How to configure Sales Tax Information in Walmart Seller Center? CedCommerce

Running short of time? Get PDF of the blog in your mail.

Let’s begin straight away, to configure Sales Tax you require Tax Nexus, Shipping Sales Tax codes and shipping policy information.

- Login to your Seller Center

- Click the Gear Icon at the top

- From Dropdown, under partner profile, select Taxes

Set up Nexus:

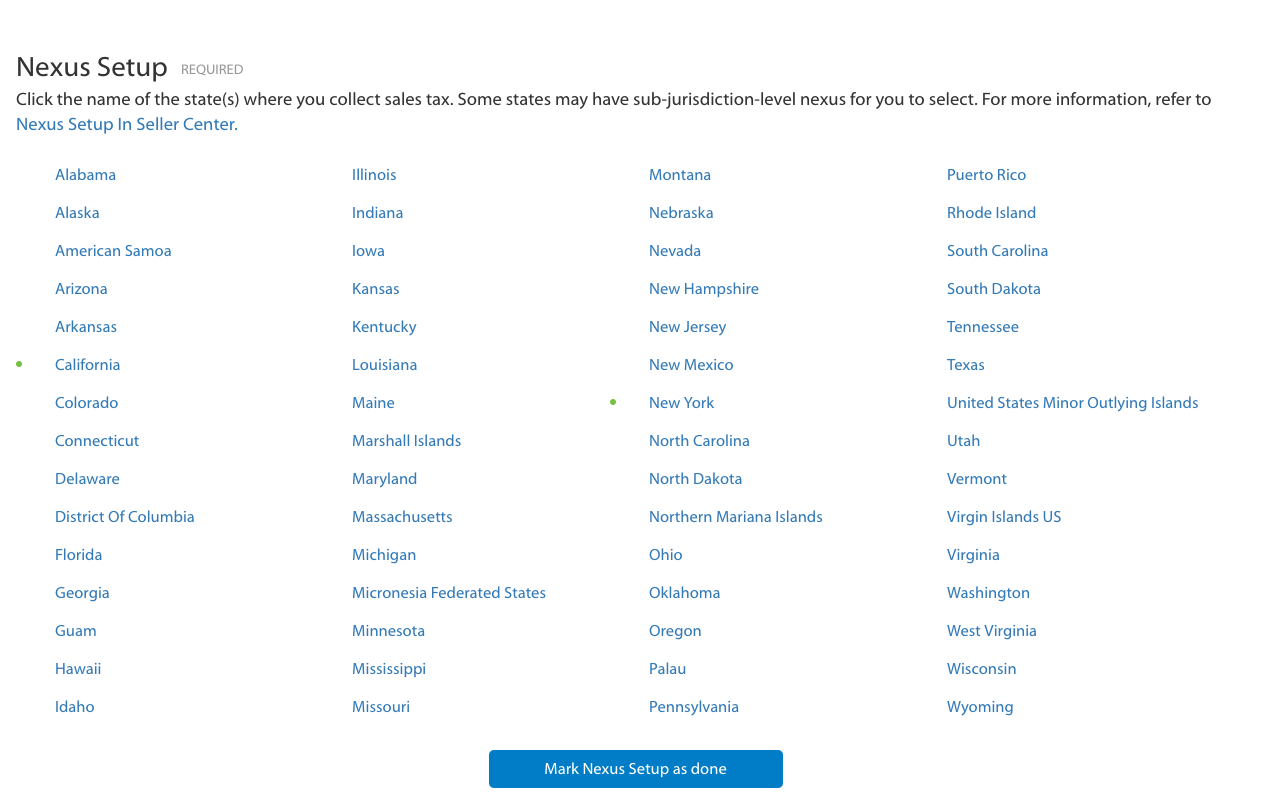

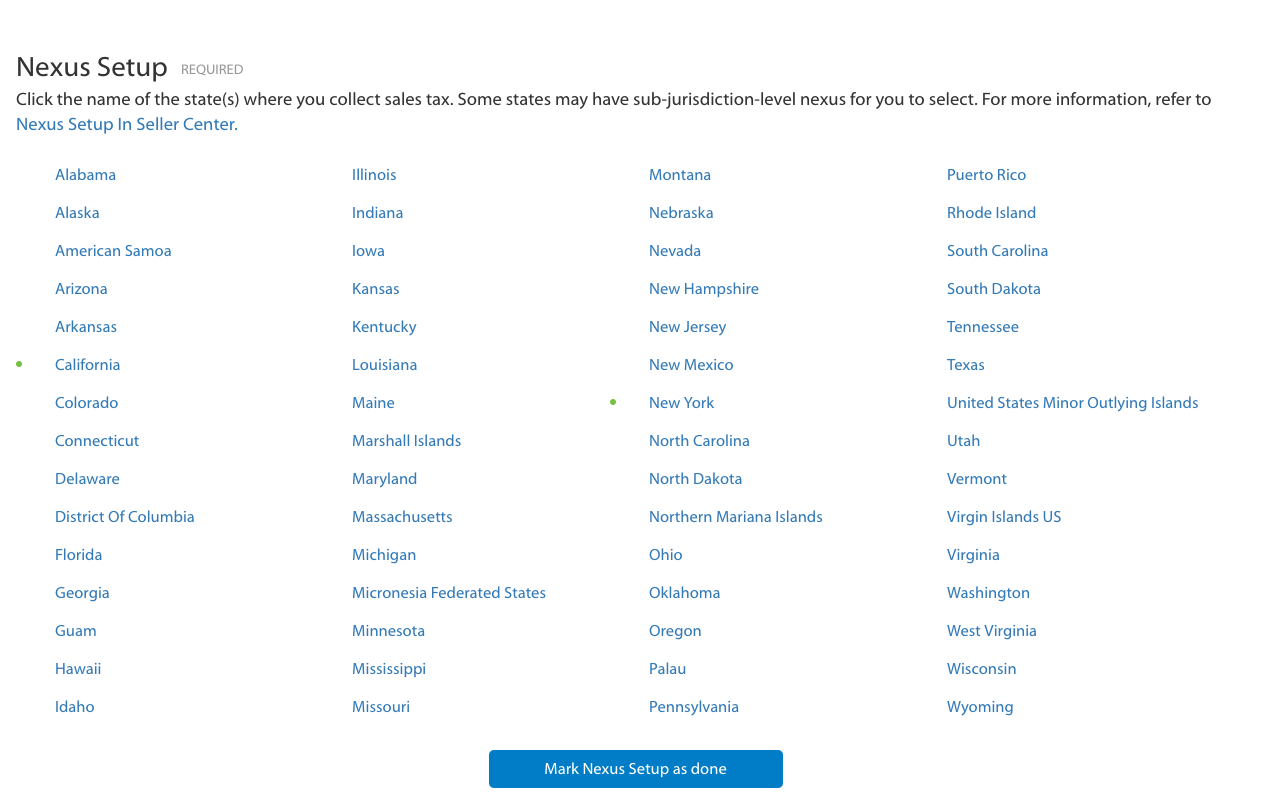

On the taxes page, you see a Nexus section, displaying the name of all the States, and once you click on the states you can see all the cities and counties listed under it, there are known as Sub-States at Walmart.

How to configure Sales Tax Information in Walmart Seller Center: Setup Nexus: Image Source: Walmart Knowledge Base

A green dot appear against the name of the state, below is the image of Nexus, comprising 50 states and Puerto Rico.

To set up nexus, click on the States, once you click on these there are three possibilities,

- State has no Sub State

- State has subtitle

- State has sub inherited states only

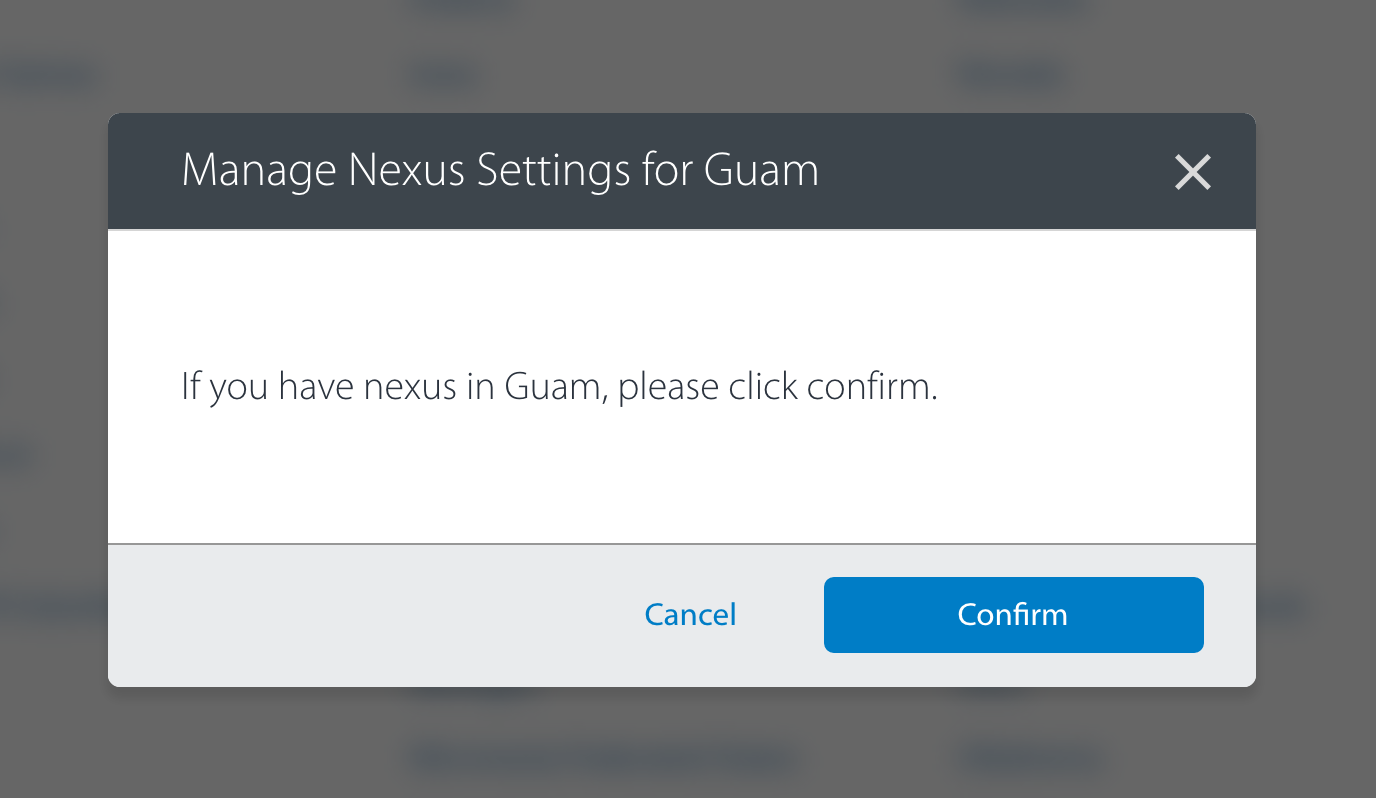

When State has no Sub-State:

Some states have uniform tax policy through entire state, like Connecticut, so there are no sub state, and setting tax code for your items is easy

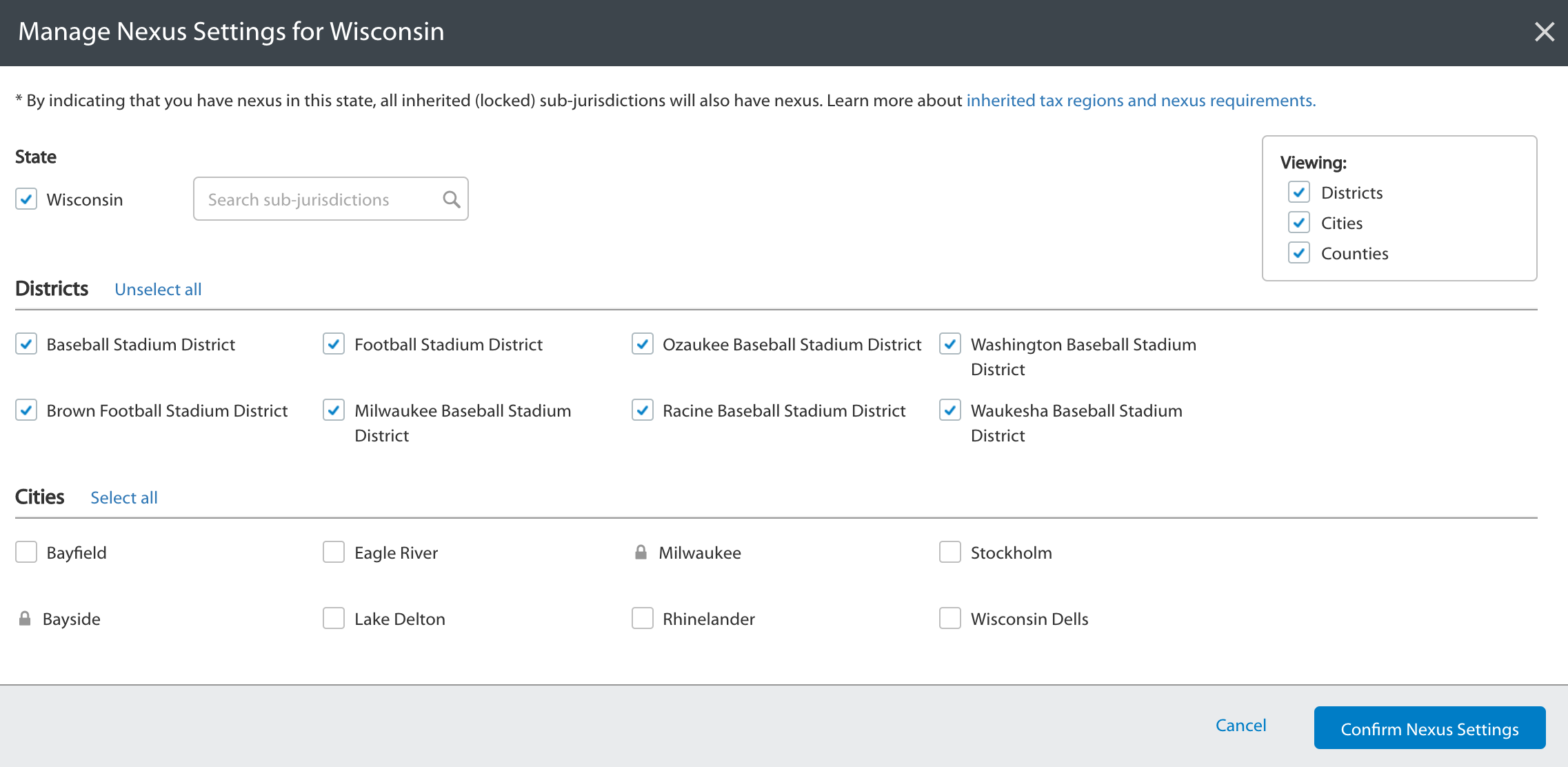

When State has Sub State:

The State where Sub-state exists, the sub states are shown in the full page view, from where you can choose the sub-state you want nexus setup for. If you serve to all the areas, Check off the State and all the sub-states

How to configure Sales Tax Information in Walmart Seller Center: Setup Nexus: Image Source: Walmart Knowledge Base

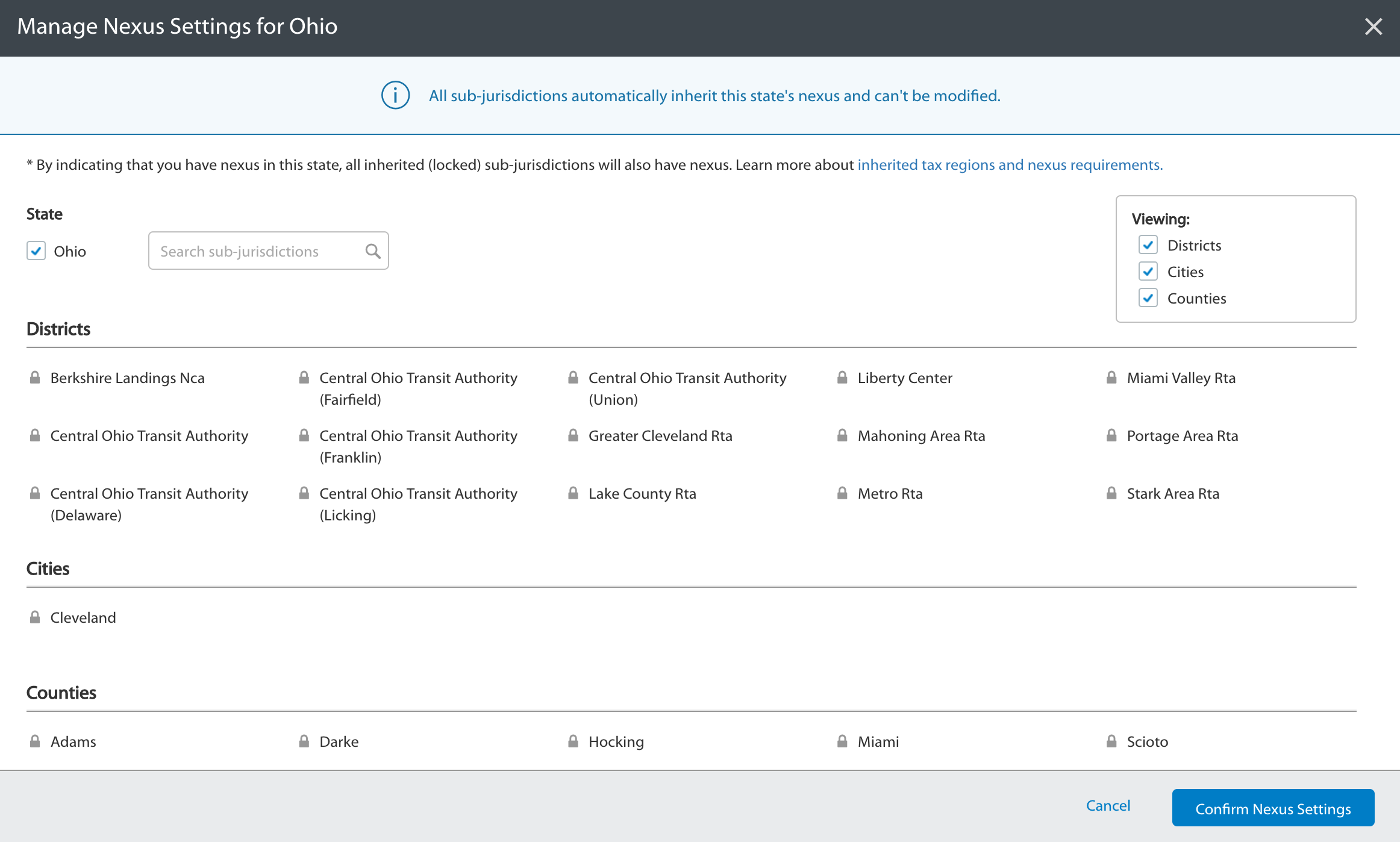

When State has Inherited States Only:

It is also possible that all the sub-state inherits state’s nexus setting. In this scenario, once you click Confirm Nexus Setting, all the sub state will inherit all the settings.

How to configure Sales Tax Information in Walmart Seller Center: Setup Nexus: Image Source: Walmart Knowledge Base

Shipping Sales Codes:

Provide Sales Tax Code for each supported shipping method, this enables Walmart to determine what price to charge from Customers for Shipment. Walmart advises strongly to use single taxcode per shipping method.

Shipping Sales Tax Codes

This section is for you to tell customers about Your Sales Tax policy, State your policy but do not exceed 4000 character limit.

Once you’re done with setting up nexus, Shipping Sales tax products and Sales tax policy, click the button which states Mark Nexus Setup as Done.

Information Source: Walmart Knowledge Base

For other Walmart Related Blogs visit Multichannel listing app

Thanks for your Interest

Team CedCommerce