BFCM Conversion Tactics: Smart Bundles, Flash Sales & Scarcity Marketing

Reading Time: 13 minutesStill approaching BFCM with generic discounts, last-minute price cuts, or scattered promotions?…

In 2025, how you fulfilled orders on Amazon became as strategic as what you sold. Over the past two years, fulfillment costs, delivery expectations, and Prime eligibility rules have changed fast, reshaping how sellers choose between Fulfillment by Amazon (FBA) and Fulfilled by Merchant (FBM).

Recent data shows 34% of Amazon sellers use FBM, partly or entirely, for flexibility during peak seasons. This shift isn’t just about saving fees but also about control, margins, and scaling. FBA offers Prime visibility and Buy Box eligibility, while FBM provides freedom and brand control. The choice impacts profits, shipping, and scalability.

This guide simplifies that choice. You’ll find:

If you’ve ever asked “Which is better, FBA or FBM?”, this data-backed comparison will help you find your answer, and possibly redefine your fulfillment strategy for the year 2026.

At its core, Fulfillment by Amazon (FBA) lets sellers store inventory in Amazon’s fulfillment centers while Amazon handles picking, packing, delivery, and customer service. But in 2025, FBA is no longer just a logistics shortcut; it’s a profit and visibility lever tightly linked to Prime eligibility, Featured Offer (Buy Box) performance, and brand perception.

This way, Amazon controls the buyer experience from checkout to doorstep, making delivery speed and reliability nearly effortless for you.

Revised Fee Structures:

Sustainability & Packaging Compliance:

Prime Eligibility & Featured Offer Advantage:

Profitability Impact:

| Ideal Seller Profile | Why FBA Fits |

|---|---|

| High-volume sellers | Benefit from scale economics and lower per-unit fulfillment effort |

| Lightweight, fast-moving SKUs | Maximize Prime conversion and minimize storage fees |

| New sellers seeking credibility | Gain trust through Prime badge and Amazon-handled service |

| DTC brands expanding globally | Use FBA’s multi-market reach without separate 3PL contracts |

FBA continues to be the default growth model for sellers who value convenience and conversion lift over logistics control. However, with new fee rules and sustainability surcharges, profitability now depends on smart inventory distribution.

Effective Oct 15, 2025 to Jan 14, 2026, holiday peak FBA fees apply. From Jan 15, 2026, non-peak rates return with updates: Standard-size items priced $10–$50 rise by an average $0.08, with small standard up $0.25 and large standard up $0.05. Items under $10 rise $0.05 on average, with small standard up $0.12 and large standard unchanged—maintaining an effective $0.86 low-price discount. Products above $50 increase $0.31 due to higher handling needs. Dimensional weight now applies to most large units. New surcharges include Overmax, SIPP-based packaging adjustments, and a Low-inventory-level fee for stock under 28 days.

In 2025, Fulfilled by Merchant (FBM) has evolved from a budget-friendly alternative to a strategic control model for Amazon sellers. Sellers store, pack, and ship orders directly, or through a third-party logistics (3PL) partner. The payoff? More freedom, lower dependency on FBA, and greater control over branding, packaging, and margins.

New Cost Landscape:

Revised Seller Fulfilled Prime (SFP) Program:

Branding and Packaging Freedom:

Operational Flexibility:

| Cost Factor | FBA Average (2025) | FBM Average (2025) | Difference |

|---|---|---|---|

| Per-unit fulfillment cost | $4.70 | $3.10 | -34% |

| Average delivery time | 1–2 days (Prime) | 2–4 days (non-SFP) | +2 days |

| Packaging & branding control | Limited | Full | — |

| Long-term storage fees | Yes (monthly) | None | — |

| Return handling cost | Managed by Amazon | Seller-controlled | Varies |

(Source: Amazon Seller Central)

| Ideal Seller Type | Why FBM Fits Best |

|---|---|

| Low-volume or niche sellers | Lower overhead and full control over fulfillment |

| Brands with fragile/customized items | FBA’s packaging automation may not suit product needs |

| Sellers with existing 3PL or in-house warehouse | Cost efficiency and flexibility in scaling operations |

| Sellers focused on branding experience | Maintain identity through packaging, inserts, and eco-marketing |

In 2025, FBM is no longer just for small sellers, it’s a scalable model for those who want autonomy, brand consistency, and cost predictability. With the rise of Seller Fulfilled Prime and better logistics automation, FBM sellers can now achieve near-FBA delivery performance while protecting their margins.

CedCommerce’s Amazon Channel supports FBM sellers through built-in Buy Shipping, enabling label generation, tracking sync, and performance compliance, without FBA’s overhead.

Amazon’s fulfillment landscape in 2026 will look very different from previous years. Seller Fulfilled Prime (SFP) now bridges the gap between FBA and FBM by allowing sellers to keep fulfillment in-house while still earning the Prime badge. With expanded carrier support and stricter SLAs, SFP has become a high-performance alternative for sellers seeking Prime-level visibility without FBA’s rising fees.

Hence, you must evaluate all three models, not just FBA vs FBM. The table below compares how each method performs across the factors that drive visibility, cost, profitability, and operational control.

| Amazon FBA – Pros (2025) | Amazon FBA – Cons (2025) |

|---|---|

| Automatic Prime badge | Highest cost model in 2025 (placement + peak + packaging fees) |

| 1–2 day delivery handled by Amazon | Minimal branding or packaging control |

| Strongest Featured Offer (Buy Box) advantage | Inventory split across Amazon FCs |

| Amazon handles storage, packing, shipping, returns | Long-term storage & removal fees |

| Easiest operational model | Less flexible for oversized/custom items |

| Amazon FBM – Pros (2025) | Amazon FBM – Cons (2025) |

|---|---|

| Full control over packaging, branding & carriers | No Prime badge without SFP |

| One centralized warehouse for all channels | Must maintain VTR ≥95% |

| Avoids placement, storage & long-term fees | Seller handles returns + prepaid labels |

| Most cost-effective for oversized, fragile, or custom items | Delivery speed impacts ranking more in 2025 |

| Typically 18–25% cheaper than FBA | Operationally heavier than FBA |

| SFP – Pros (2025) | SFP – Cons (2025) |

|---|---|

| Prime badge without FBA fees | Strictest Amazon SLAs (1–2 day delivery, <1% LSR) |

| Full control of branding & packaging | Must maintain ≥99% VTR |

| No inbound placement fees | Losing compliance removes Prime instantly |

| Works with one centralized warehouse | Higher staffing & logistics workload |

| Ideal for sellers with strong 3PL | Carrier limitations & higher fulfillment responsibility |

| If you want… | Choose… |

|---|---|

| Maximum conversion + minimal effort | FBA |

| Highest margins + full control | FBM |

| Prime badge + full control + no FBA fees | SFP |

| Best overall scalability | Hybrid (FBA + FBM/SFP) |

Choosing between FBA, FBM, and SFP in 2025 comes down to true per-unit costs, so you can evaluate all cost components, not just the surface-level “pick-pack-ship” rate. Below is the complete breakdown of every cost driver in 2025, including what’s new for the coming year.

It is cheaper for many categories but more operationally intensive.

FBM Cost Components (2025):

SFP sits between FBA and FBM, with Prime visibility without FBA fees, but the strictest logistics requirements.

Example Per-Unit Cost Scenario (2025)

Example SKU: Standard-size | 1 lb | Priced $19.99

FBA (2025 Non-Peak Fees)

FBM

SFP

Bottom Line:

| Cost Summary: If your goal is… | Your Best Option Is… |

|---|---|

| Lowest per-unit cost | FBM |

| Highest conversion + least work | FBA |

| Prime visibility without FBA fees | SFP |

| Balanced scalability | Hybrid FBA + FBM/SFP |

Why Hybrid Works in 2025 and 2026

Ideal Hybrid Scenarios

Benefits of Going Hybrid

How CedCommerce Supports Hybrid Sellers

Fulfillment choice also depends on where—and how—you plan to sell.

In 2025, Amazon’s regional compliance requirements differ significantly between the US, EU/UK, and India. Sellers must consider tax, documentation, packaging, and marketplace rules when deciding between FBA, FBM, SFP, or hybrid fulfillment.

| Region | FBA Impact | FBM/SFP Impact |

|---|---|---|

| EU/UK | VAT in every storage country | VAT only in origin country |

| US | Multi-state nexus | Limited nexus |

| India | Multi-state GST with FC storage | Single-state GST |

| Packaging rules | Amazon SIPP required | Full control |

| Cross-border | High compliance overhead | Moderate |

| Prime eligibility | Automatic | SFP only |

There is no single “best” model. FBA offers the highest conversion and fastest delivery but has the highest fees. FBM is more cost-effective and gives full control over packaging and operations. SFP bridges both by offering the Prime badge without FBA fees — but only if you meet strict SLAs. The right choice depends on your margins, logistics capability, and product type.

Yes — FBA is still profitable for fast-moving SKUs, items under 2 lb, and categories that benefit heavily from the Prime badge. However, oversized, slow-moving, and seasonal products may see declining profitability due to higher placement, storage, and peak fees.

On average, FBM is 18–25% cheaper per unit for many categories, especially lightweight, oversized, and custom-packaged items. Savings come from avoiding placement fees, long-term storage charges, and Amazon’s peak season surcharges.

Yes — through Seller Fulfilled Prime (SFP). SFP allows FBM sellers to earn the Prime badge while fulfilling orders from their own warehouse or 3PL. But the performance bar is extremely high: VTR ≥ 99%, LSR < 1%, and on-time delivery > 97%.

No — FBM can win the Featured Offer if the seller maintains fast delivery, low cancellation rates, accurate promises, and a Valid Tracking Rate above 95%. Amazon now ranks listings more on performance, not just the fulfillment method.

The biggest changes include: higher fulfillment fees, new inbound placement fees, expanded SIPP packaging surcharges, higher peak surcharges, and stricter long-term storage penalties — all of which impact profitability.

FBM sellers must plan for shipping rates, packaging materials, warehouse labor, returns processing, VTR penalties, delivery accuracy enforcement, and multichannel tool costs. With efficient logistics, FBM still maintains the lowest per-unit cost.

SFP is worth it only if you can consistently meet Amazon’s strict SLAs. SFP provides Prime visibility and full branding control, but it often becomes the most expensive model unless your warehouse is positioned close to major order zones.

Yes, sellers can switch between FBA, FBM, and SFP listings. It does not reset ranking, but delivery speed changes may temporarily affect visibility. Avoid switching during low Amazon inventory to prevent stranded stock.

For multichannel brands, FBM or SFP provides maximum flexibility because it enables centralized inventory. A hybrid setup works best: fast movers through FBA, oversized/fragile SKUs via FBM, and Prime-critical SKUs through SFP.

In 2025, the right fulfillment model depends on your catalog, margins, and logistics readiness. FBA offers Prime convenience but higher fees; FBM delivers control and lower costs; SFP gives Prime visibility without FBA storage but requires strict delivery performance. Most sellers now succeed with a hybrid approach that uses each model where it makes the most sense.

CedCommerce helps you manage hybrid fulfillment with Amazon Buy Shipping, real-time inventory sync, and automated order + tracking updates. Book your free consultation to find the best mix of FBA, FBM, and SFP for your business.

Boost visibility, win the Featured Offer, and increase revenue with CedCommerce’s Amazon marketing and ads management expertise.

Reading Time: 13 minutesStill approaching BFCM with generic discounts, last-minute price cuts, or scattered promotions?…

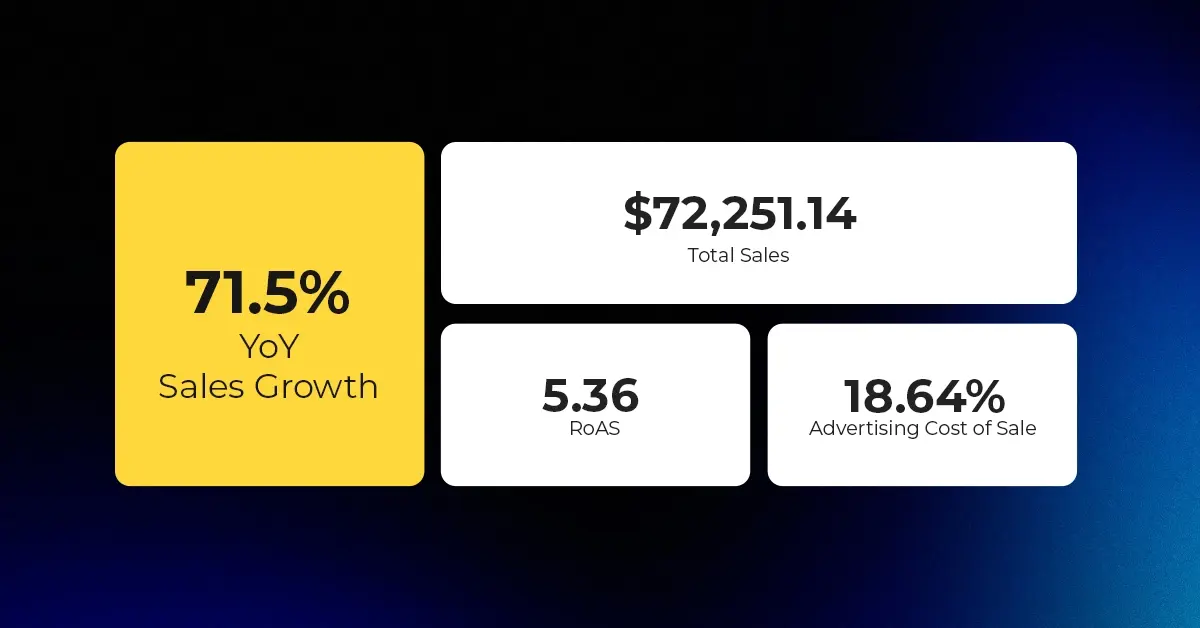

Reading Time: 3 minutesTikTok Shop reached a major milestone during its largest U.S. “Global Black…

Reading Time: 3 minutesOpenAI has announced a new AI-powered shopping research tool designed to help…

Reading Time: 9 minutesIf your TikTok Shop listings often sit in review or your visibility…

Reading Time: 3 minutesAmazon has rolled out a new “Seller Challenge” feature for eligible Account…

Reading Time: 3 minutesWalmart Marketplace has sharpened its requirements around product classification (category, type group,…

Reading Time: 3 minutesJust ahead of Black Friday, Amazon is enforcing tighter controls on its…

Reading Time: 11 minutesWhere holiday prep of past years focused on legacy channels like Amazon,…

Reading Time: 11 minutesThe eCommerce shift you actually need to act on Multi-channel fulfillment has…

Reading Time: 10 minutesBlack Friday Cyber Monday (BFCM) isn’t a weekend anymore; it’s a two-month…

Reading Time: 2 minuteseBay is quietly testing a new feature that could reshape how buyers…

Reading Time: 2 minutesAmazon is stepping into a new era of value commerce with the…

Reading Time: 11 minutesThe $240 Billion BFCM Opportunity & Why Operations Matter Every seller, business,…

Reading Time: 7 minutesTL;DR — Your 60-Second BFCM Battle Plan Time remaining: 3 weeks until…

Reading Time: 2 minutesChina’s Double 11 shopping festival — the world’s largest annual online retail…

Reading Time: 2 minutesAs the holiday season approaches, TikTok Shop has released its September 2025…

Reading Time: 3 minutesIn a continued effort to enable sellers and stimulate new product launches…

Reading Time: 2 minutesAs global trade enters a new phase of regulation and cost restructuring,…

Reading Time: 2 minutesOpenAI Turns to Amazon Web Services in $38 Billion Cloud Deal: What…

Reading Time: 4 minutesAbout the Client TMRG is a global health and wellness brand with…