country of destination. More and more countries are actively implementing penalties for businesses that do not comply with the VAT requirements and even forcing platforms like Amazon, eBay, etc., to close accounts of non-compliant sellers.

Value Added Tax (VAT) has different names for different countries, such as GST, QST, JCT, etc. If you’re a VAT-registered seller, you may need to collect VAT on the physical products you sell on Etsy.

You should be careful of the fact that the threshold for such taxes changes from country to country, so the best way to stay on top of things is to contact your local customs/tax office and a local tax advisor.

You can also visit the Postal Explorer page on the USPS website to learn about the specific customs requirements for shipping to various countries from the US.

How the Etsy Integration App by CedCommerce helps you account for the customs taxes?

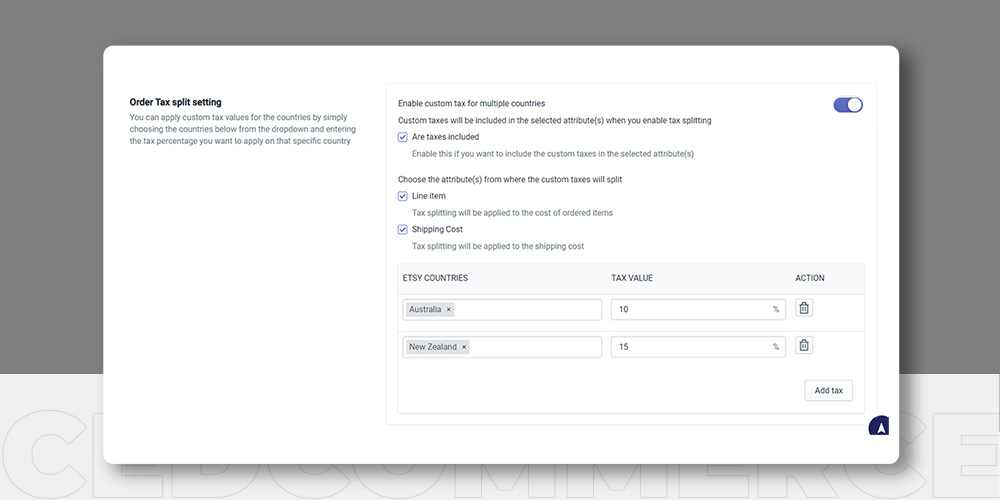

The Etsy Integration app gives you the option to enable the Order tax Split Setting, where you can provide the individual custom tax rates for the countries where you ship your products.

It will help you keep an account of what part of the sales is your income and what part of it is the custom tax that Etsy automatically charges for various countries. Visit the article ‘Custom Fees and Physical Vat collection‘ on Etsy to find out which countries are part of automatic taxation and which ones are not.

Check out the Etsy Integration App on the Shopify App Store.

Tax forms you need to know about

As a business owner, you may be introduced to many tax forms that are sometimes hard to understand. Sometimes you’ll end up scratching your head about what forms you need to fill out as the owner of an Etsy Shop.

Keep reading to learn about the forms you may need to fill out as an Etsy Seller.

The IRS 1099-K form

The purpose of the IRS 1099-K form is to make sure that all online retailers, like yourself, report their sales for tax purposes. So if you receive online payments through any payment cards or any third-party payment processor like Paypal, you may get a 1099-K form at the end of the year.

Even Etsy will send out a 1099-K form to you if you get paid through ‘Etsy Payments.’

Who gets the 1099-K form?

All online retailers who meet the following requirements will receive a 1099-K form at the end of the year –

- They must receive online payments through payment cards and third-party payment processors like Paypal.

- They should have received a total payment of more than $600 in one year. Before January 2022, this threshold was $20,000 and 200 transactions.

Contact Etsy Support or the third-party payment processor in the following cases –

- When your monthly and annual sales totals are incorrect.

- If the 1099-K form mentions the wrong taxpayer ID.

- When you qualify for getting the 1099-K form but have not received it.

- When you need another copy of the form because you lost the original one.

You have to report your 1099-K payments on the Schedule C form. Ensure that your total business income on the Schedule C form matches your accounting records.

The IRS Schedule C – Profit or Loss From Business – form

The IRS Schedule C form reports your business income and expenses as a sole-proprietor or a single-member LLC. If the income is more than the expenses, then it’s a profit. Otherwise, it’s a loss.

Some of the important items on a Schedule C form include –

- Business name and address.

- Principle business or profession, including product or service your business offers.

- Accounting methods such as Cash or Accrual or any other.

- Whether you should file the 1099 form if you made payments to other businesses.

- Details of your income.

- Details about your business expenses, including advertising, car and truck expenses, commissions and fees, Contract labor, Insurance, Supplies, hired legal and professional services, office expenses, and many more.

- Cost of goods sold.

- Any other expenses that are not mentioned specifically in the form.

When you fill out a Schedule C form, you will usually also fill the Schedule SE form to pay Self-employment taxes for Social Security and Medicare purposes. You will report this on the 1040 form, Schedule 2 part 2, Other Taxes.

Self-employed individuals should also expect to receive a 1099-NEC (non-employee compensation) form from their business clients who have paid them $600 or more during the tax year. These payments should also be included in the Schedule C form as income earned.

You’ll also send out a 1099-NEC form to any contractors or vendors you have paid for business purposes. You’ll need to provide this information on the Schedule C form as part of your business expenses.

Read the full information on the 1099-NEC form on Turbotax.

The IRS Schedule SE form

Schedule SE is one of the Schedules of the 1040 form – the form you use to file your tax return – and you will use it to calculate your self-employment tax. The self-employment tax consists of two parts. The first is the Social Security Tax, and the second is the Medicare tax.

You need to fill out the Schedule SE form if you’ve made more than $400 in self-employment income in a tax year. The good news about the self-employment tax is that you can deduct 50% of this tax from your total taxable income in the 1040 form.

The IRS 1040 form

The 1040 form is the official document that U.S. taxpayers use to file their annual income tax returns. Use this form to calculate your total taxable income and how much tax you owe or the refund you can expect to receive.

You need to calculate your Adjusted Gross Income by reporting your total income and then claiming any above-the-line deductions.

You can reduce your AGI even further with the standard deduction or the itemized deductions reported on Schedule A, including items like; Medical and Dental expenses, Taxes you paid, Interest you paid, Gifts to Charity, casualty & theft Losses, and other Itemized deductions.

Your taxable income will be lower if your total itemized deductions don’t exceed the standard deductions when claiming for the standard deductions.

You will attach the Schedules you filled with the 1040 form to calculate specific items that are required in the form. We have already discussed the Schedules you will need as an Etsy seller. All you need to do is make sure that you keep records of all the expenses and payments you receive throughout the year.

The IRS 1040-ES form

The 1040-ES form stands for Estimated Tax for Individuals. You have to use this form to pay the Estimated Quarterly Taxes that we discussed earlier. Paying 100% of the taxes you paid in the previous tax year is the safest way to avoid any penalties from the IRS.

Conclusion

It can be a bit difficult to figure out the nuances of Etsy taxes as a new Etsy shop owner. Here’s everything you need to know, summarized in a few points.

- If the IRS classifies your Etsy shop as a business rather than a hobby, you will be much better off.

- Registering your business entity as a single-member LLC has many benefits compared to a sole proprietorship.

- You need to know about the following taxes –

- Annual Income Tax

- Estimated Quarterly Tax

- State Income Tax

- Self-Employment Tax

- Sales Tax

- Customs Tax

- You need to know about the following tax forms –

- The IRS 1099-K form

- The Schedule C – Profit or Loss From Business – form

- The Schedule SE form

- The IRS 1040 – annual income tax returns – form

- The IRS 1040-ES form

We hope this information was valuable to you, and perhaps it will send you down a path where you will be more vigilant toward maintaining proper records for all your business income and expenses.

Disclaimer– Etsy is a trademark of Etsy, Inc. This content is not created or endorsed by Etsy, Inc.